Real Estate Development Pro Forma

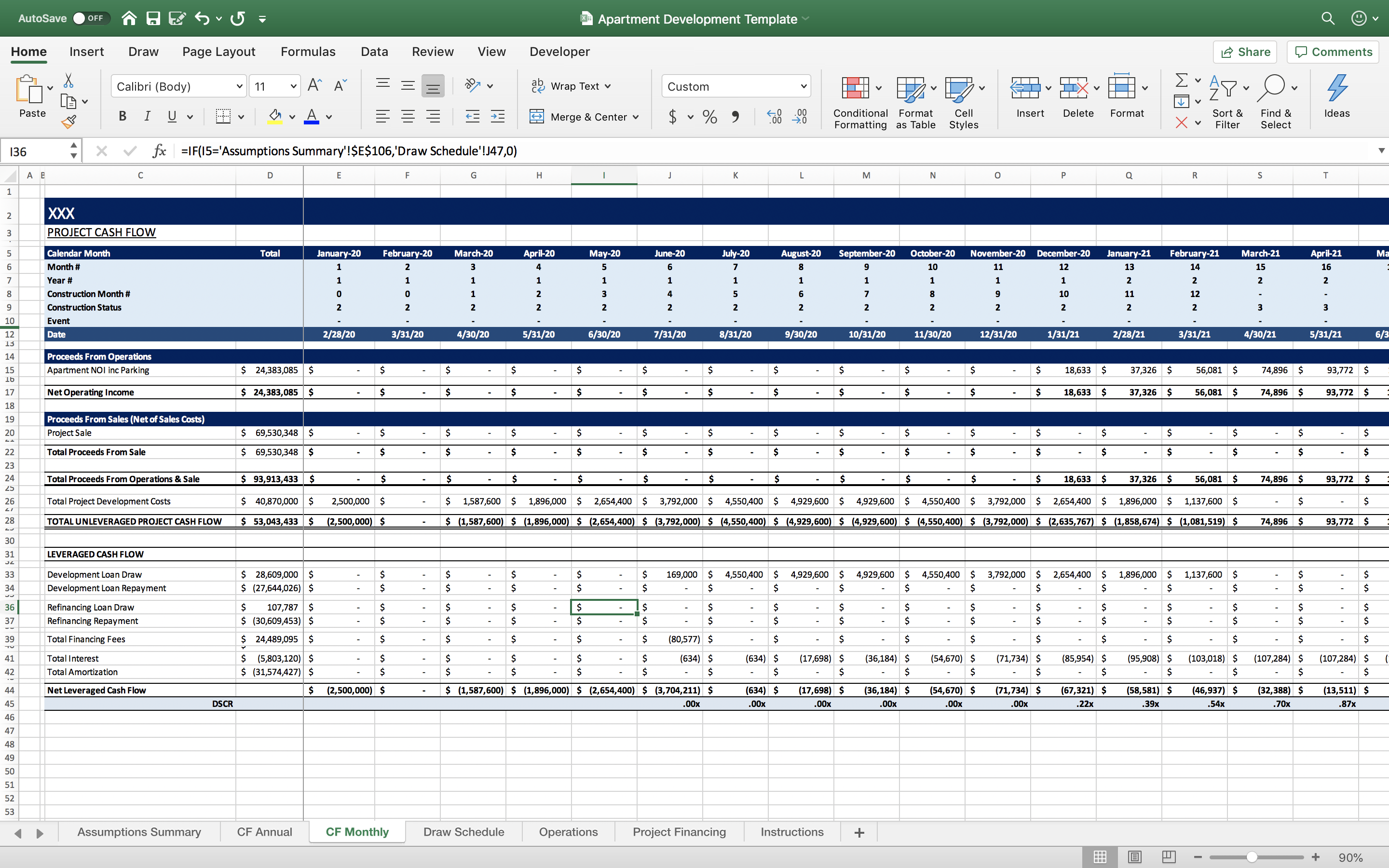

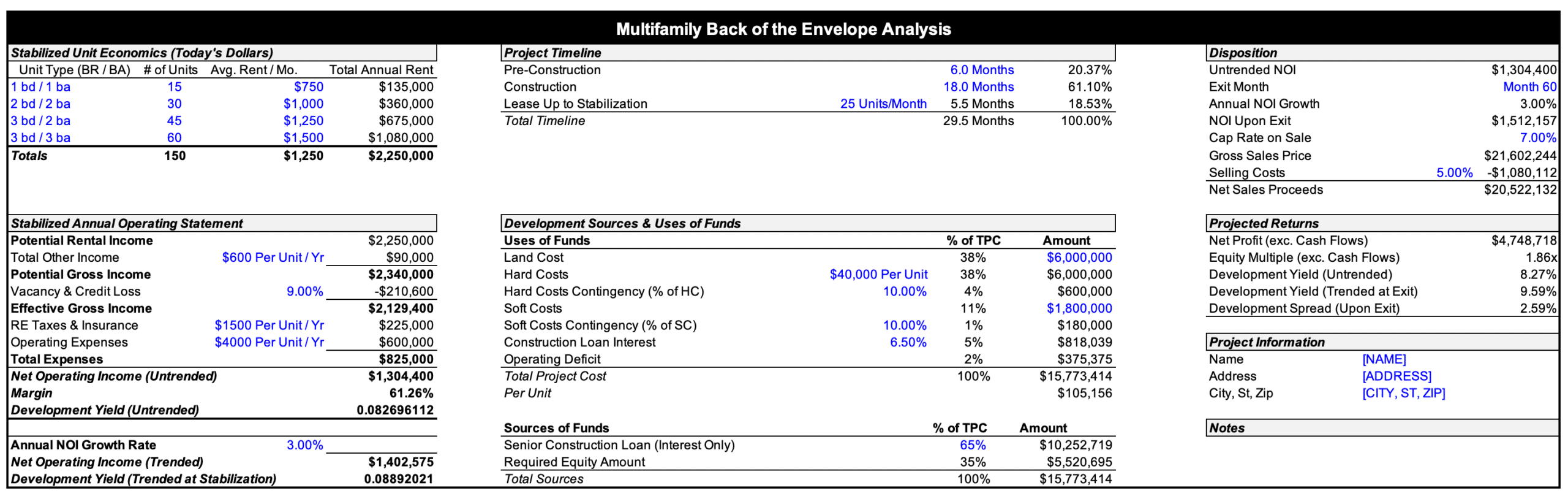

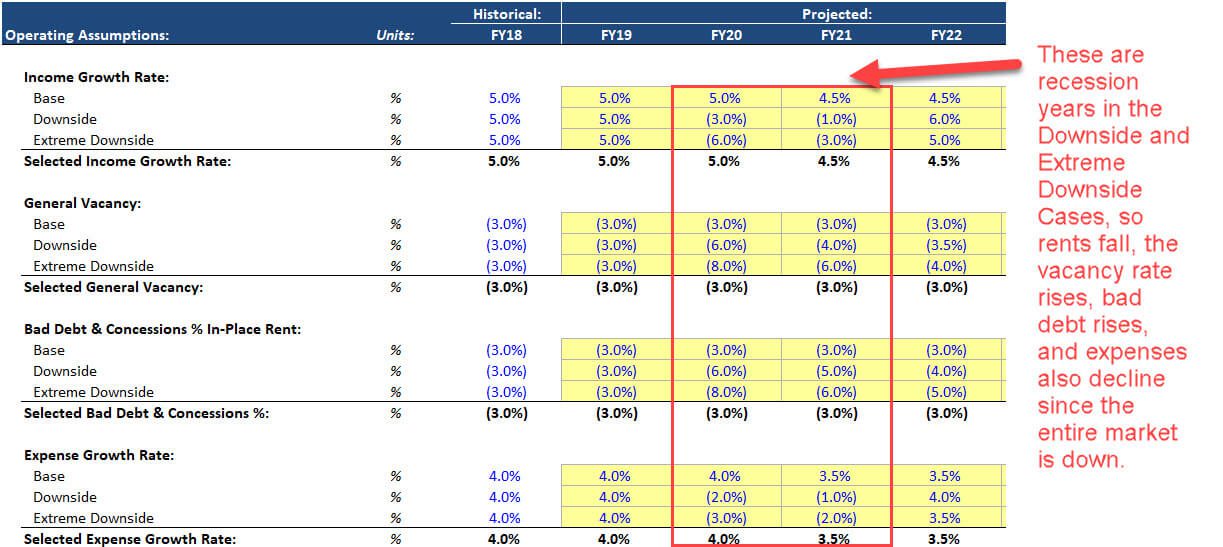

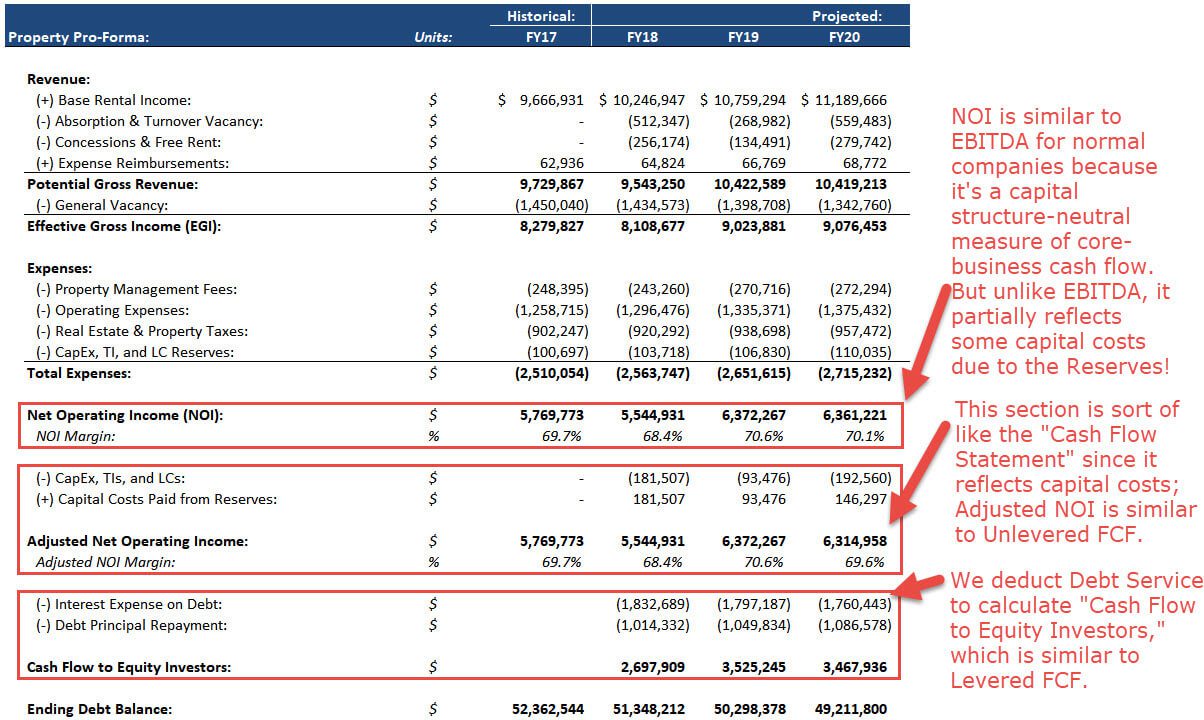

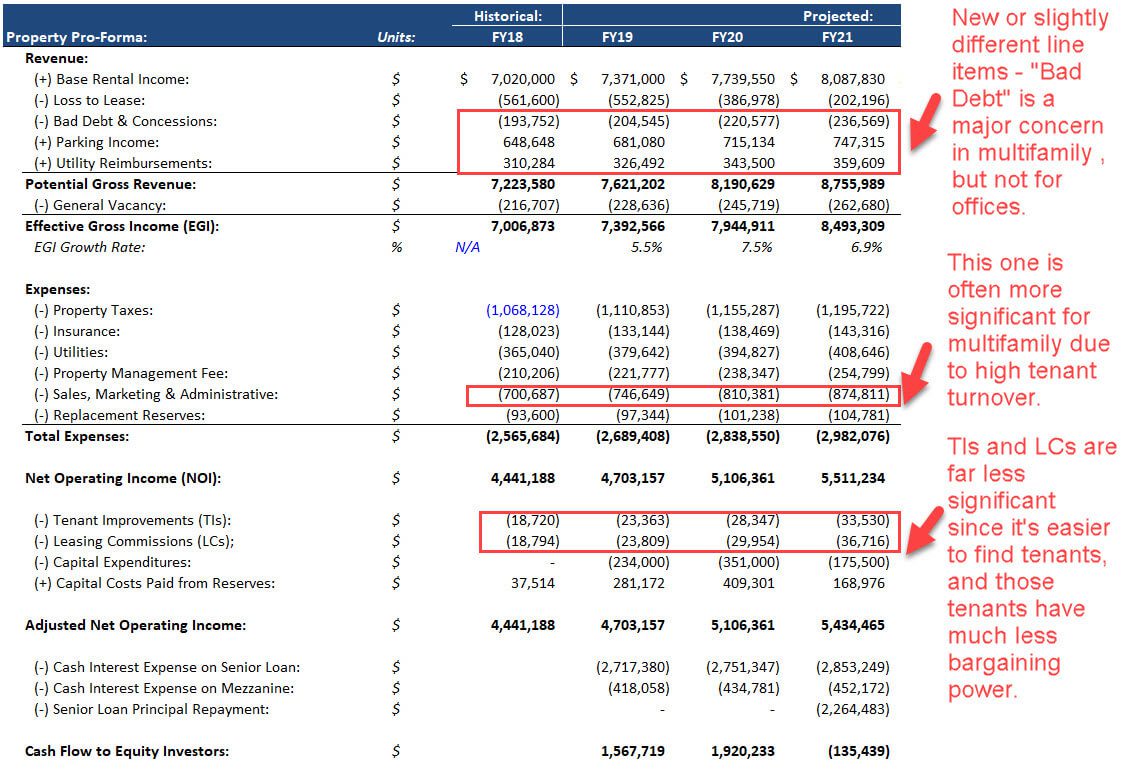

Real Estate Development Pro Forma - It starts with the potential gross income, then deducts vacancy and credit loss. A pro forma allows an investor, developer or lender to look at the net operating income (noi) and cash flow projections from a real estate project to make investment. A real estate proforma is a financial projection that estimates a property’s income and expenses. Over the last few years, we’ve worked to build the world’s largest library of readily accessible excel models (real estate pro formas) for commercial and residential real estate professionals.

