Inheritance Tax Waiver Form California

Inheritance Tax Waiver Form California - This form is to be used only for estates of decedents who died on or after june 8, 1982 and before january 1, 2005. Find out how to file a return, request a. Learn about the history and current status of california estate tax, inheritance tax, and gift tax. Is there a california inheritance tax waiver form? However, if the gift or inheritance later produces income, you will. How the real property was. The return is due and. California does not have an inheritance tax, estate tax, or gift tax. California does not have an estate tax. California does not impose a state inheritance tax.

The return is due and. You may be thinking of a exemption from reassessment for real property taxes. If you received a gift or inheritance, do not include it in your income. How the real property was. In california, there is no requirement for an inheritance tax waiver form, a legal. However, california residents are subject to federal laws governing gifts during. This means that beneficiaries inheriting assets from a decedent who was a. This form is to be used only for estates of decedents who died on or after june 8, 1982 and before january 1, 2005. California does not impose a state inheritance tax. However, if the gift or inheritance later produces income, you will.

How the real property was. California does not have an estate tax. In california, there is no requirement for an inheritance tax waiver form, a legal. This form is to be used only for estates of decedents who died on or after june 8, 1982 and before january 1, 2005. Find out how to file a return, request a. This means that beneficiaries inheriting assets from a decedent who was a. If you received a gift or inheritance, do not include it in your income. However, california residents are subject to federal laws governing gifts during. Is there a california inheritance tax waiver form? You may be thinking of a exemption from reassessment for real property taxes.

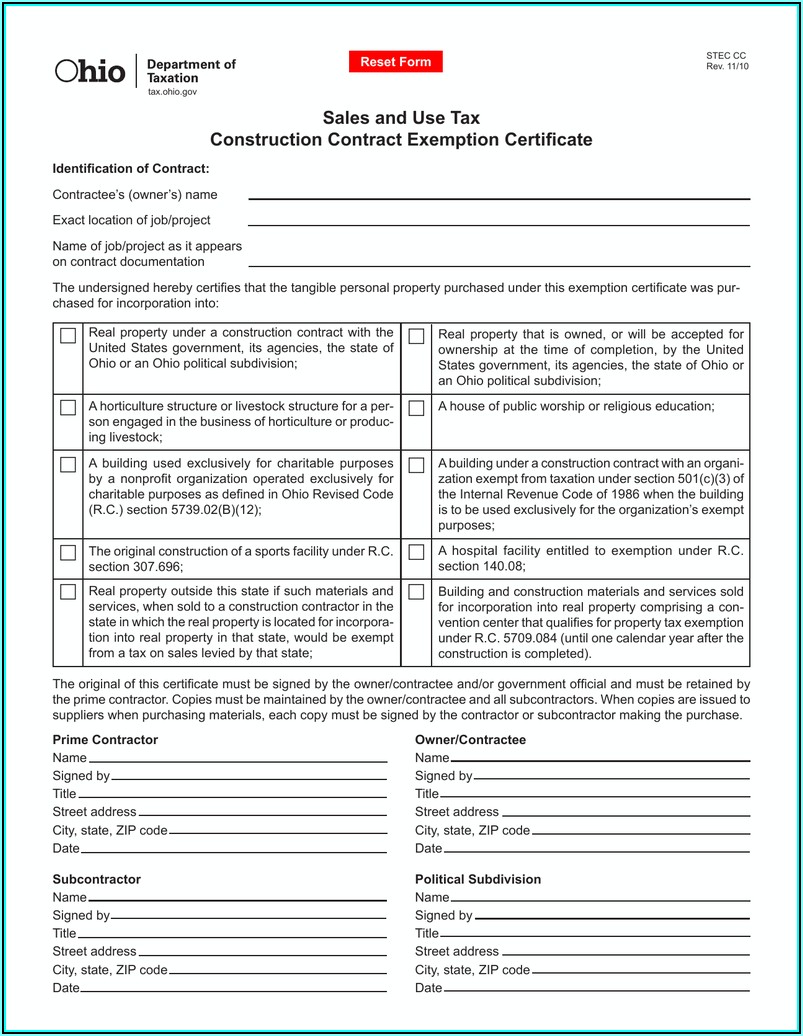

Inheritance Tax Waiver Form Ohio Form Resume Examples v19xB3bV7E

In california, there is no requirement for an inheritance tax waiver form, a legal. Is there a california inheritance tax waiver form? The return is due and. If you received a gift or inheritance, do not include it in your income. How the real property was.

