Form 13 Ne

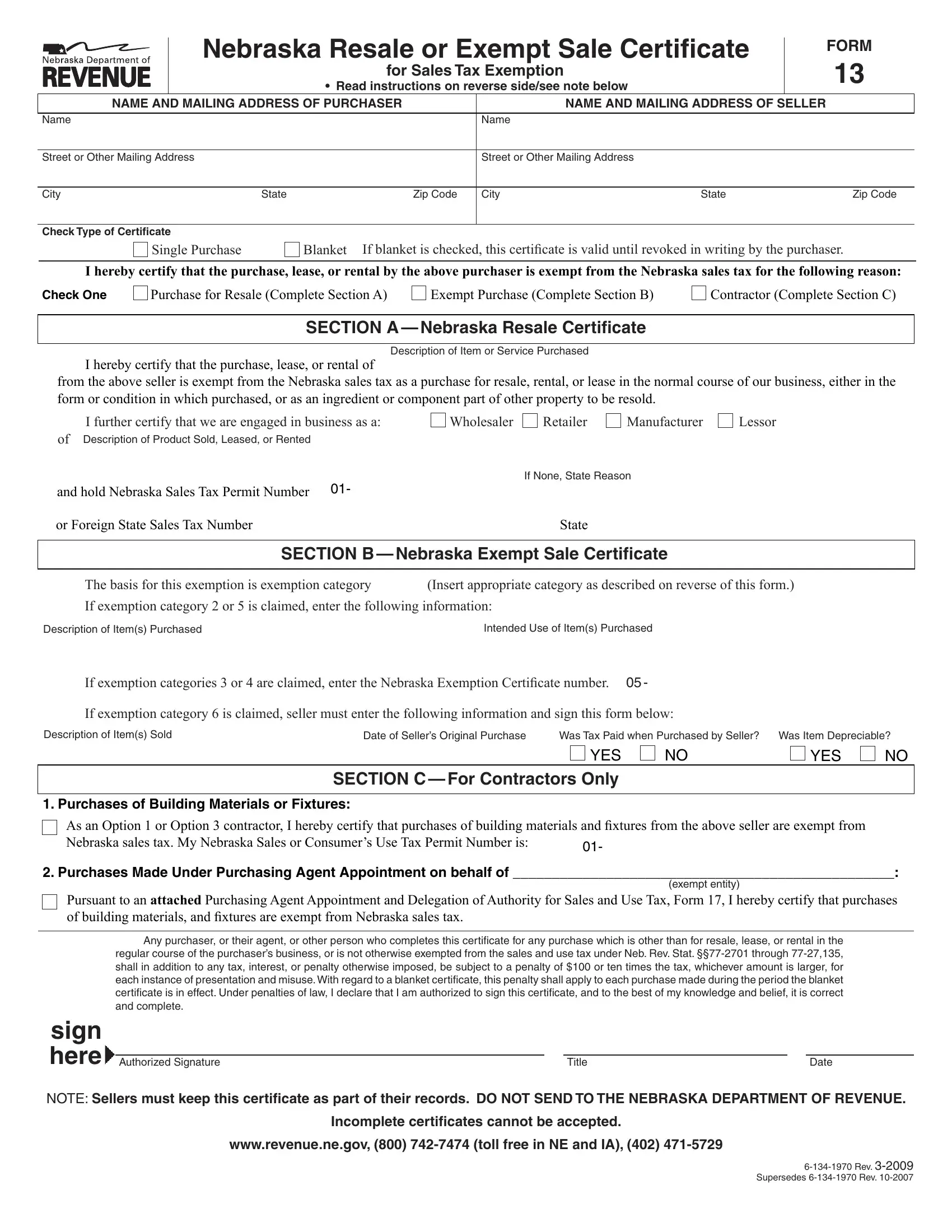

Form 13 Ne - A properly completed form 13, section a, when making purchases of property or taxable services that will subsequently be resold in the. 013.01 a sale for resale is a sale of property (services) to any purchaser for the purpose of resale in the normal course of the purchaser's. 8 rows code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption list of most. Form 13 may be found guilty of a class iv misdemeanor. The department is committed to the fair administration of the nebraska tax laws. It is unlawful to claim an exemption for purchases. Categories of exemption 1.purchases made directly by certain.

A properly completed form 13, section a, when making purchases of property or taxable services that will subsequently be resold in the. 8 rows code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption list of most. The department is committed to the fair administration of the nebraska tax laws. Categories of exemption 1.purchases made directly by certain. It is unlawful to claim an exemption for purchases. Form 13 may be found guilty of a class iv misdemeanor. 013.01 a sale for resale is a sale of property (services) to any purchaser for the purpose of resale in the normal course of the purchaser's.

A properly completed form 13, section a, when making purchases of property or taxable services that will subsequently be resold in the. 8 rows code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption list of most. Form 13 may be found guilty of a class iv misdemeanor. It is unlawful to claim an exemption for purchases. Categories of exemption 1.purchases made directly by certain. 013.01 a sale for resale is a sale of property (services) to any purchaser for the purpose of resale in the normal course of the purchaser's. The department is committed to the fair administration of the nebraska tax laws.

