Form 706 Filing Requirements

Form 706 Filing Requirements - Citizen or resident), increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is. Tax form 706 is required for the decedent’s estate of u.s. Citizens or residents whose gross estates, plus adjusted taxable gifts and specific exemptions, exceed the federal. Form 706 must be filed by the executor of the estate of every u.s. Information about form 706, united states estate (and generation. Form 706 is used to figure the estate tax imposed by chapter 11, and compute the gst tax imposed by chapter 13 on direct skips. An estate tax return (form 706) must be filed if the gross estate of the decedent (who is a u.s. If you are unable to file form 706 by the due date, you may receive. You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. Whose executor elects to transfer the “deceased spousal unused exclusion” (dsue).

Citizen or resident), increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is. Form 706 must be filed by the executor of the estate of every u.s. Information about form 706, united states estate (and generation. Whose executor elects to transfer the “deceased spousal unused exclusion” (dsue). Citizens or residents whose gross estates, plus adjusted taxable gifts and specific exemptions, exceed the federal. You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. An estate tax return (form 706) must be filed if the gross estate of the decedent (who is a u.s. If you are unable to file form 706 by the due date, you may receive. Form 706 is used to figure the estate tax imposed by chapter 11, and compute the gst tax imposed by chapter 13 on direct skips. Tax form 706 is required for the decedent’s estate of u.s.

Whose executor elects to transfer the “deceased spousal unused exclusion” (dsue). An estate tax return (form 706) must be filed if the gross estate of the decedent (who is a u.s. Citizens or residents whose gross estates, plus adjusted taxable gifts and specific exemptions, exceed the federal. You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. Form 706 is used to figure the estate tax imposed by chapter 11, and compute the gst tax imposed by chapter 13 on direct skips. Citizen or resident), increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is. If you are unable to file form 706 by the due date, you may receive. Form 706 must be filed by the executor of the estate of every u.s. Tax form 706 is required for the decedent’s estate of u.s. Information about form 706, united states estate (and generation.

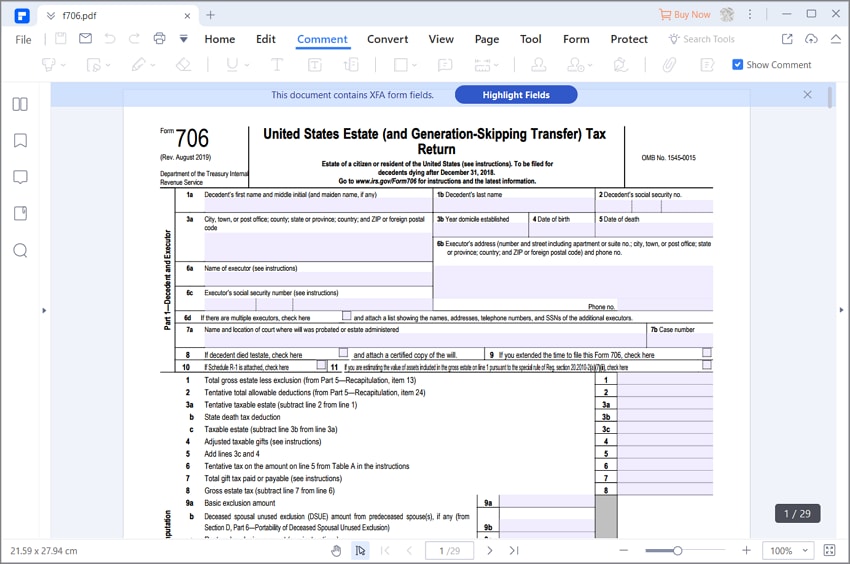

form 706 instructions 2020 Fill Online, Printable, Fillable Blank

Form 706 must be filed by the executor of the estate of every u.s. Form 706 is used to figure the estate tax imposed by chapter 11, and compute the gst tax imposed by chapter 13 on direct skips. Citizen or resident), increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is. Whose executor elects to transfer.