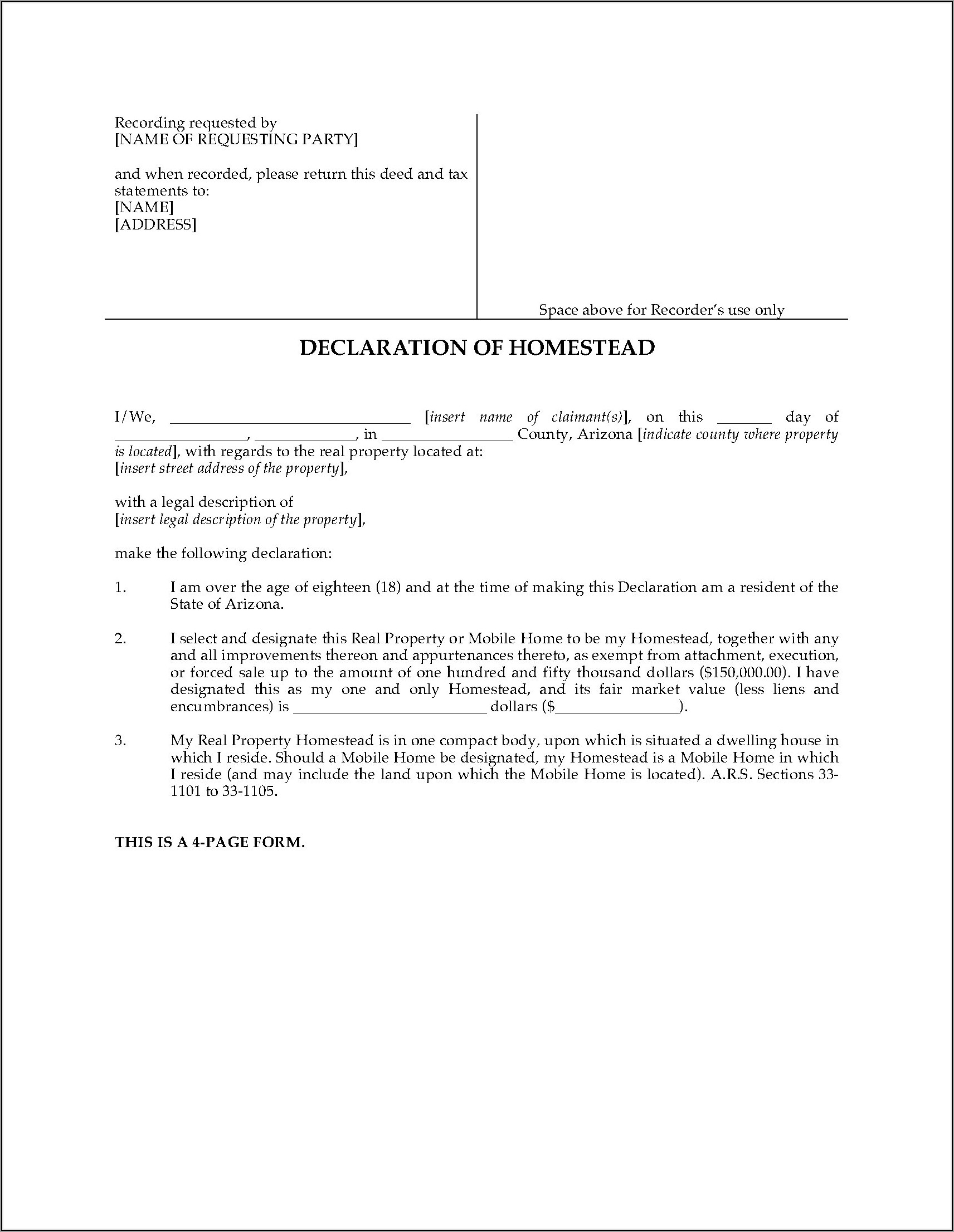

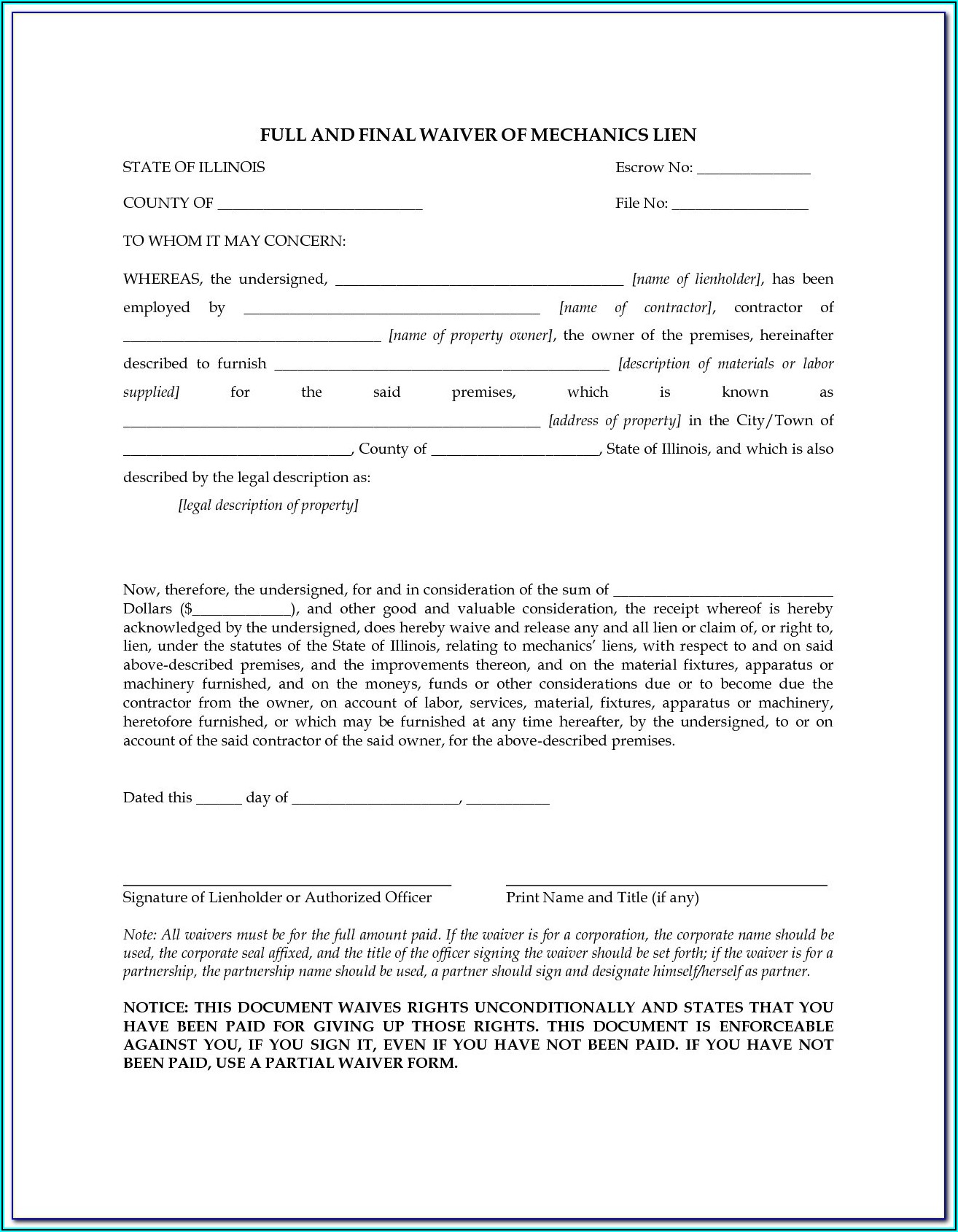

Inheritance Tax Waiver Form Az Form Resume Examples N8VZwyM2we

Find out how to file a return, request a. However, california residents are subject to federal laws governing gifts during. However, if the gift or inheritance later produces income, you will. If you received a gift or inheritance, do not include it in your income. In california, there is no requirement for an inheritance tax waiver form, a legal.

