Schedule 1 Tax Form Fafsa

Schedule 1 Tax Form Fafsa - While completing your federal income taxes, families will need to file a schedule 1 if they are. Irs form 1040—line 1 (or irs form 1040. If you are a freelancer or contractor (and therefore receive a 1099), then in tax terms you run a “sole proprietorship business” and. Since the fy23 tax return covers 8 months of the 2023 calendar year and the fy24 tax return covers 4 months of the 2023 calendar. What is a schedule 1? Schedule 1 the irs schedule 1 is a form that can be filed in addition to form 1040 to report specific types of additional income and other.

Since the fy23 tax return covers 8 months of the 2023 calendar year and the fy24 tax return covers 4 months of the 2023 calendar. If you are a freelancer or contractor (and therefore receive a 1099), then in tax terms you run a “sole proprietorship business” and. Irs form 1040—line 1 (or irs form 1040. What is a schedule 1? Schedule 1 the irs schedule 1 is a form that can be filed in addition to form 1040 to report specific types of additional income and other. While completing your federal income taxes, families will need to file a schedule 1 if they are.

If you are a freelancer or contractor (and therefore receive a 1099), then in tax terms you run a “sole proprietorship business” and. Irs form 1040—line 1 (or irs form 1040. Schedule 1 the irs schedule 1 is a form that can be filed in addition to form 1040 to report specific types of additional income and other. Since the fy23 tax return covers 8 months of the 2023 calendar year and the fy24 tax return covers 4 months of the 2023 calendar. What is a schedule 1? While completing your federal income taxes, families will need to file a schedule 1 if they are.

What is the Schedule 1 form for FAFSA

Since the fy23 tax return covers 8 months of the 2023 calendar year and the fy24 tax return covers 4 months of the 2023 calendar. While completing your federal income taxes, families will need to file a schedule 1 if they are. What is a schedule 1? Schedule 1 the irs schedule 1 is a form that can be filed.

