Sales Tax Exemption Form Ohio

Sales Tax Exemption Form Ohio - While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. Claiming sales tax exemptions in ohio requires businesses to follow specific procedures, including obtaining resale. What purchases are exempt from the ohio sales tax? There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. To provide this exemption certificate (or the data elements required on the form) to a state that would otherwise be due tax on this sale. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. This form allows purchasers to claim exception or exemption on all purchases of tangible personal property and selected services in ohio. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate.

While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. This form allows purchasers to claim exception or exemption on all purchases of tangible personal property and selected services in ohio. Claiming sales tax exemptions in ohio requires businesses to follow specific procedures, including obtaining resale. There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. To provide this exemption certificate (or the data elements required on the form) to a state that would otherwise be due tax on this sale. What purchases are exempt from the ohio sales tax? Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio.

There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. This form allows purchasers to claim exception or exemption on all purchases of tangible personal property and selected services in ohio. Claiming sales tax exemptions in ohio requires businesses to follow specific procedures, including obtaining resale. To provide this exemption certificate (or the data elements required on the form) to a state that would otherwise be due tax on this sale. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. What purchases are exempt from the ohio sales tax?

Sales Tax Exemption Certificate Sc

While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. This form allows purchasers to claim exception or exemption on all purchases of tangible personal property and selected services in ohio. There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. Claiming sales tax exemptions in.

Texas Sales And Use Tax Resale Certificate Example / 01 315 Form Fill

There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. What purchases are exempt from the.

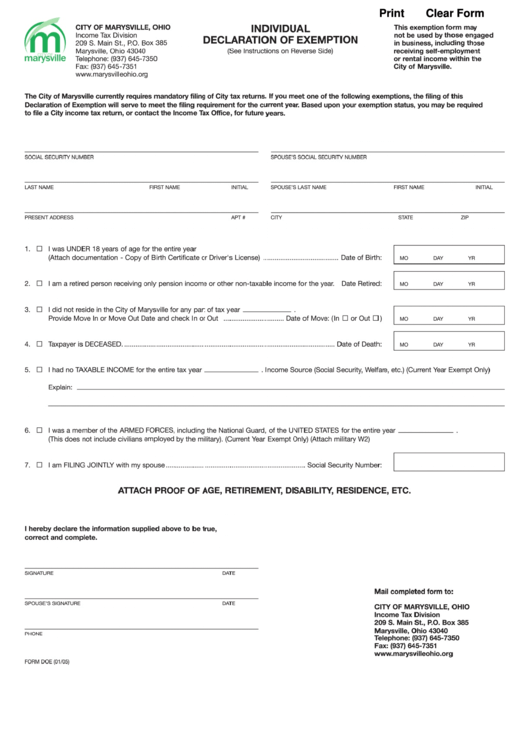

ohio sales tax exemption form example Fighting Column Photo Galleries

To provide this exemption certificate (or the data elements required on the form) to a state that would otherwise be due tax on this sale. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. Download and fill out this form to claim exception or exemption on purchases of tangible.