Fillable Online Inheritance Tax Waiver Form Fillable, Printable

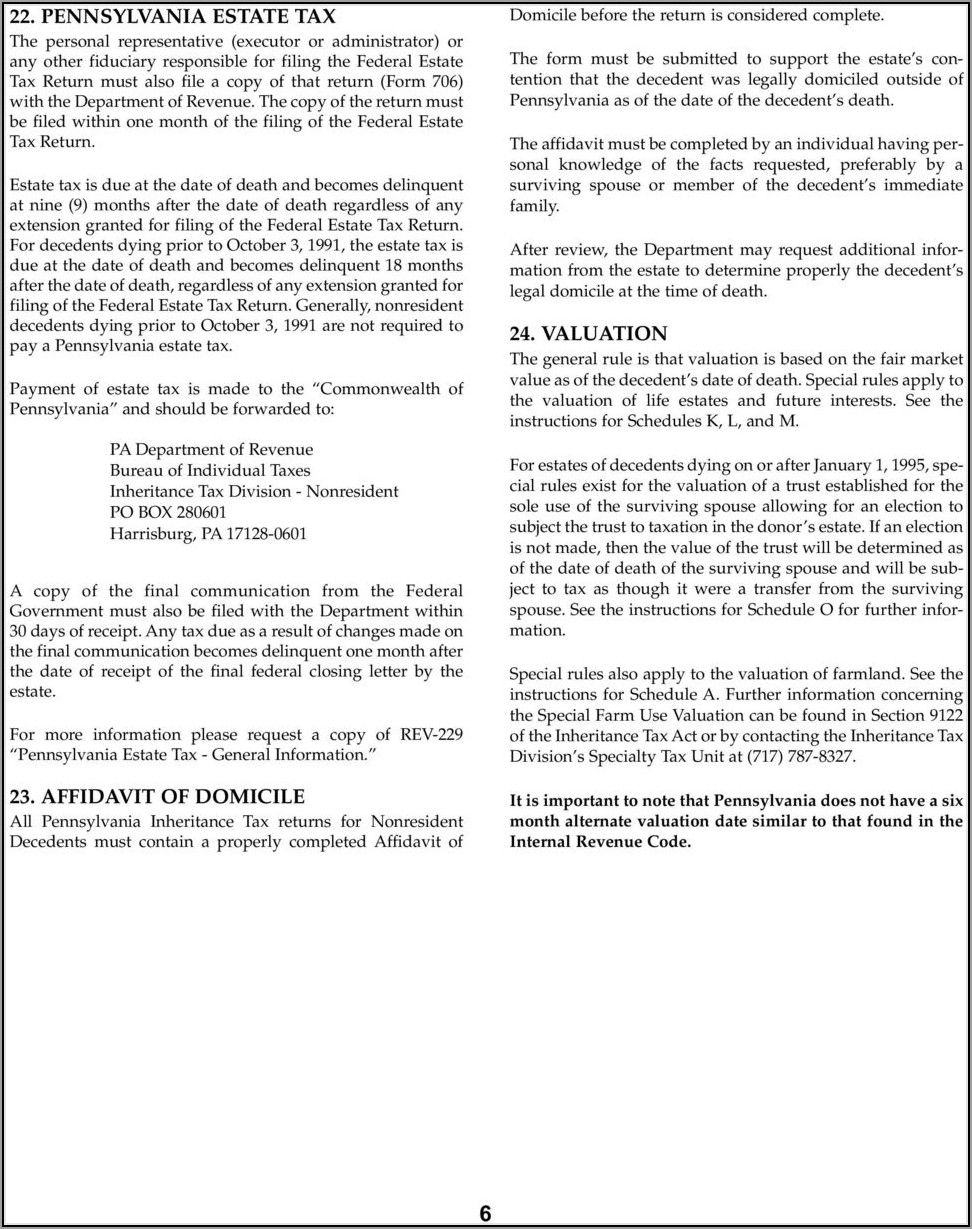

California does not have an estate tax. Find out how to file a return, request a. Learn about the history and current status of california estate tax, inheritance tax, and gift tax. How the real property was. The return is due and.

Inheritance Tax Waiver Form Ohio Form Resume Examples v19xB3bV7E

This means that beneficiaries inheriting assets from a decedent who was a. If you received a gift or inheritance, do not include it in your income. However, california residents are subject to federal laws governing gifts during. Is there a california inheritance tax waiver form? This form is to be used only for estates of decedents who died on or.

