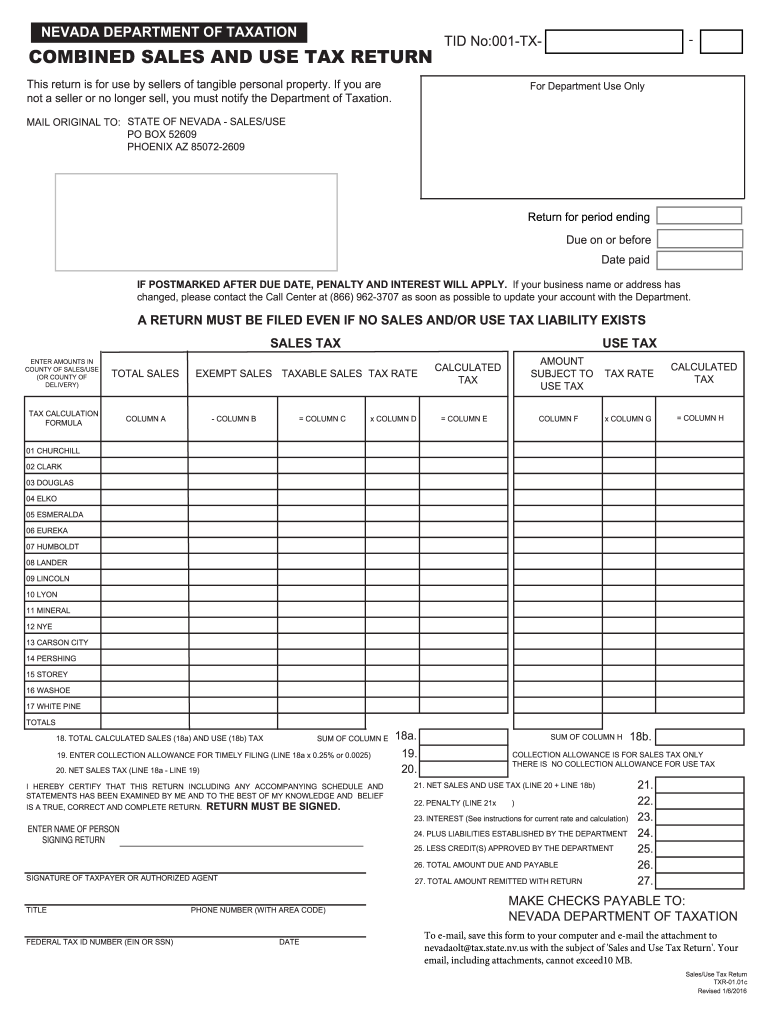

Sales And Use Tax Form Nevada

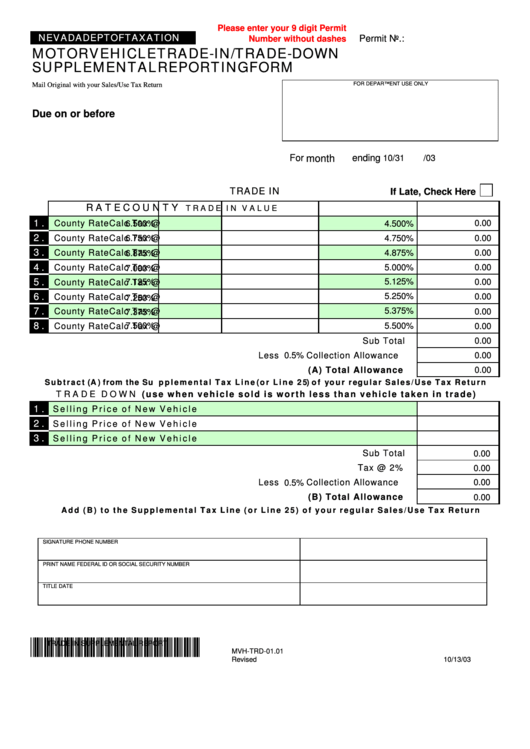

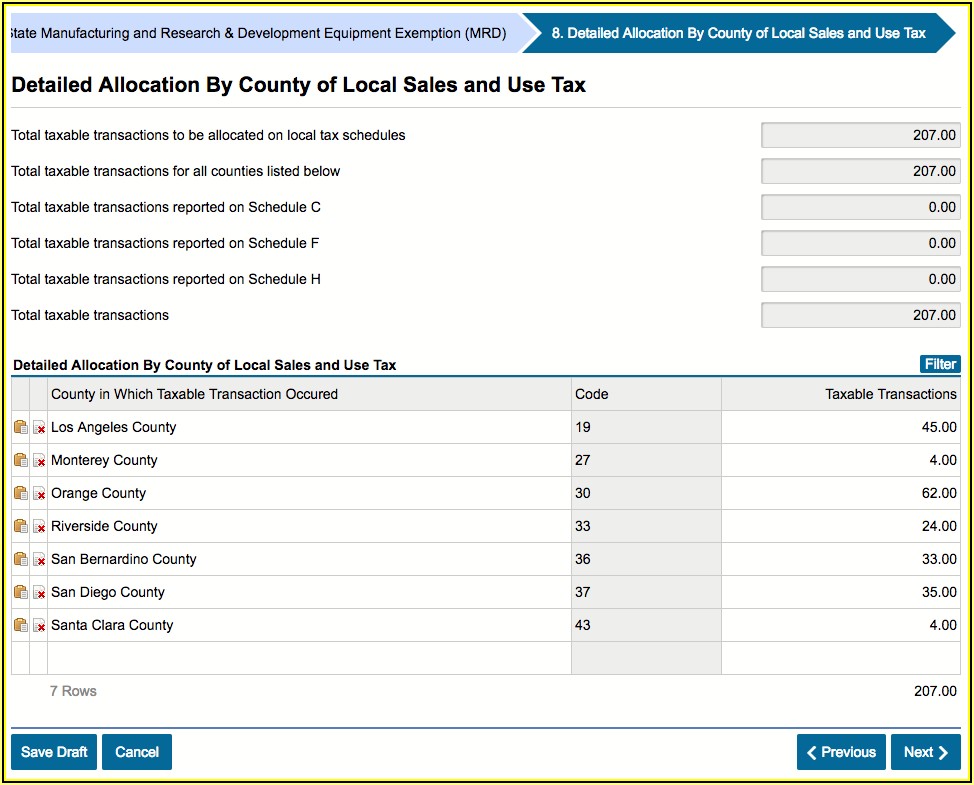

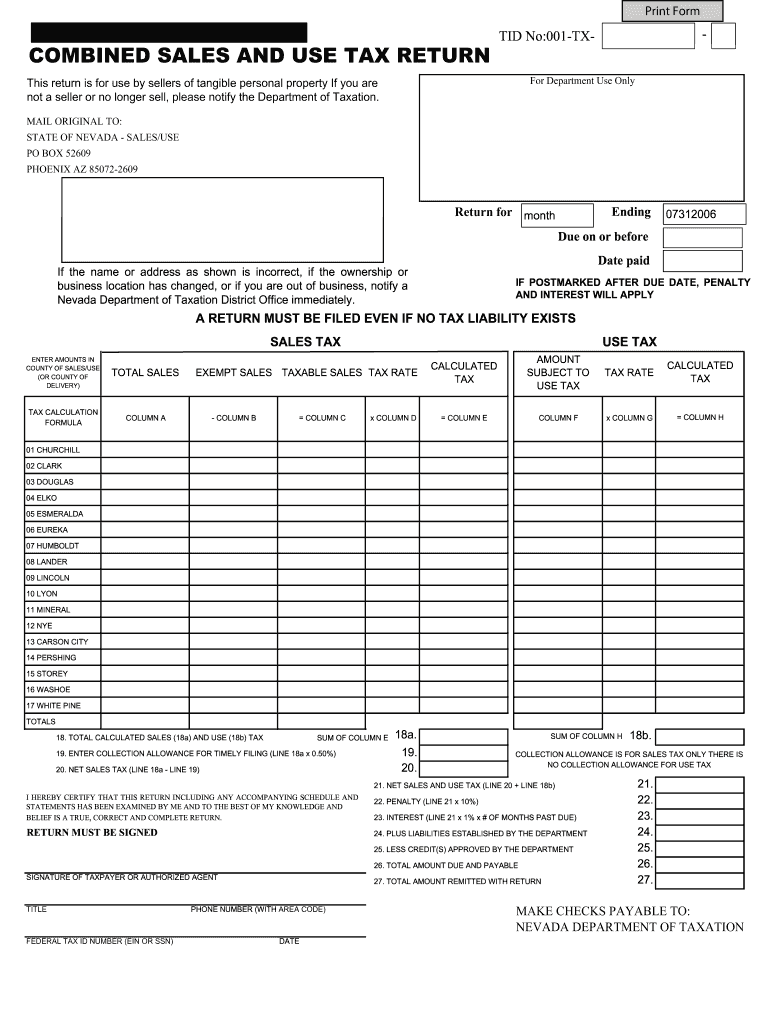

Sales And Use Tax Form Nevada - Sales & use tax forms. Total calculated sales (18a) and use (18b) tax 16 washoe 19. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. (b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible. Sales & use tax return. Sales and use tax return.