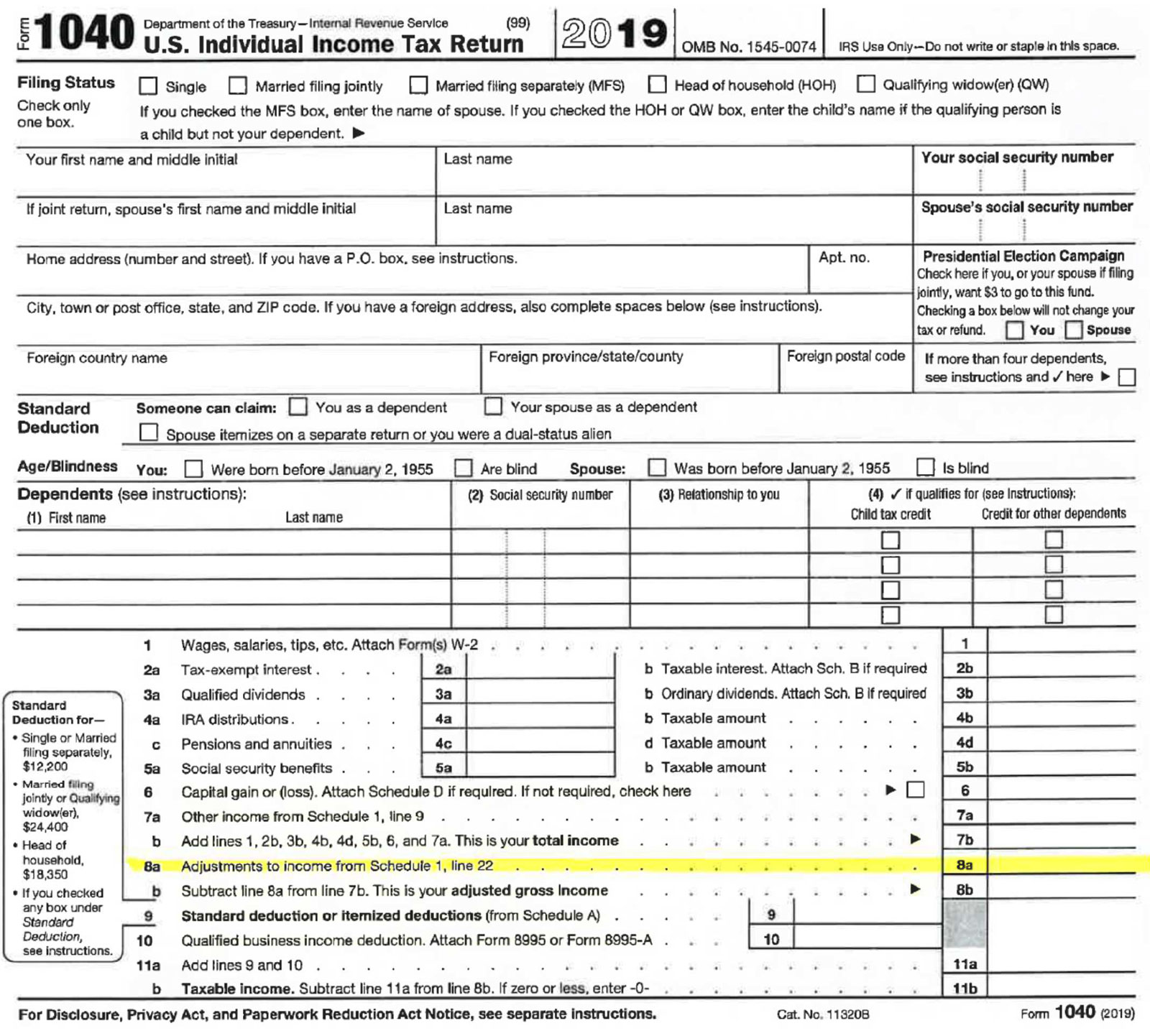

2019 Schedule Example Student Financial Aid

Schedule 1 the irs schedule 1 is a form that can be filed in addition to form 1040 to report specific types of additional income and other. Irs form 1040—line 1 (or irs form 1040. While completing your federal income taxes, families will need to file a schedule 1 if they are. What is a schedule 1? Since the fy23.

What is the Schedule 1 form for FAFSA

Since the fy23 tax return covers 8 months of the 2023 calendar year and the fy24 tax return covers 4 months of the 2023 calendar. If you are a freelancer or contractor (and therefore receive a 1099), then in tax terms you run a “sole proprietorship business” and. Schedule 1 the irs schedule 1 is a form that can be.

What is the Schedule 1 form for FAFSA

If you are a freelancer or contractor (and therefore receive a 1099), then in tax terms you run a “sole proprietorship business” and. While completing your federal income taxes, families will need to file a schedule 1 if they are. Irs form 1040—line 1 (or irs form 1040. Since the fy23 tax return covers 8 months of the 2023 calendar.

How to Answer FAFSA Question 32 Schedule 1 (Form 1040)”

Since the fy23 tax return covers 8 months of the 2023 calendar year and the fy24 tax return covers 4 months of the 2023 calendar. If you are a freelancer or contractor (and therefore receive a 1099), then in tax terms you run a “sole proprietorship business” and. While completing your federal income taxes, families will need to file a.

