Form 8027 Due Date

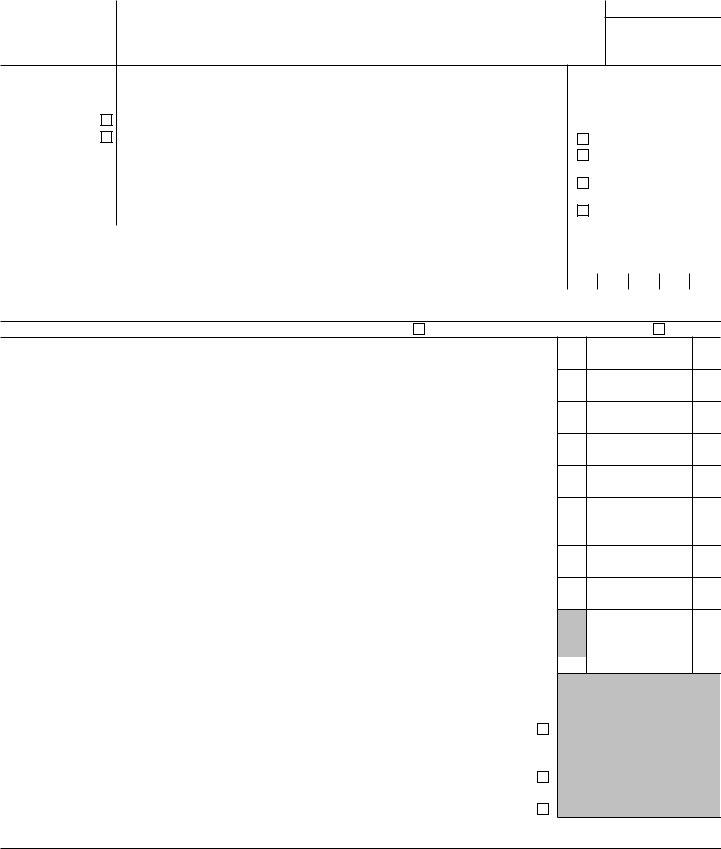

Form 8027 Due Date - Annually report to the irs receipts and tips from their large food or beverage establishments. You must file form 8027 by february 28 of the year after the calendar year for which you’re filing the return. However, if you file electronically, the due date. File the completed form 8027 by the due date specified. Employers use form 8027 to: Form 8027 department of the treasury internal revenue service employer’s annual information return of tip income and allocated tips see. Who needs the instructions for form 8027 tip income reporting?

However, if you file electronically, the due date. Employers use form 8027 to: You must file form 8027 by february 28 of the year after the calendar year for which you’re filing the return. Annually report to the irs receipts and tips from their large food or beverage establishments. File the completed form 8027 by the due date specified. Who needs the instructions for form 8027 tip income reporting? Form 8027 department of the treasury internal revenue service employer’s annual information return of tip income and allocated tips see.

Who needs the instructions for form 8027 tip income reporting? Form 8027 department of the treasury internal revenue service employer’s annual information return of tip income and allocated tips see. File the completed form 8027 by the due date specified. However, if you file electronically, the due date. Employers use form 8027 to: You must file form 8027 by february 28 of the year after the calendar year for which you’re filing the return. Annually report to the irs receipts and tips from their large food or beverage establishments.