SCR Form 13 (SCL013) Fill Out, Sign Online and Download Fillable PDF

It is unlawful to claim an exemption for purchases. The department is committed to the fair administration of the nebraska tax laws. A properly completed form 13, section a, when making purchases of property or taxable services that will subsequently be resold in the. 013.01 a sale for resale is a sale of property (services) to any purchaser for the.

Form 13 Transfer of Installation4 PDF

The department is committed to the fair administration of the nebraska tax laws. 8 rows code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption list of most. 013.01 a sale for resale is a sale of property (services) to any purchaser for the purpose of resale in the normal course of the.

Non Resident Tax Exemption Form

A properly completed form 13, section a, when making purchases of property or taxable services that will subsequently be resold in the. Categories of exemption 1.purchases made directly by certain. Form 13 may be found guilty of a class iv misdemeanor. 013.01 a sale for resale is a sale of property (services) to any purchaser for the purpose of resale.

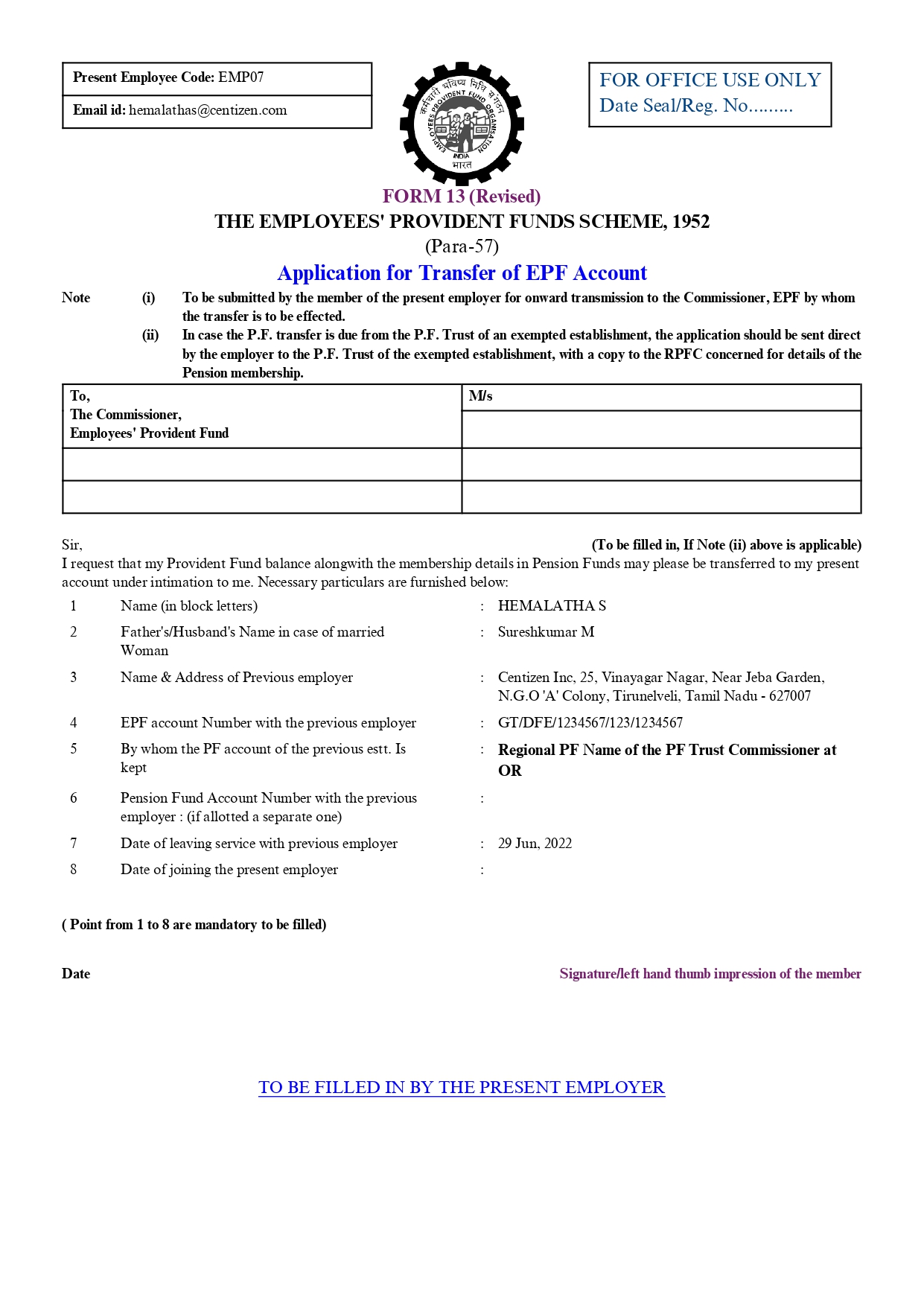

How To Download And Fill Form 13 To Transfer EPF Account? UBS

Categories of exemption 1.purchases made directly by certain. Form 13 may be found guilty of a class iv misdemeanor. 8 rows code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption list of most. 013.01 a sale for resale is a sale of property (services) to any purchaser for the purpose of resale.