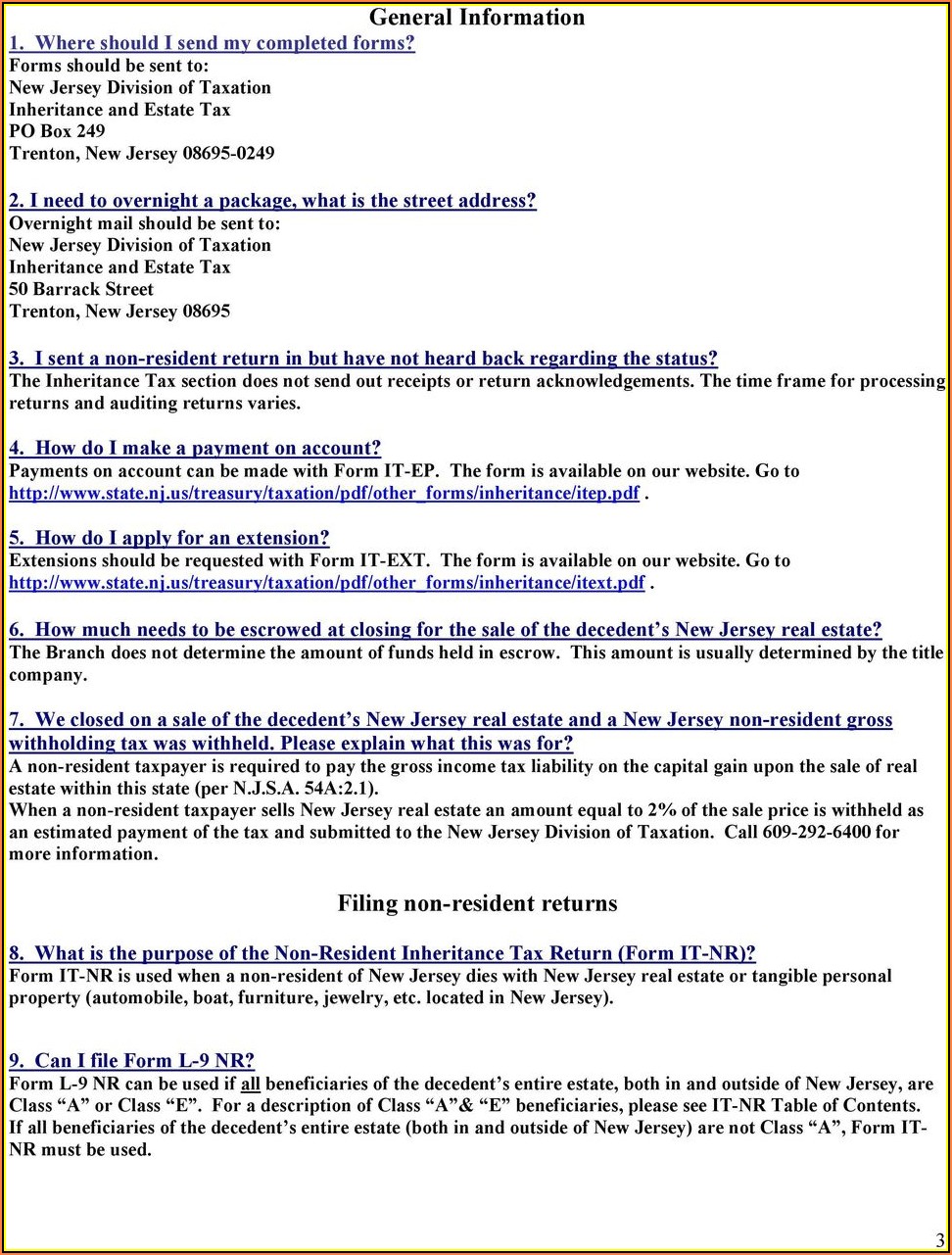

20192024 Form NJ L4 Fill Online, Printable, Fillable, Blank pdfFiller

Is there a california inheritance tax waiver form? California does not have an estate tax. California does not have an inheritance tax, estate tax, or gift tax. Learn about the history and current status of california estate tax, inheritance tax, and gift tax. This form is to be used only for estates of decedents who died on or after june.

Inheritance Tax Waiver Form Pa Form Resume Examples kLYrL0326a

Learn about the history and current status of california estate tax, inheritance tax, and gift tax. California does not impose a state inheritance tax. This means that beneficiaries inheriting assets from a decedent who was a. Is there a california inheritance tax waiver form? In california, there is no requirement for an inheritance tax waiver form, a legal.

California inheritance tax waiver form Fill out & sign online DocHub

Find out how to file a return, request a. However, if the gift or inheritance later produces income, you will. This means that beneficiaries inheriting assets from a decedent who was a. This form is to be used only for estates of decedents who died on or after june 8, 1982 and before january 1, 2005. How the real property.

Inheritance Tax Waiver Form Missouri Form Resume Examples P32EdpZVJ8

You may be thinking of a exemption from reassessment for real property taxes. California does not have an estate tax. Learn about the history and current status of california estate tax, inheritance tax, and gift tax. This form is to be used only for estates of decedents who died on or after june 8, 1982 and before january 1, 2005..

Inheritance Tax Waiver Form Ohio Form Resume Examples v19xB3bV7E