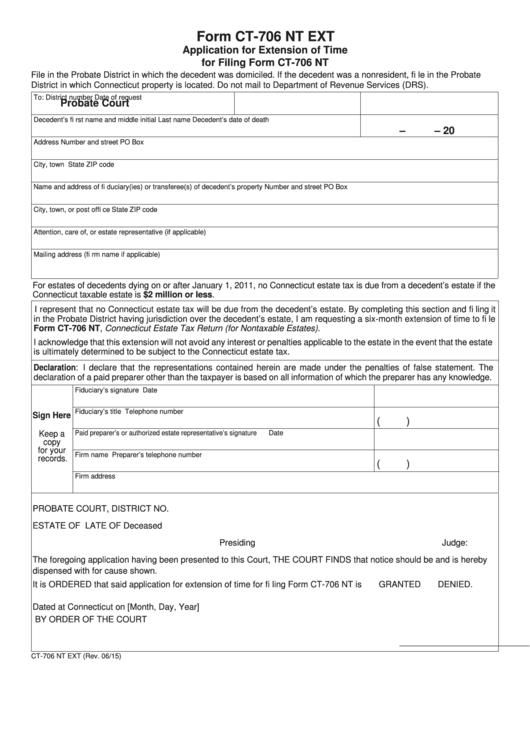

Form Ct706 Nt Ext Application For Extension Of Time For Filing Form

Whose executor elects to transfer the “deceased spousal unused exclusion” (dsue). If you are unable to file form 706 by the due date, you may receive. Form 706 must be filed by the executor of the estate of every u.s. Information about form 706, united states estate (and generation. An estate tax return (form 706) must be filed if the.

