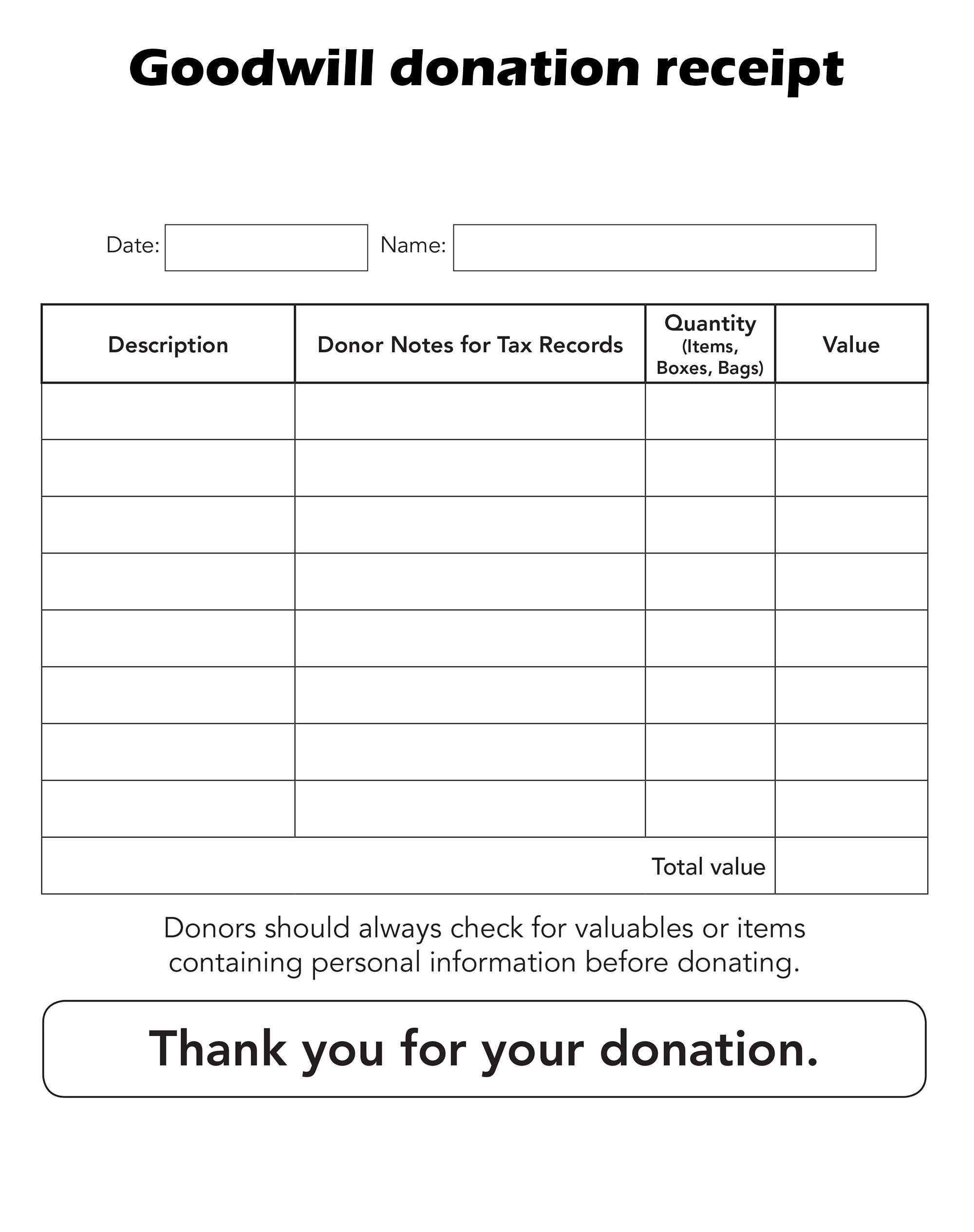

Goodwill Itemized Donation Form

Goodwill Itemized Donation Form - Not all donations to goodwill automatically qualify for tax deductions. Federal law states that taxpayers are responsible for determining the value of their donated items to goodwill® on their taxes. If you itemize your deductions on your tax return, you can deduct these donations. To claim such a deduction, the donations must be made. Learn how to value your donations and claim a tax deduction for clothing and household items that are in good condition.

