Form 712 Life Insurance

Form 712 Life Insurance - Turbotax software for individuals doesn’t support form 712, life insurance statement. I received form 712 for a $5000 life insurance payout following my husband's death. Do i need to report that as income? If you are required to file form 706, it would be. Turbotax software for individuals doesn’t support form 712, life insurance statement. The irs levies a 1% excise tax on the foreign life insurance. However, this isn’t a form that you’d include with your personal income tax return. It goes to the executor of the. * if your foreign life insurance policy is considered a pfic, there may be far more complex tax factors to consider. Form 712 is a statement of valuation to be used in filing a.

Turbotax software for individuals doesn’t support form 712, life insurance statement. Turbotax software for individuals doesn’t support form 712, life insurance statement. * if your foreign life insurance policy is considered a pfic, there may be far more complex tax factors to consider. Form 712 is a statement of valuation to be used in filing a. The irs levies a 1% excise tax on the foreign life insurance. However, this isn’t a form that you’d include with your personal income tax return. Life insurance death proceeds form 712 if your mother's estate was less than (approximately) $5.4 million, you are not required to file form 706. I received form 712 for a $5000 life insurance payout following my husband's death. If you are required to file form 706, it would be. Do i need to report that as income?

Turbotax software for individuals doesn’t support form 712, life insurance statement. However, this isn’t a form that you’d include with your personal income tax return. It goes to the executor of the. Do i need to report that as income? The irs levies a 1% excise tax on the foreign life insurance. If you are required to file form 706, it would be. Turbotax software for individuals doesn’t support form 712, life insurance statement. I received form 712 for a $5000 life insurance payout following my husband's death. Life insurance death proceeds form 712 if your mother's estate was less than (approximately) $5.4 million, you are not required to file form 706. However, this isn’t a form that you’d include with your personal income tax return.