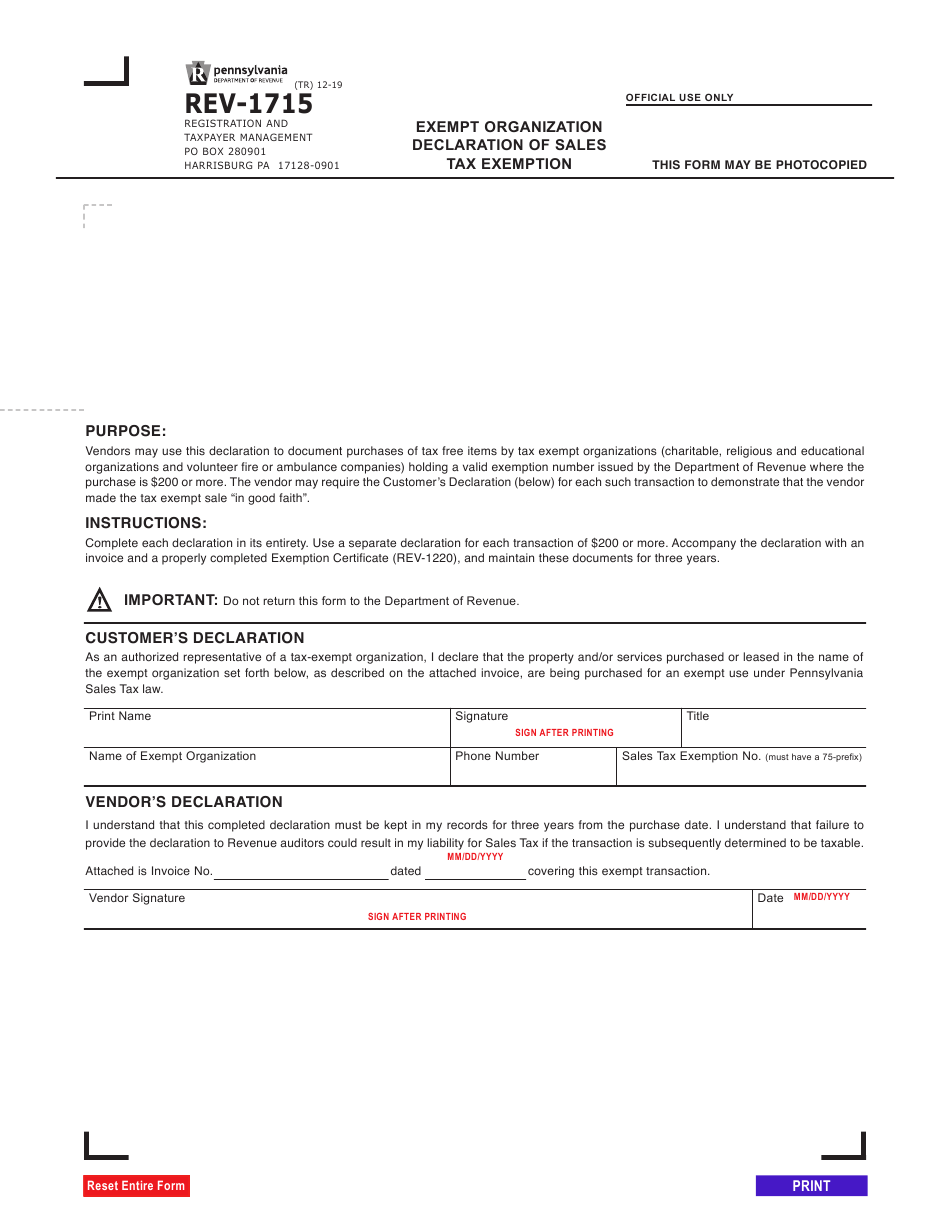

Pa Sales Taxe Exemption Form

While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. To provide this exemption certificate (or the data elements required on the form) to a state that would otherwise be due tax.

Ohio Sales Tax Blanket Exemption Form 2021

Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. What purchases are exempt from the ohio sales tax? This form allows purchasers to claim exception or exemption on all purchases of tangible personal property and selected services in ohio. To provide this exemption certificate (or the data.

Sample Certificate Tax Exempt Certificate Form

While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. What purchases are exempt from the ohio sales tax? Claiming sales tax exemptions in ohio requires businesses to follow specific procedures, including obtaining resale. This form allows purchasers to claim exception or exemption on all purchases of tangible personal property and selected services in.

Tax Exemption Form Printable Ohio Printable Forms Free Online

This form allows purchasers to claim exception or exemption on all purchases of tangible personal property and selected services in ohio. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected.

Icc Mc Sales Tax Exemption Form Ohio

Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. What purchases are exempt from the ohio sales tax? There is a special contractor's exemption certificate and a.

Ohio Farm Sales Tax Exemption Form Tax New tax Available, Act Fast

This form allows purchasers to claim exception or exemption on all purchases of tangible personal property and selected services in ohio. Claiming sales tax exemptions in ohio requires businesses to follow specific procedures, including obtaining resale. While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. Ohio accepts the uniform sales and use tax.