To claim such a deduction, the donations must be made. If you itemize your deductions on your tax return, you can deduct these donations. Federal law states that taxpayers are responsible for determining the value of their donated items to goodwill® on their taxes. Not all donations to goodwill automatically qualify for tax deductions. Learn how to value your donations and claim a tax deduction for clothing and household items that are in good condition.

If you itemize your deductions on your tax return, you can deduct these donations. Federal law states that taxpayers are responsible for determining the value of their donated items to goodwill® on their taxes. Not all donations to goodwill automatically qualify for tax deductions. Learn how to value your donations and claim a tax deduction for clothing and household items that are in good condition. To claim such a deduction, the donations must be made.

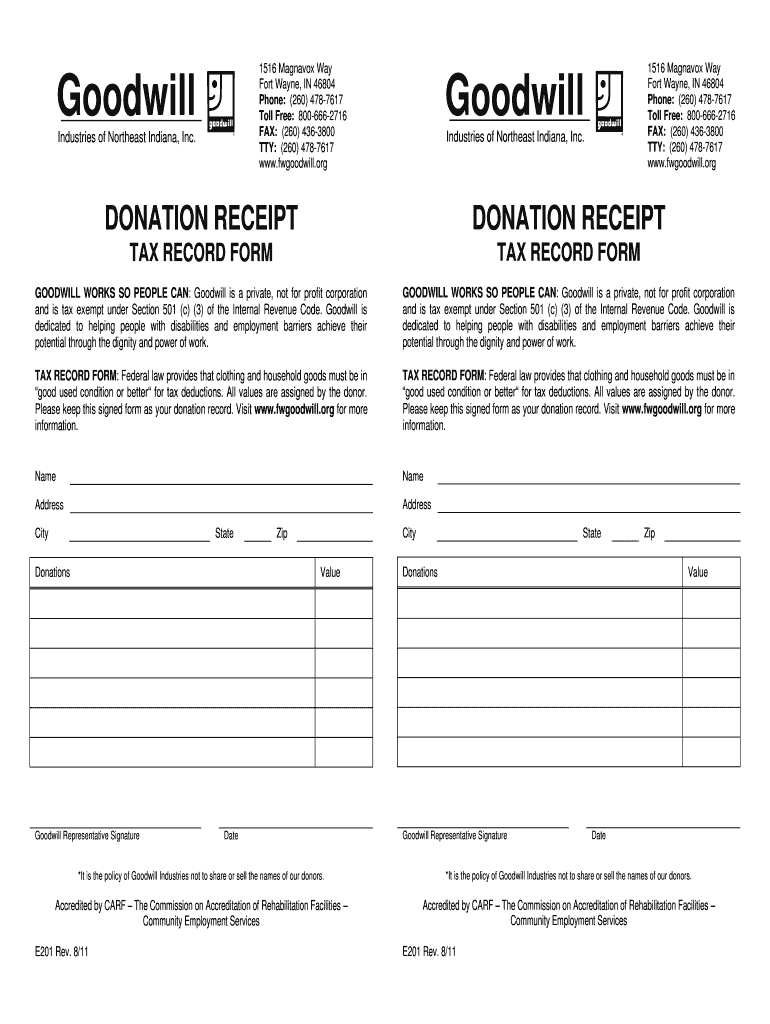

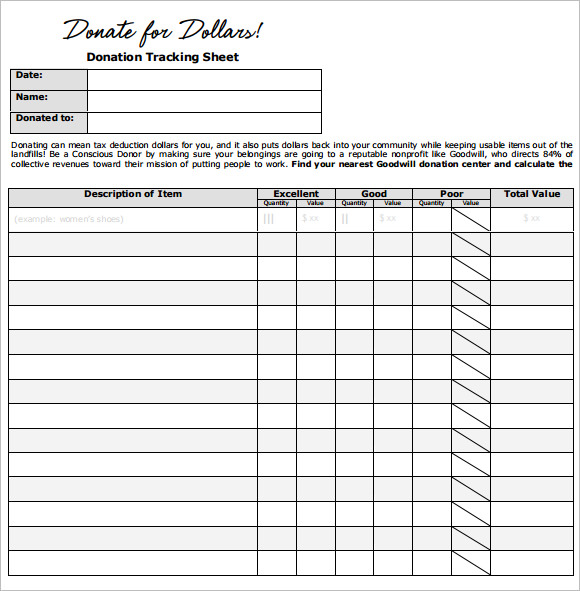

Donation Printable Form Printable Forms Free Online

Federal law states that taxpayers are responsible for determining the value of their donated items to goodwill® on their taxes. To claim such a deduction, the donations must be made. If you itemize your deductions on your tax return, you can deduct these donations. Learn how to value your donations and claim a tax deduction for clothing and household items.