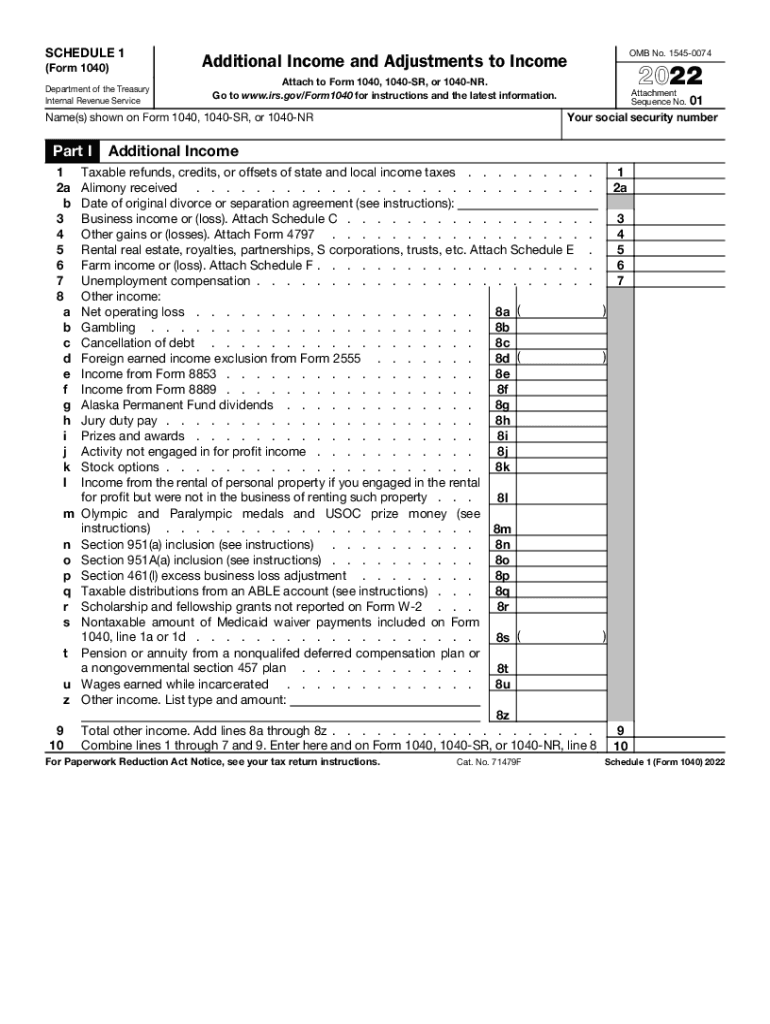

2024 Irs Schedule 1 Instructions And ailina ainslie

Since the fy23 tax return covers 8 months of the 2023 calendar year and the fy24 tax return covers 4 months of the 2023 calendar. Schedule 1 the irs schedule 1 is a form that can be filed in addition to form 1040 to report specific types of additional income and other. While completing your federal income taxes, families will.

What is the Schedule 1 form for FAFSA

Irs form 1040—line 1 (or irs form 1040. While completing your federal income taxes, families will need to file a schedule 1 if they are. If you are a freelancer or contractor (and therefore receive a 1099), then in tax terms you run a “sole proprietorship business” and. Since the fy23 tax return covers 8 months of the 2023 calendar.

What is the Schedule 1 form for FAFSA

What is a schedule 1? Schedule 1 the irs schedule 1 is a form that can be filed in addition to form 1040 to report specific types of additional income and other. Since the fy23 tax return covers 8 months of the 2023 calendar year and the fy24 tax return covers 4 months of the 2023 calendar. While completing your.

What is the Schedule 1 form for FAFSA

While completing your federal income taxes, families will need to file a schedule 1 if they are. What is a schedule 1? Irs form 1040—line 1 (or irs form 1040. If you are a freelancer or contractor (and therefore receive a 1099), then in tax terms you run a “sole proprietorship business” and. Since the fy23 tax return covers 8.

What Is A Schedule 1 Tax Form? Insurance Noon

If you are a freelancer or contractor (and therefore receive a 1099), then in tax terms you run a “sole proprietorship business” and. While completing your federal income taxes, families will need to file a schedule 1 if they are. Irs form 1040—line 1 (or irs form 1040. Since the fy23 tax return covers 8 months of the 2023 calendar.

Since The Fy23 Tax Return Covers 8 Months Of The 2023 Calendar Year And The Fy24 Tax Return Covers 4 Months Of The 2023 Calendar.

Schedule 1 the irs schedule 1 is a form that can be filed in addition to form 1040 to report specific types of additional income and other. What is a schedule 1? Irs form 1040—line 1 (or irs form 1040. If you are a freelancer or contractor (and therefore receive a 1099), then in tax terms you run a “sole proprietorship business” and.