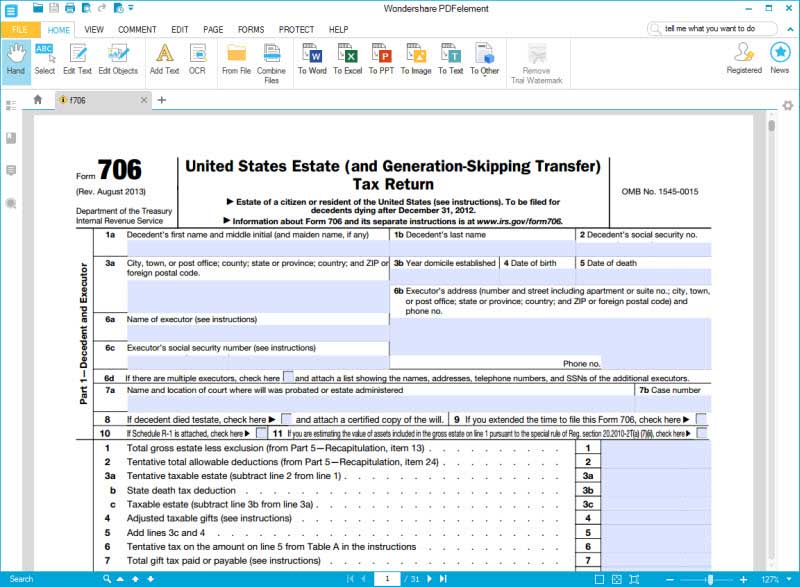

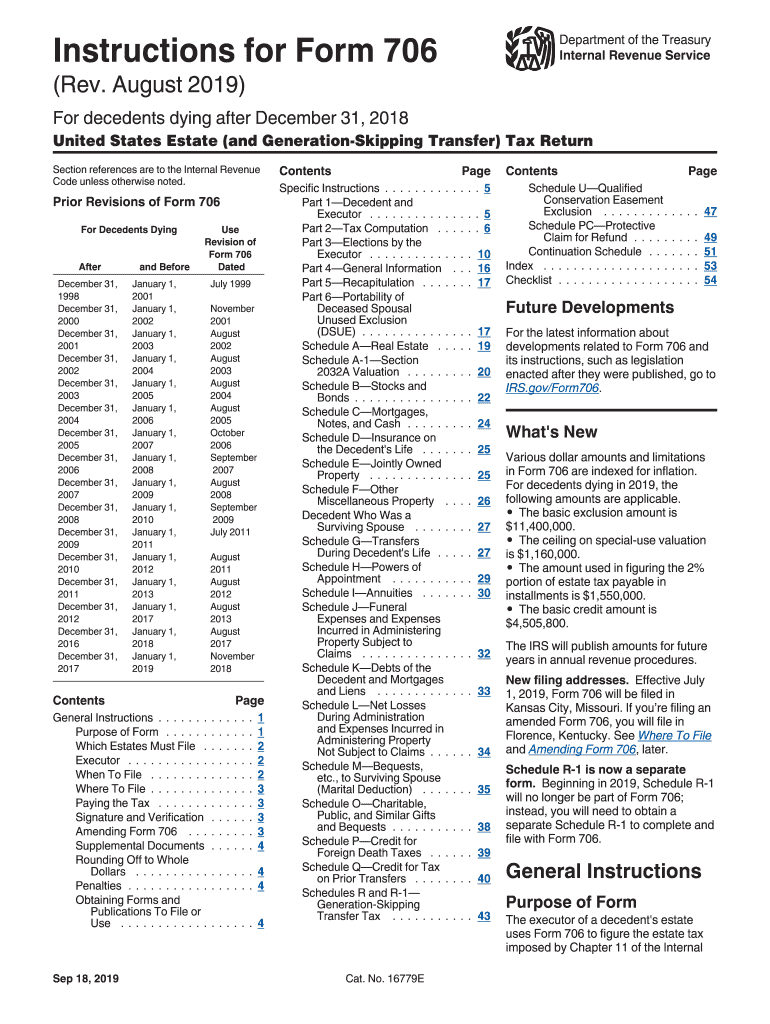

for How to Fill in IRS Form 706

Form 706 must be filed by the executor of the estate of every u.s. Citizens or residents whose gross estates, plus adjusted taxable gifts and specific exemptions, exceed the federal. Citizen or resident), increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is. Whose executor elects to transfer the “deceased spousal unused exclusion” (dsue). An estate tax.