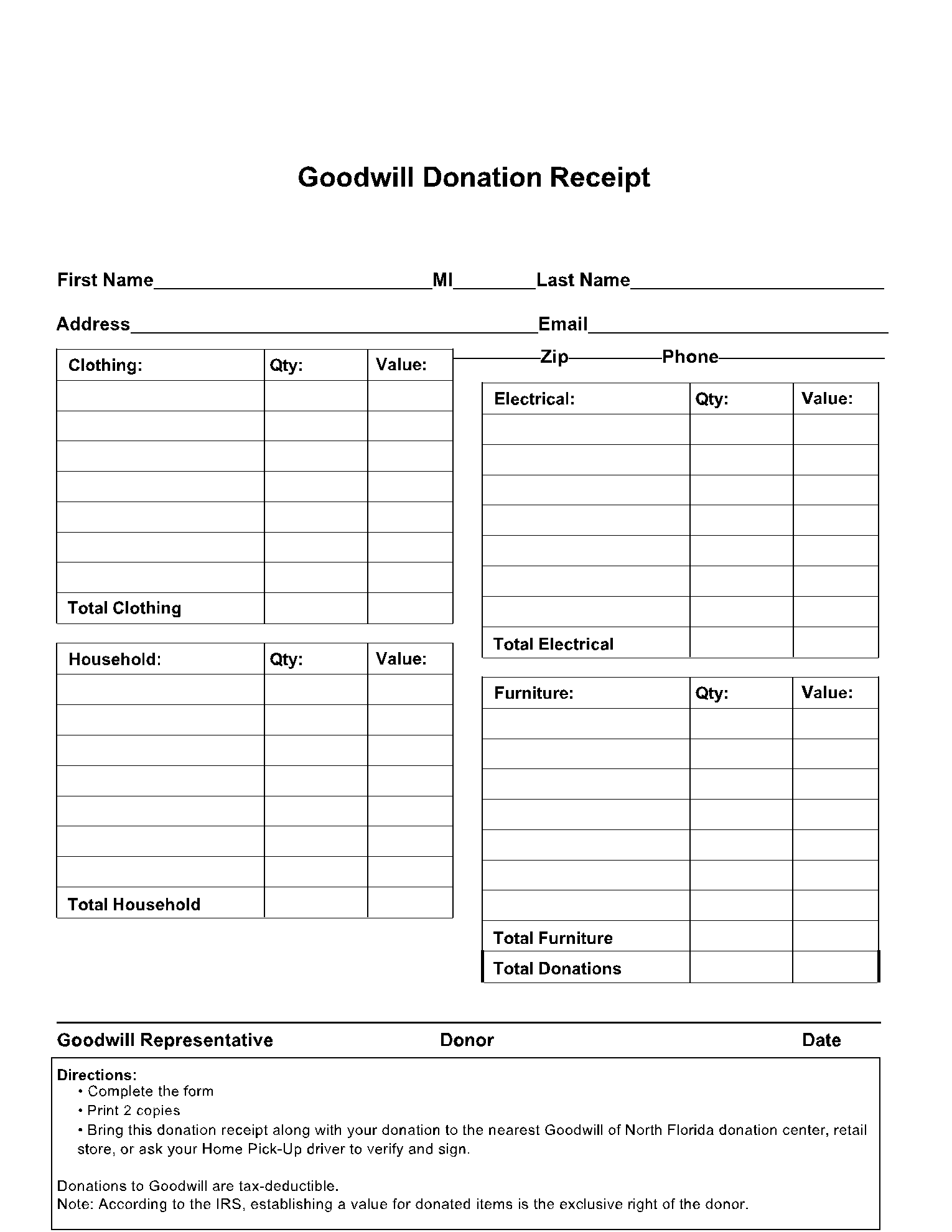

free goodwill donation receipt template pdf eforms free goodwill

If you itemize your deductions on your tax return, you can deduct these donations. Learn how to value your donations and claim a tax deduction for clothing and household items that are in good condition. Federal law states that taxpayers are responsible for determining the value of their donated items to goodwill® on their taxes. Not all donations to goodwill.