Ga Sr13 Printable Form Printable Word Searches

Form 13 may be found guilty of a class iv misdemeanor. A properly completed form 13, section a, when making purchases of property or taxable services that will subsequently be resold in the. 013.01 a sale for resale is a sale of property (services) to any purchaser for the purpose of resale in the normal course of the purchaser's. The.

Nebraska Sales Tax Form ≡ Fill Out Printable PDF Forms Online

Form 13 may be found guilty of a class iv misdemeanor. A properly completed form 13, section a, when making purchases of property or taxable services that will subsequently be resold in the. 013.01 a sale for resale is a sale of property (services) to any purchaser for the purpose of resale in the normal course of the purchaser's. The.

23 Application Form Complete with ease airSlate SignNow

Form 13 may be found guilty of a class iv misdemeanor. A properly completed form 13, section a, when making purchases of property or taxable services that will subsequently be resold in the. Categories of exemption 1.purchases made directly by certain. The department is committed to the fair administration of the nebraska tax laws. 013.01 a sale for resale is.

Zenyo Payroll

The department is committed to the fair administration of the nebraska tax laws. 013.01 a sale for resale is a sale of property (services) to any purchaser for the purpose of resale in the normal course of the purchaser's. 8 rows code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption list of.

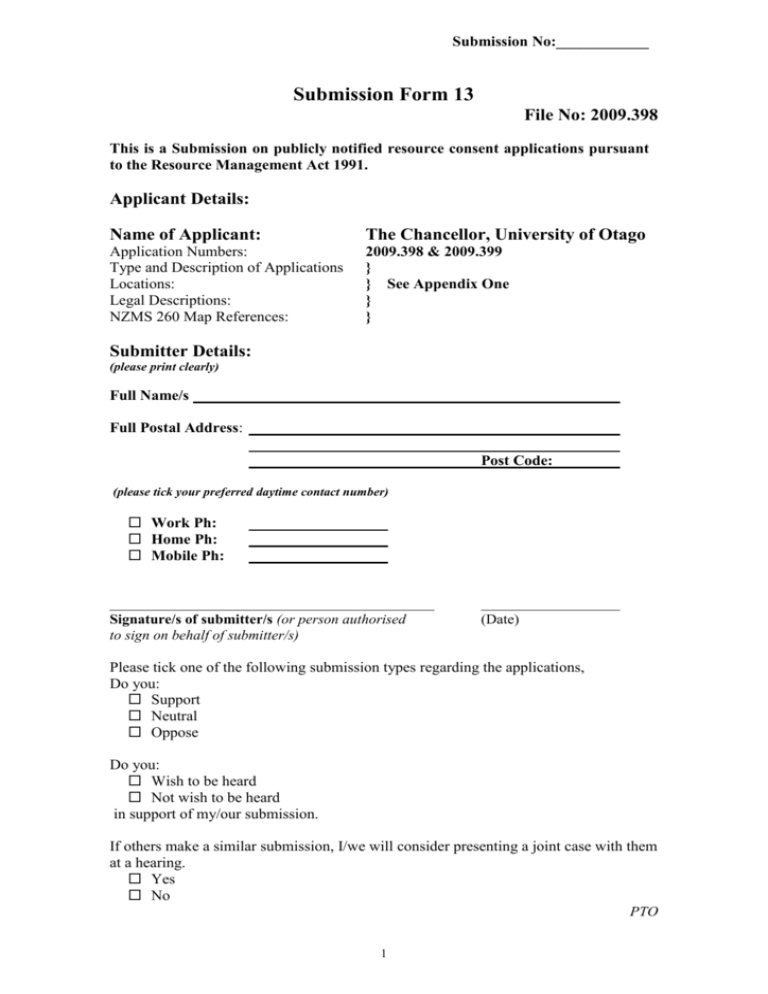

Submission Form 13 Otago Regional Council

8 rows code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption list of most. The department is committed to the fair administration of the nebraska tax laws. 013.01 a sale for resale is a sale of property (services) to any purchaser for the purpose of resale in the normal course of the.

Form13

Form 13 may be found guilty of a class iv misdemeanor. Categories of exemption 1.purchases made directly by certain. A properly completed form 13, section a, when making purchases of property or taxable services that will subsequently be resold in the. 8 rows code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption.

The Department Is Committed To The Fair Administration Of The Nebraska Tax Laws.

8 rows code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption list of most. It is unlawful to claim an exemption for purchases. Form 13 may be found guilty of a class iv misdemeanor. A properly completed form 13, section a, when making purchases of property or taxable services that will subsequently be resold in the.

Categories Of Exemption 1.Purchases Made Directly By Certain.

013.01 a sale for resale is a sale of property (services) to any purchaser for the purpose of resale in the normal course of the purchaser's.