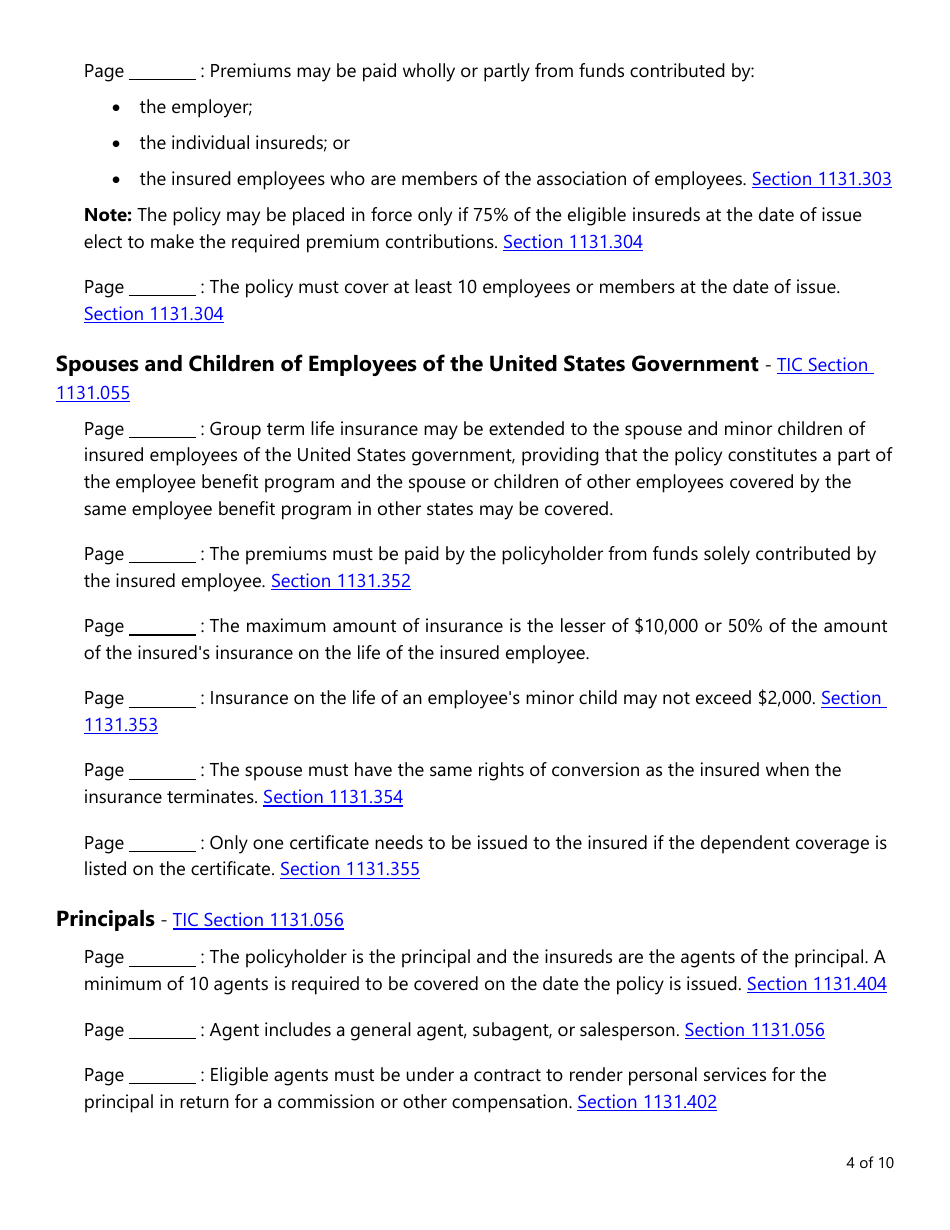

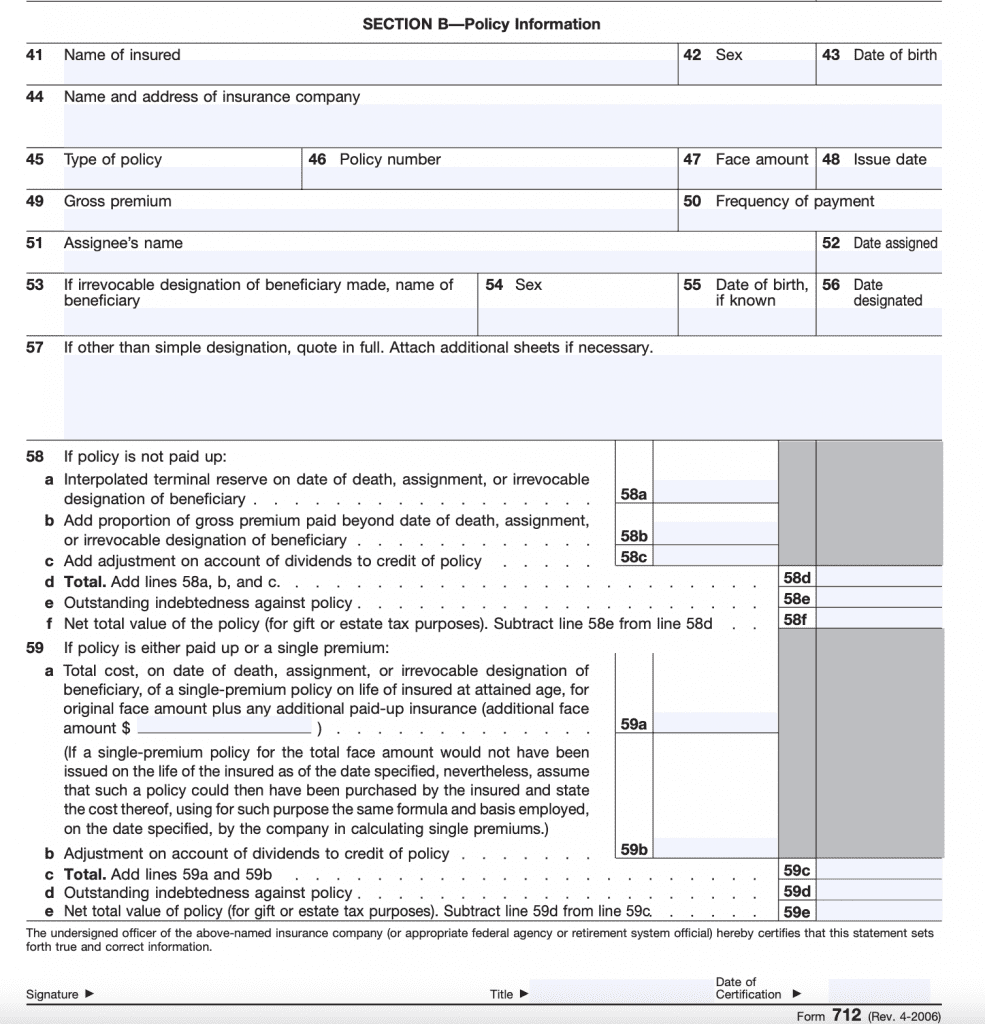

Form 712 Life Insurance Statement (2006) Free Download

I received form 712 for a $5000 life insurance payout following my husband's death. * if your foreign life insurance policy is considered a pfic, there may be far more complex tax factors to consider. It goes to the executor of the. However, this isn’t a form that you’d include with your personal income tax return. Life insurance death proceeds.

Customer Declaration Form Prudential Life Insurance Printable Pdf

* if your foreign life insurance policy is considered a pfic, there may be far more complex tax factors to consider. However, this isn’t a form that you’d include with your personal income tax return. It goes to the executor of the. Life insurance death proceeds form 712 if your mother's estate was less than (approximately) $5.4 million, you are.