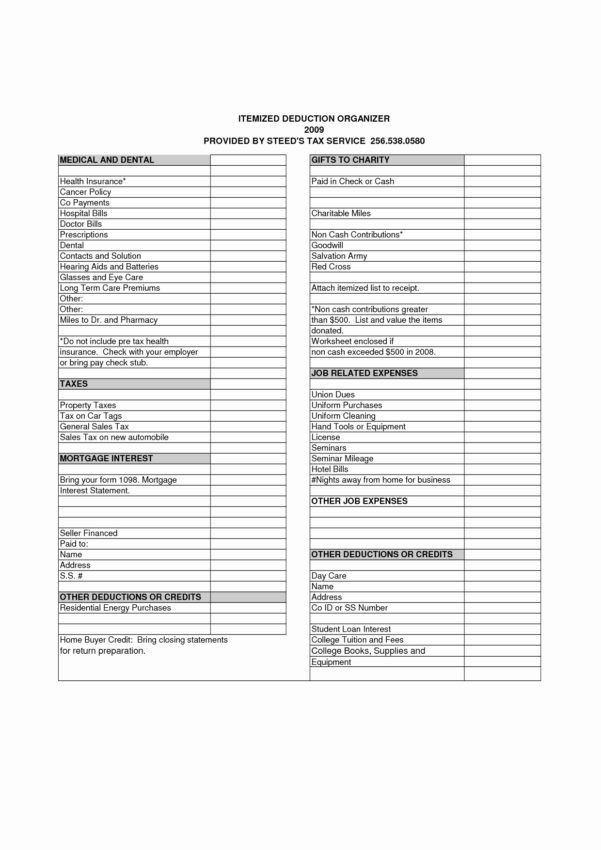

Irs Donation Value Guide 2018 Spreadsheet Payment Spreadshee irs

Learn how to value your donations and claim a tax deduction for clothing and household items that are in good condition. If you itemize your deductions on your tax return, you can deduct these donations. To claim such a deduction, the donations must be made. Federal law states that taxpayers are responsible for determining the value of their donated items.