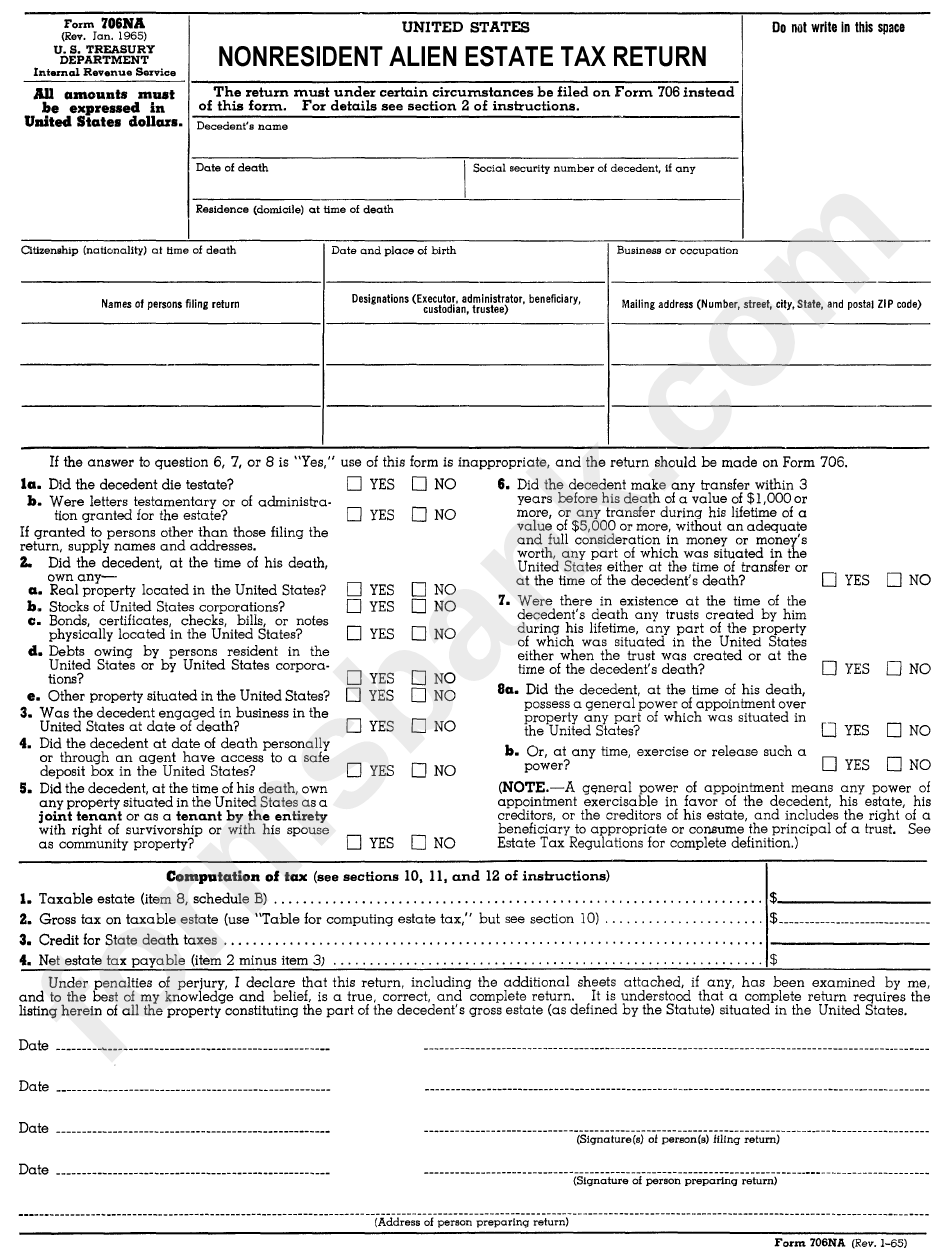

Instructions for How to Fill in IRS Form 706

An estate tax return (form 706) must be filed if the gross estate of the decedent (who is a u.s. Citizens or residents whose gross estates, plus adjusted taxable gifts and specific exemptions, exceed the federal. If you are unable to file form 706 by the due date, you may receive. Tax form 706 is required for the decedent’s estate.

Plcb 706 Form ≡ Fill Out Printable PDF Forms Online

Form 706 must be filed by the executor of the estate of every u.s. Citizens or residents whose gross estates, plus adjusted taxable gifts and specific exemptions, exceed the federal. Citizen or resident), increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is. You must file form 706 to report estate and/or gst tax within 9 months.

Form 706 Edit, Fill, Sign Online Handypdf

Citizen or resident), increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is. Citizens or residents whose gross estates, plus adjusted taxable gifts and specific exemptions, exceed the federal. An estate tax return (form 706) must be filed if the gross estate of the decedent (who is a u.s. Form 706 is used to figure the estate.