It starts with the potential gross income, then deducts vacancy and credit loss. A real estate proforma is a financial projection that estimates a property’s income and expenses. A pro forma allows an investor, developer or lender to look at the net operating income (noi) and cash flow projections from a real estate project to make investment. Over the last few years, we’ve worked to build the world’s largest library of readily accessible excel models (real estate pro formas) for commercial and residential real estate professionals.

A pro forma allows an investor, developer or lender to look at the net operating income (noi) and cash flow projections from a real estate project to make investment. Over the last few years, we’ve worked to build the world’s largest library of readily accessible excel models (real estate pro formas) for commercial and residential real estate professionals. It starts with the potential gross income, then deducts vacancy and credit loss. A real estate proforma is a financial projection that estimates a property’s income and expenses.

Pro Forma Real Estate Everything You Need to Know

It starts with the potential gross income, then deducts vacancy and credit loss. A real estate proforma is a financial projection that estimates a property’s income and expenses. A pro forma allows an investor, developer or lender to look at the net operating income (noi) and cash flow projections from a real estate project to make investment. Over the last.

Real Estate Proforma Excel Model Template Eloquens

It starts with the potential gross income, then deducts vacancy and credit loss. Over the last few years, we’ve worked to build the world’s largest library of readily accessible excel models (real estate pro formas) for commercial and residential real estate professionals. A pro forma allows an investor, developer or lender to look at the net operating income (noi) and.

Real Estate Development Pro Forma Template Excel

It starts with the potential gross income, then deducts vacancy and credit loss. A real estate proforma is a financial projection that estimates a property’s income and expenses. A pro forma allows an investor, developer or lender to look at the net operating income (noi) and cash flow projections from a real estate project to make investment. Over the last.

Real Estate Development Proforma Template PropertyMetrics

A real estate proforma is a financial projection that estimates a property’s income and expenses. A pro forma allows an investor, developer or lender to look at the net operating income (noi) and cash flow projections from a real estate project to make investment. It starts with the potential gross income, then deducts vacancy and credit loss. Over the last.

Real Estate Development Proforma Ultimate Guide

It starts with the potential gross income, then deducts vacancy and credit loss. A pro forma allows an investor, developer or lender to look at the net operating income (noi) and cash flow projections from a real estate project to make investment. Over the last few years, we’ve worked to build the world’s largest library of readily accessible excel models.

Real Estate Development Pro Forma Template Excel

A pro forma allows an investor, developer or lender to look at the net operating income (noi) and cash flow projections from a real estate project to make investment. A real estate proforma is a financial projection that estimates a property’s income and expenses. Over the last few years, we’ve worked to build the world’s largest library of readily accessible.

Commercial Real Estate Development Pro Forma Excel Peatix

A pro forma allows an investor, developer or lender to look at the net operating income (noi) and cash flow projections from a real estate project to make investment. It starts with the potential gross income, then deducts vacancy and credit loss. A real estate proforma is a financial projection that estimates a property’s income and expenses. Over the last.

Commercial Real Estate Development Pro Forma Excel supplylasopa

A pro forma allows an investor, developer or lender to look at the net operating income (noi) and cash flow projections from a real estate project to make investment. Over the last few years, we’ve worked to build the world’s largest library of readily accessible excel models (real estate pro formas) for commercial and residential real estate professionals. A real.

Real Estate ProForma Calculations, Examples, and Scenarios (Video)

A real estate proforma is a financial projection that estimates a property’s income and expenses. It starts with the potential gross income, then deducts vacancy and credit loss. Over the last few years, we’ve worked to build the world’s largest library of readily accessible excel models (real estate pro formas) for commercial and residential real estate professionals. A pro forma.

Real Estate Development Pro Forma Template Excel

A real estate proforma is a financial projection that estimates a property’s income and expenses. A pro forma allows an investor, developer or lender to look at the net operating income (noi) and cash flow projections from a real estate project to make investment. Over the last few years, we’ve worked to build the world’s largest library of readily accessible.

Over The Last Few Years, We’ve Worked To Build The World’s Largest Library Of Readily Accessible Excel Models (Real Estate Pro Formas) For Commercial And Residential Real Estate Professionals.

A real estate proforma is a financial projection that estimates a property’s income and expenses. It starts with the potential gross income, then deducts vacancy and credit loss. A pro forma allows an investor, developer or lender to look at the net operating income (noi) and cash flow projections from a real estate project to make investment.