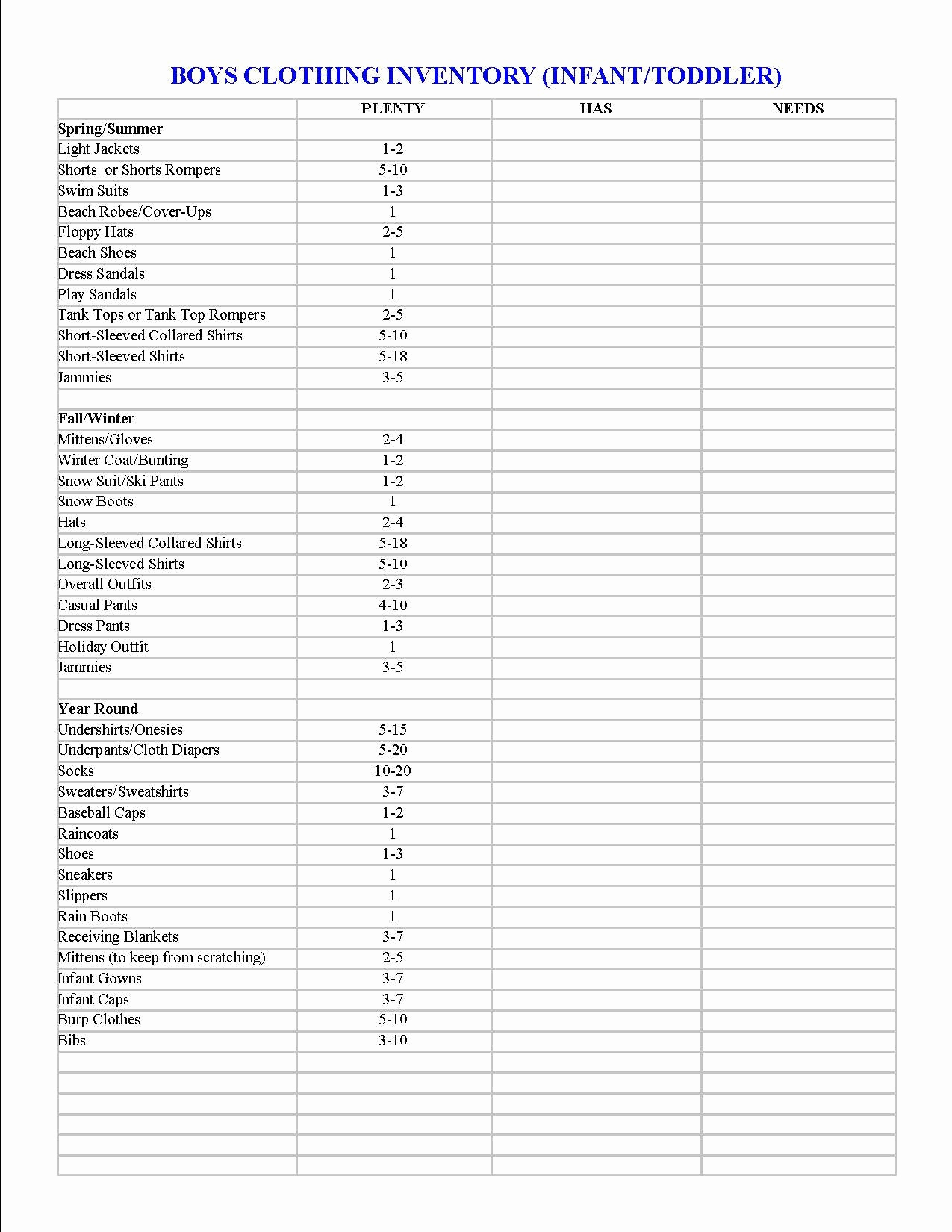

goodwill donations list Google Search Donate, Goodwill donations

To claim such a deduction, the donations must be made. Not all donations to goodwill automatically qualify for tax deductions. Learn how to value your donations and claim a tax deduction for clothing and household items that are in good condition. Federal law states that taxpayers are responsible for determining the value of their donated items to goodwill® on their.

Wigs For Kids Florida Printable Donation Form Printable Forms Free Online

Not all donations to goodwill automatically qualify for tax deductions. If you itemize your deductions on your tax return, you can deduct these donations. Federal law states that taxpayers are responsible for determining the value of their donated items to goodwill® on their taxes. Learn how to value your donations and claim a tax deduction for clothing and household items.