Sales and use tax return. Sales & use tax forms. (b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. Total calculated sales (18a) and use (18b) tax 16 washoe 19. Sales & use tax return.

Sales & use tax forms. (b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. Total calculated sales (18a) and use (18b) tax 16 washoe 19. Sales and use tax return. Sales & use tax return.

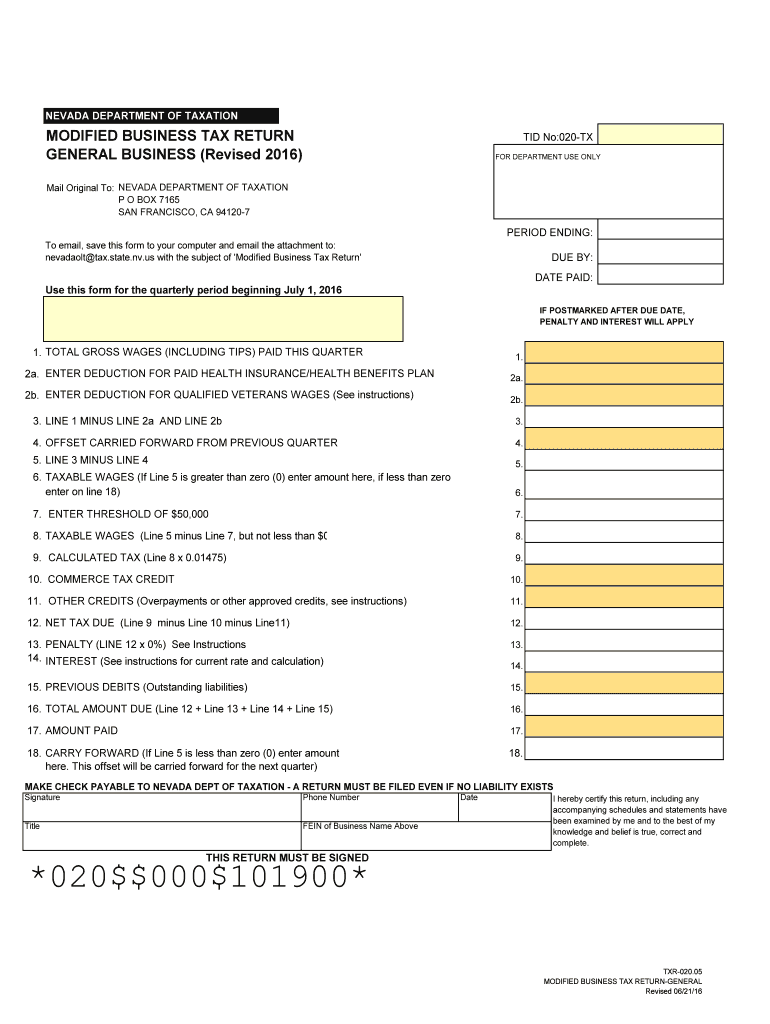

Nevada State Withholding Tax Form

Sales & use tax return. (b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible. Sales and use tax return. Sales & use tax forms. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax.

Email Fill Out Form Printable Printable Forms Free Online

Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. Sales & use tax return. (b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible. Total calculated sales (18a) and use (18b) tax 16 washoe 19. Sales & use tax forms.