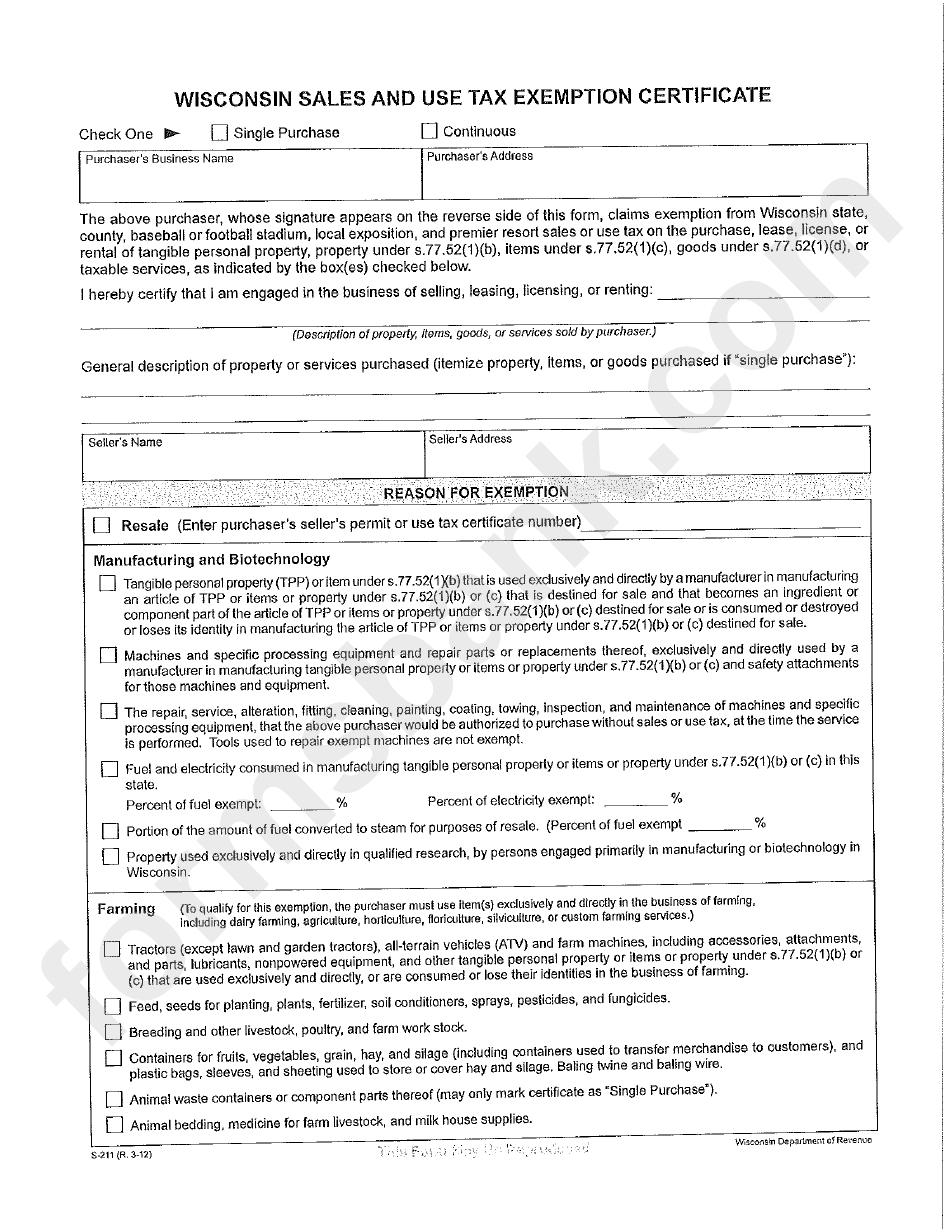

Wi Sales Tax Exemption Form

To provide this exemption certificate (or the data elements required on the form) to a state that would otherwise be due tax on this sale. Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. What purchases are exempt from the ohio sales tax? Ohio accepts the uniform.

What Purchases Are Exempt From The Ohio Sales Tax?

Download and fill out this form to claim exception or exemption on purchases of tangible personal property and selected services in ohio. There is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner. While the ohio sales tax of 5.75% applies to most transactions, there are certain items that. Ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate.

To Provide This Exemption Certificate (Or The Data Elements Required On The Form) To A State That Would Otherwise Be Due Tax On This Sale.

This form allows purchasers to claim exception or exemption on all purchases of tangible personal property and selected services in ohio. Claiming sales tax exemptions in ohio requires businesses to follow specific procedures, including obtaining resale.