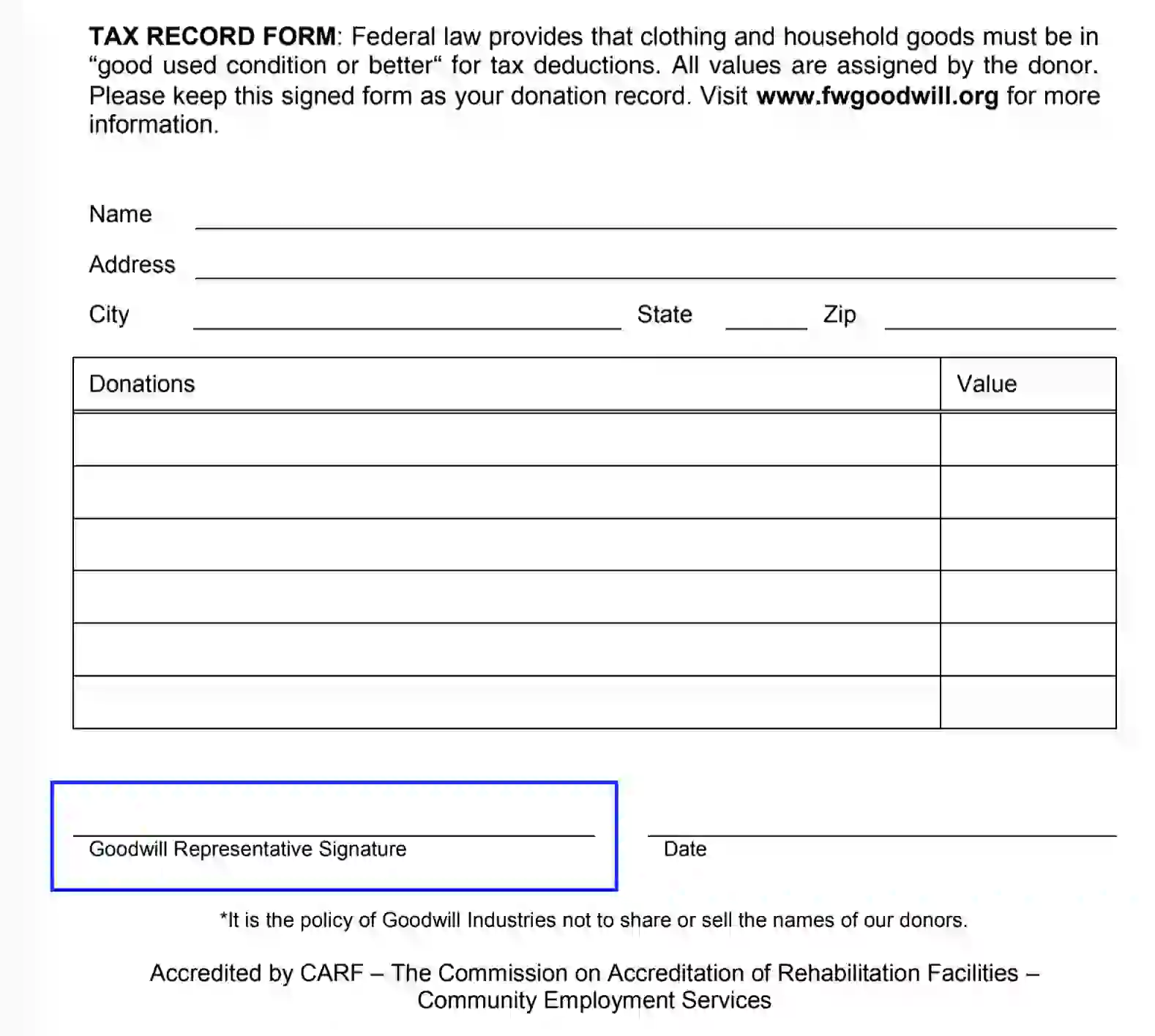

Goodwill Donation Receipt Fill Online Printable Fillable —

Federal law states that taxpayers are responsible for determining the value of their donated items to goodwill® on their taxes. To claim such a deduction, the donations must be made. Learn how to value your donations and claim a tax deduction for clothing and household items that are in good condition. Not all donations to goodwill automatically qualify for tax.

Goodwill Donation Valuation Guide 2022

To claim such a deduction, the donations must be made. Federal law states that taxpayers are responsible for determining the value of their donated items to goodwill® on their taxes. If you itemize your deductions on your tax return, you can deduct these donations. Not all donations to goodwill automatically qualify for tax deductions. Learn how to value your donations.

Itemized Donation List For Taxes

Not all donations to goodwill automatically qualify for tax deductions. Learn how to value your donations and claim a tax deduction for clothing and household items that are in good condition. Federal law states that taxpayers are responsible for determining the value of their donated items to goodwill® on their taxes. To claim such a deduction, the donations must be.

Goodwill Clothing Donation Form Template Donation form, Goodwill

Not all donations to goodwill automatically qualify for tax deductions. Federal law states that taxpayers are responsible for determining the value of their donated items to goodwill® on their taxes. Learn how to value your donations and claim a tax deduction for clothing and household items that are in good condition. To claim such a deduction, the donations must be.

Printable Goodwill Donation Receipt

Federal law states that taxpayers are responsible for determining the value of their donated items to goodwill® on their taxes. To claim such a deduction, the donations must be made. Not all donations to goodwill automatically qualify for tax deductions. If you itemize your deductions on your tax return, you can deduct these donations. Learn how to value your donations.

Federal Law States That Taxpayers Are Responsible For Determining The Value Of Their Donated Items To Goodwill® On Their Taxes.

Not all donations to goodwill automatically qualify for tax deductions. Learn how to value your donations and claim a tax deduction for clothing and household items that are in good condition. To claim such a deduction, the donations must be made. If you itemize your deductions on your tax return, you can deduct these donations.