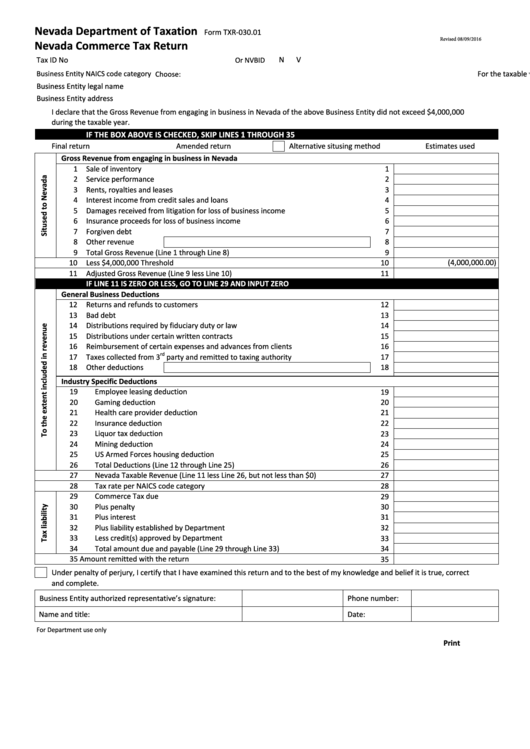

Fillable Form Txr030.01 Nevada Department Of Taxation Nevada

(b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible. Total calculated sales (18a) and use (18b) tax 16 washoe 19. Sales and use tax return. Sales & use tax forms. Sales & use tax return.

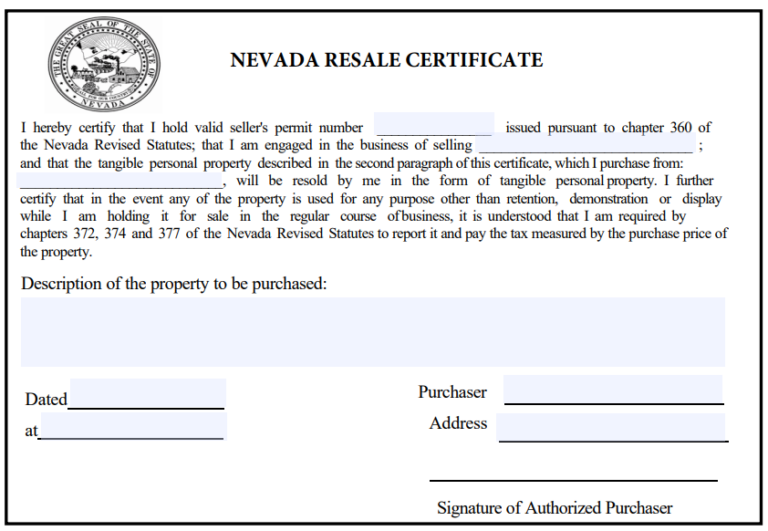

Nevada Sales Tax Exemption Certificate Form

Sales & use tax forms. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. (b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible. Sales & use tax return. Sales and use tax return.

Blank Nv Sales And Use Tax Form Nevada Fillable Durable Power Of

Sales and use tax return. Sales & use tax return. Sales & use tax forms. Total calculated sales (18a) and use (18b) tax 16 washoe 19. (b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible.

Nevada Monthly Sales Tax Return Due Date

Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. Sales & use tax forms. Sales & use tax return. Total calculated sales (18a) and use (18b) tax 16 washoe 19. (b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible.

Top 6 Nevada Sales Tax Form Templates free to download in PDF format

(b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible. Total calculated sales (18a) and use (18b) tax 16 washoe 19. Sales & use tax return. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. Sales & use tax forms.

Nevada Combined Sales And Use Tax Return Form Form Resume Examples

Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. Total calculated sales (18a) and use (18b) tax 16 washoe 19. (b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible. Sales & use tax return. Sales & use tax forms.

Nevada State Sales Tax Form 2020 Paul Smith

(b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible. Sales & use tax forms. Sales and use tax return. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. Total calculated sales (18a) and use (18b) tax 16 washoe 19.

Total Calculated Sales (18A) And Use (18B) Tax 16 Washoe 19.

(b) the use tax, a return must be filed by each retailer maintaining a place of business in the state and by each person purchasing tangible. Enter collection allowance for timely filing (line 18a x 0.25%) net sales tax. Sales and use tax return. Sales & use tax return.