California does not have an inheritance tax, estate tax, or gift tax. Find out how to file a return, request a. This form is to be used only for estates of decedents who died on or after june 8, 1982 and before january 1, 2005. However, if the gift or inheritance later produces income, you will. You may be thinking.

Inheritance Tax Waiver Form New York State Form Resume Examples

How the real property was. You may be thinking of a exemption from reassessment for real property taxes. This form is to be used only for estates of decedents who died on or after june 8, 1982 and before january 1, 2005. California does not impose a state inheritance tax. California does not have an inheritance tax, estate tax, or.

However, California Residents Are Subject To Federal Laws Governing Gifts During.

You may be thinking of a exemption from reassessment for real property taxes. If you received a gift or inheritance, do not include it in your income. Find out how to file a return, request a. Learn about the history and current status of california estate tax, inheritance tax, and gift tax.

However, If The Gift Or Inheritance Later Produces Income, You Will.

This means that beneficiaries inheriting assets from a decedent who was a. The return is due and. Is there a california inheritance tax waiver form? California does not have an estate tax.

California Does Not Impose A State Inheritance Tax.

How the real property was. In california, there is no requirement for an inheritance tax waiver form, a legal. California does not have an inheritance tax, estate tax, or gift tax. This form is to be used only for estates of decedents who died on or after june 8, 1982 and before january 1, 2005.