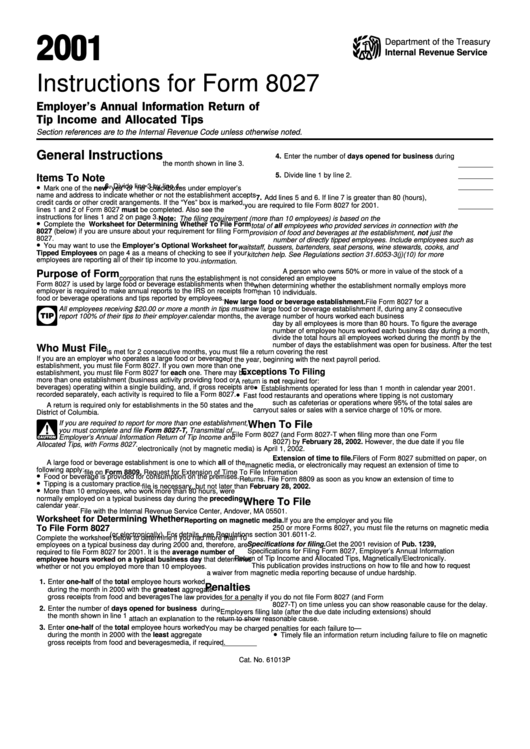

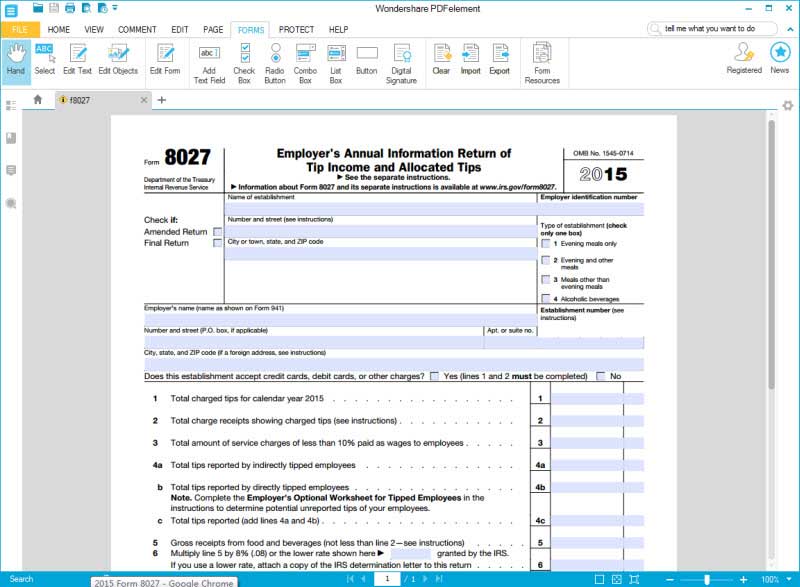

Instructions For Form 8027 printable pdf download

However, if you file electronically, the due date. Who needs the instructions for form 8027 tip income reporting? File the completed form 8027 by the due date specified. Employers use form 8027 to: Annually report to the irs receipts and tips from their large food or beverage establishments.

Form 8027 ≡ Fill Out Printable PDF Forms Online

Who needs the instructions for form 8027 tip income reporting? However, if you file electronically, the due date. Form 8027 department of the treasury internal revenue service employer’s annual information return of tip income and allocated tips see. File the completed form 8027 by the due date specified. Annually report to the irs receipts and tips from their large food.

Irs tip reporting form 4070 Fill online, Printable, Fillable Blank

File the completed form 8027 by the due date specified. Form 8027 department of the treasury internal revenue service employer’s annual information return of tip income and allocated tips see. Employers use form 8027 to: Annually report to the irs receipts and tips from their large food or beverage establishments. However, if you file electronically, the due date.

DA Form 8027r Fill Out, Sign Online and Download Fillable PDF

Employers use form 8027 to: Form 8027 department of the treasury internal revenue service employer’s annual information return of tip income and allocated tips see. Annually report to the irs receipts and tips from their large food or beverage establishments. File the completed form 8027 by the due date specified. However, if you file electronically, the due date.

Compliance Calendar for the month of August 2023 (FY 20222023

You must file form 8027 by february 28 of the year after the calendar year for which you’re filing the return. Who needs the instructions for form 8027 tip income reporting? Annually report to the irs receipts and tips from their large food or beverage establishments. However, if you file electronically, the due date. Employers use form 8027 to:

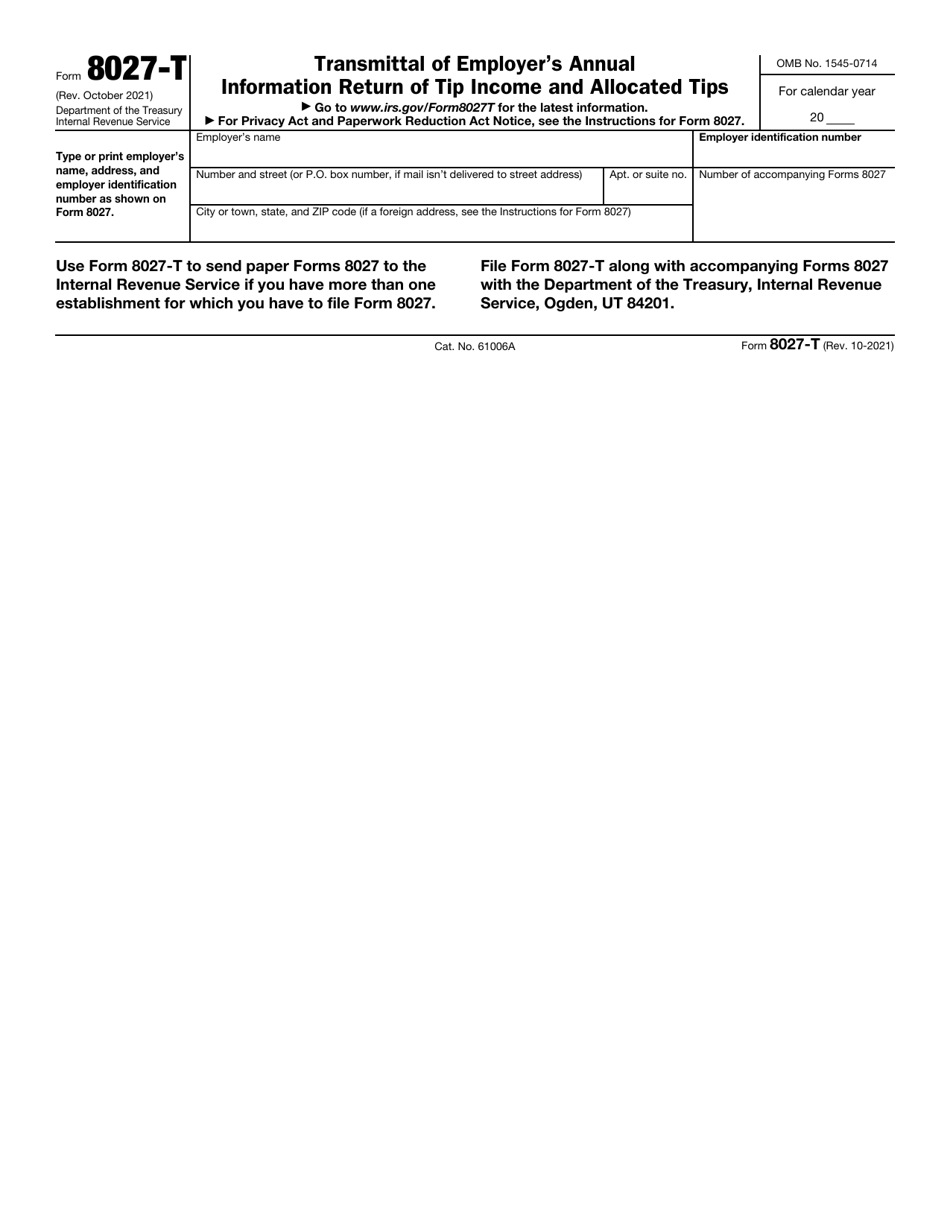

IRS Form 8027T Download Fillable PDF or Fill Online Transmittal of

File the completed form 8027 by the due date specified. Annually report to the irs receipts and tips from their large food or beverage establishments. You must file form 8027 by february 28 of the year after the calendar year for which you’re filing the return. Employers use form 8027 to: Form 8027 department of the treasury internal revenue service.

Federal Form 8027

Employers use form 8027 to: File the completed form 8027 by the due date specified. You must file form 8027 by february 28 of the year after the calendar year for which you’re filing the return. Who needs the instructions for form 8027 tip income reporting? Form 8027 department of the treasury internal revenue service employer’s annual information return of.

Fillable Irs Form 8027 Printable Forms Free Online

Form 8027 department of the treasury internal revenue service employer’s annual information return of tip income and allocated tips see. Annually report to the irs receipts and tips from their large food or beverage establishments. Employers use form 8027 to: File the completed form 8027 by the due date specified. You must file form 8027 by february 28 of the.

Workforce Reports Form 8027 Overview and Setup Support Center

Who needs the instructions for form 8027 tip income reporting? File the completed form 8027 by the due date specified. Annually report to the irs receipts and tips from their large food or beverage establishments. You must file form 8027 by february 28 of the year after the calendar year for which you’re filing the return. However, if you file.

A quick guide to IRS Form 8027 Outsource Accelerator

File the completed form 8027 by the due date specified. Who needs the instructions for form 8027 tip income reporting? Form 8027 department of the treasury internal revenue service employer’s annual information return of tip income and allocated tips see. However, if you file electronically, the due date. Employers use form 8027 to:

You Must File Form 8027 By February 28 Of The Year After The Calendar Year For Which You’re Filing The Return.

Employers use form 8027 to: File the completed form 8027 by the due date specified. Who needs the instructions for form 8027 tip income reporting? Form 8027 department of the treasury internal revenue service employer’s annual information return of tip income and allocated tips see.

However, If You File Electronically, The Due Date.

Annually report to the irs receipts and tips from their large food or beverage establishments.