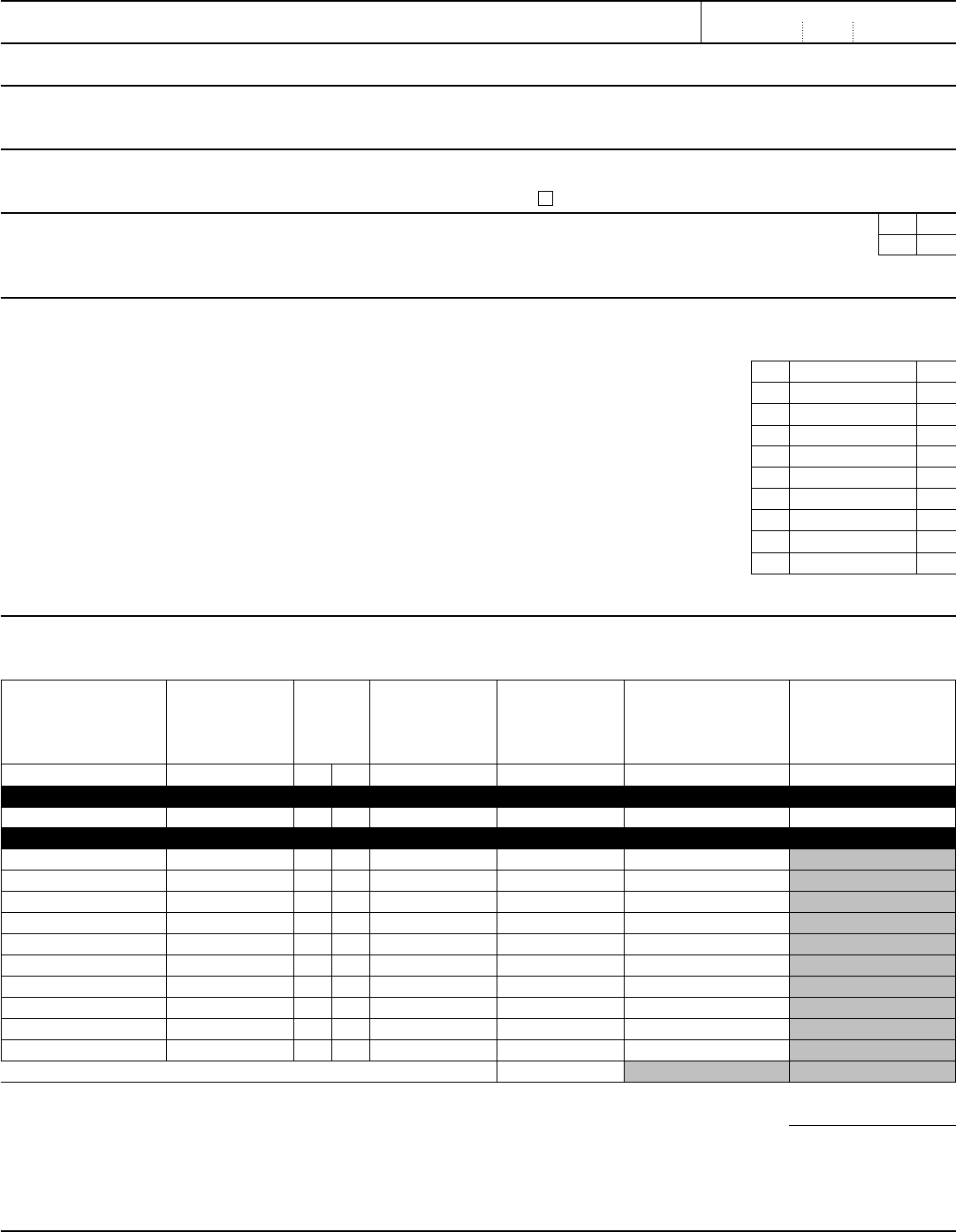

Form 706 na Fill out & sign online DocHub

Form 706 must be filed by the executor of the estate of every u.s. Information about form 706, united states estate (and generation. Tax form 706 is required for the decedent’s estate of u.s. You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. Citizen or resident), increased by.

Fillable Online Form 706 Na Instructions Fax Email

Form 706 must be filed by the executor of the estate of every u.s. An estate tax return (form 706) must be filed if the gross estate of the decedent (who is a u.s. Information about form 706, united states estate (and generation. If you are unable to file form 706 by the due date, you may receive. Tax form.

Form 706 Na (Rev. 011965) Nonresident Alien Estate Tax Return

You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death. Tax form 706 is required for the decedent’s estate of u.s. An estate tax return (form 706) must be filed if the gross estate of the decedent (who is a u.s. Citizens or residents whose gross estates, plus adjusted.

Fillable 706 2019 Complete with ease airSlate SignNow

An estate tax return (form 706) must be filed if the gross estate of the decedent (who is a u.s. If you are unable to file form 706 by the due date, you may receive. Form 706 is used to figure the estate tax imposed by chapter 11, and compute the gst tax imposed by chapter 13 on direct skips..

Form 706 Is Used To Figure The Estate Tax Imposed By Chapter 11, And Compute The Gst Tax Imposed By Chapter 13 On Direct Skips.

An estate tax return (form 706) must be filed if the gross estate of the decedent (who is a u.s. Information about form 706, united states estate (and generation. Form 706 must be filed by the executor of the estate of every u.s. Citizen or resident), increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is.

Tax Form 706 Is Required For The Decedent’s Estate Of U.s.

If you are unable to file form 706 by the due date, you may receive. Whose executor elects to transfer the “deceased spousal unused exclusion” (dsue). Citizens or residents whose gross estates, plus adjusted taxable gifts and specific exemptions, exceed the federal. You must file form 706 to report estate and/or gst tax within 9 months after the date of the decedent's death.