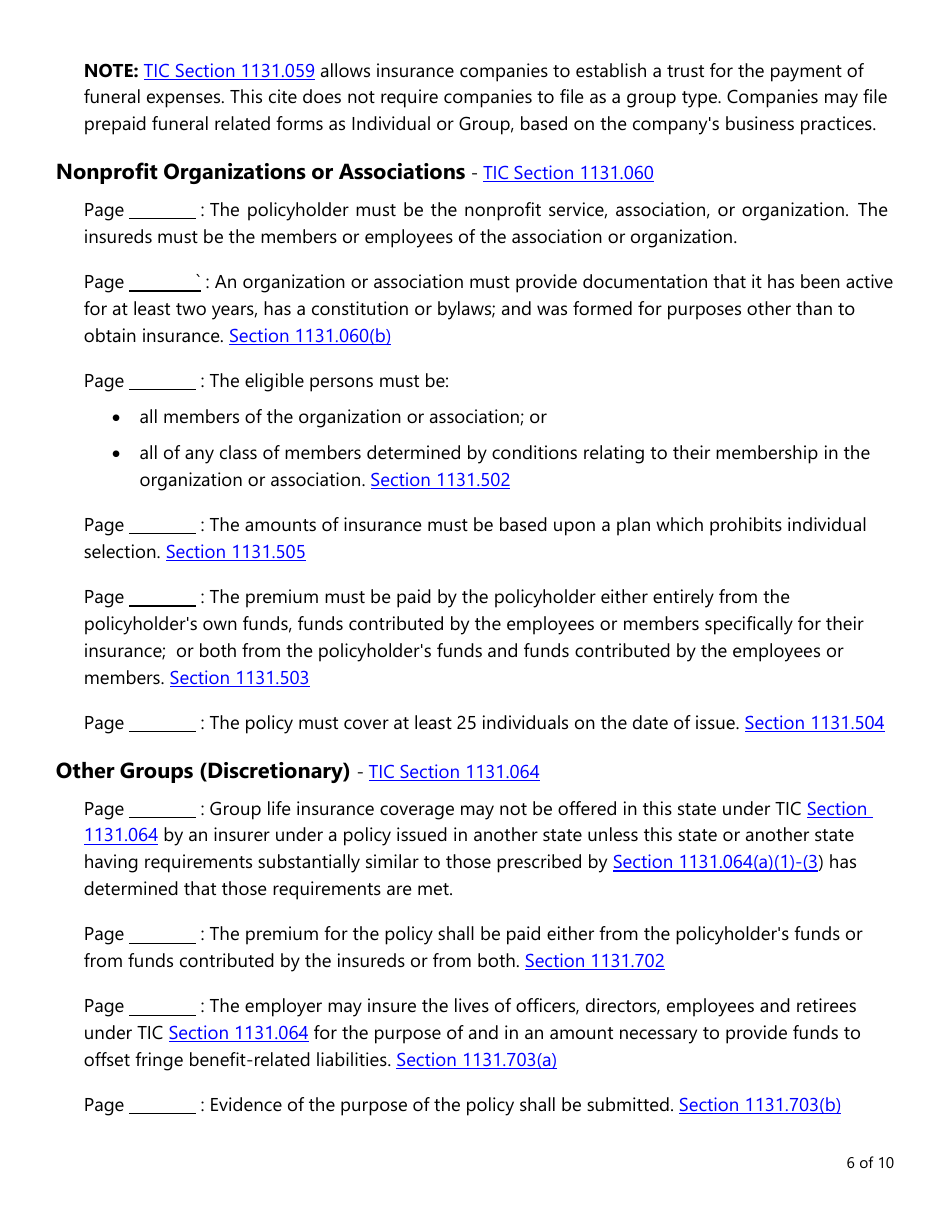

Form LAC005 Download Fillable PDF or Fill Online Group Life Insurance

Do i need to report that as income? * if your foreign life insurance policy is considered a pfic, there may be far more complex tax factors to consider. However, this isn’t a form that you’d include with your personal income tax return. Life insurance death proceeds form 712 if your mother's estate was less than (approximately) $5.4 million, you.

Form LAC005 Download Fillable PDF or Fill Online Group Life Insurance

Do i need to report that as income? Turbotax software for individuals doesn’t support form 712, life insurance statement. Form 712 is a statement of valuation to be used in filing a. I received form 712 for a $5000 life insurance payout following my husband's death. The irs levies a 1% excise tax on the foreign life insurance.

IRS Form 712 Instructions laacib

However, this isn’t a form that you’d include with your personal income tax return. Form 712 is a statement of valuation to be used in filing a. Do i need to report that as income? Life insurance death proceeds form 712 if your mother's estate was less than (approximately) $5.4 million, you are not required to file form 706. The.

Form 712 Life Insurance Statement (2006) Free Download

However, this isn’t a form that you’d include with your personal income tax return. I received form 712 for a $5000 life insurance payout following my husband's death. Form 712 is a statement of valuation to be used in filing a. * if your foreign life insurance policy is considered a pfic, there may be far more complex tax factors.

Fill Free fillable Form 712 Life Insurance Statement 2006 PDF form

If you are required to file form 706, it would be. However, this isn’t a form that you’d include with your personal income tax return. I received form 712 for a $5000 life insurance payout following my husband's death. Do i need to report that as income? Life insurance death proceeds form 712 if your mother's estate was less than.

IRS Form 712 Fill Out, Sign Online and Download Fillable PDF

Turbotax software for individuals doesn’t support form 712, life insurance statement. It goes to the executor of the. * if your foreign life insurance policy is considered a pfic, there may be far more complex tax factors to consider. However, this isn’t a form that you’d include with your personal income tax return. Life insurance death proceeds form 712 if.

Form 712 Life Insurance Statement Stock Image Image of dollar

Form 712 is a statement of valuation to be used in filing a. Life insurance death proceeds form 712 if your mother's estate was less than (approximately) $5.4 million, you are not required to file form 706. If you are required to file form 706, it would be. * if your foreign life insurance policy is considered a pfic, there.

Fillable Online Life insurance form. Life insurance form. Life

However, this isn’t a form that you’d include with your personal income tax return. * if your foreign life insurance policy is considered a pfic, there may be far more complex tax factors to consider. The irs levies a 1% excise tax on the foreign life insurance. Life insurance death proceeds form 712 if your mother's estate was less than.

However, This Isn’t A Form That You’d Include With Your Personal Income Tax Return.

* if your foreign life insurance policy is considered a pfic, there may be far more complex tax factors to consider. Life insurance death proceeds form 712 if your mother's estate was less than (approximately) $5.4 million, you are not required to file form 706. Do i need to report that as income? I received form 712 for a $5000 life insurance payout following my husband's death.

Turbotax Software For Individuals Doesn’t Support Form 712, Life Insurance Statement.

The irs levies a 1% excise tax on the foreign life insurance. If you are required to file form 706, it would be. It goes to the executor of the. Form 712 is a statement of valuation to be used in filing a.

Turbotax Software For Individuals Doesn’t Support Form 712, Life Insurance Statement.

However, this isn’t a form that you’d include with your personal income tax return.