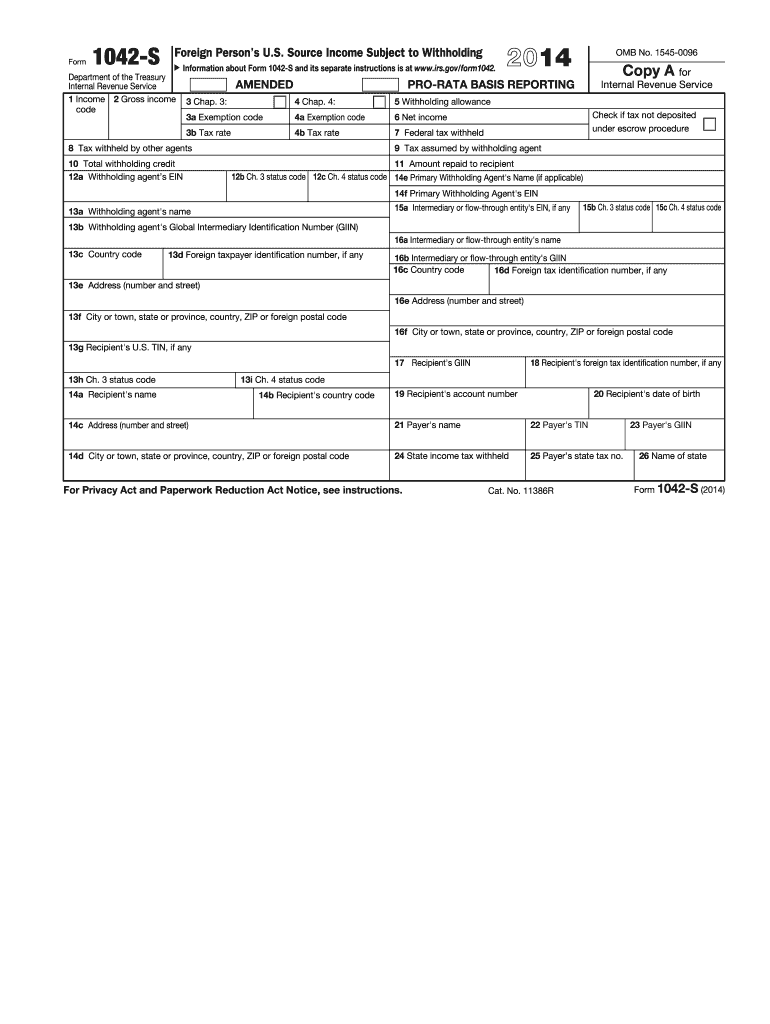

Form 1042 S

Form 1042 S - Hello, i am a us citizen and i married my wife last year, who is working as a postdoc. I am a resident alien on f1 visa. Should i report it as an. I am an international student, but have stayed in u.s for more than 5 years, and i am now considered a resident alien for tax purposes. Is the interest income taxable? However, i still received 1042s with income code 29, exemption code 02, and tax rate 0%. I'm resident alien for tax purposes.

Is the interest income taxable? Hello, i am a us citizen and i married my wife last year, who is working as a postdoc. Should i report it as an. I'm resident alien for tax purposes. I am a resident alien on f1 visa. I am an international student, but have stayed in u.s for more than 5 years, and i am now considered a resident alien for tax purposes. However, i still received 1042s with income code 29, exemption code 02, and tax rate 0%.

However, i still received 1042s with income code 29, exemption code 02, and tax rate 0%. Is the interest income taxable? I am a resident alien on f1 visa. Should i report it as an. Hello, i am a us citizen and i married my wife last year, who is working as a postdoc. I'm resident alien for tax purposes. I am an international student, but have stayed in u.s for more than 5 years, and i am now considered a resident alien for tax purposes.

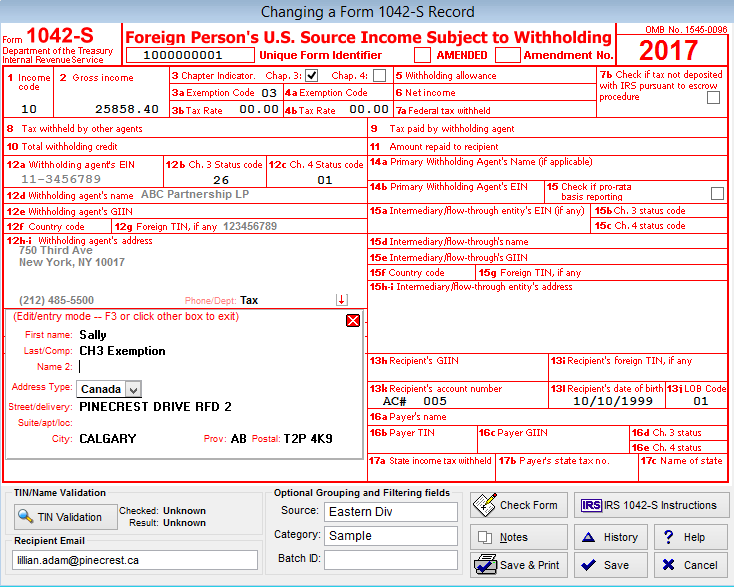

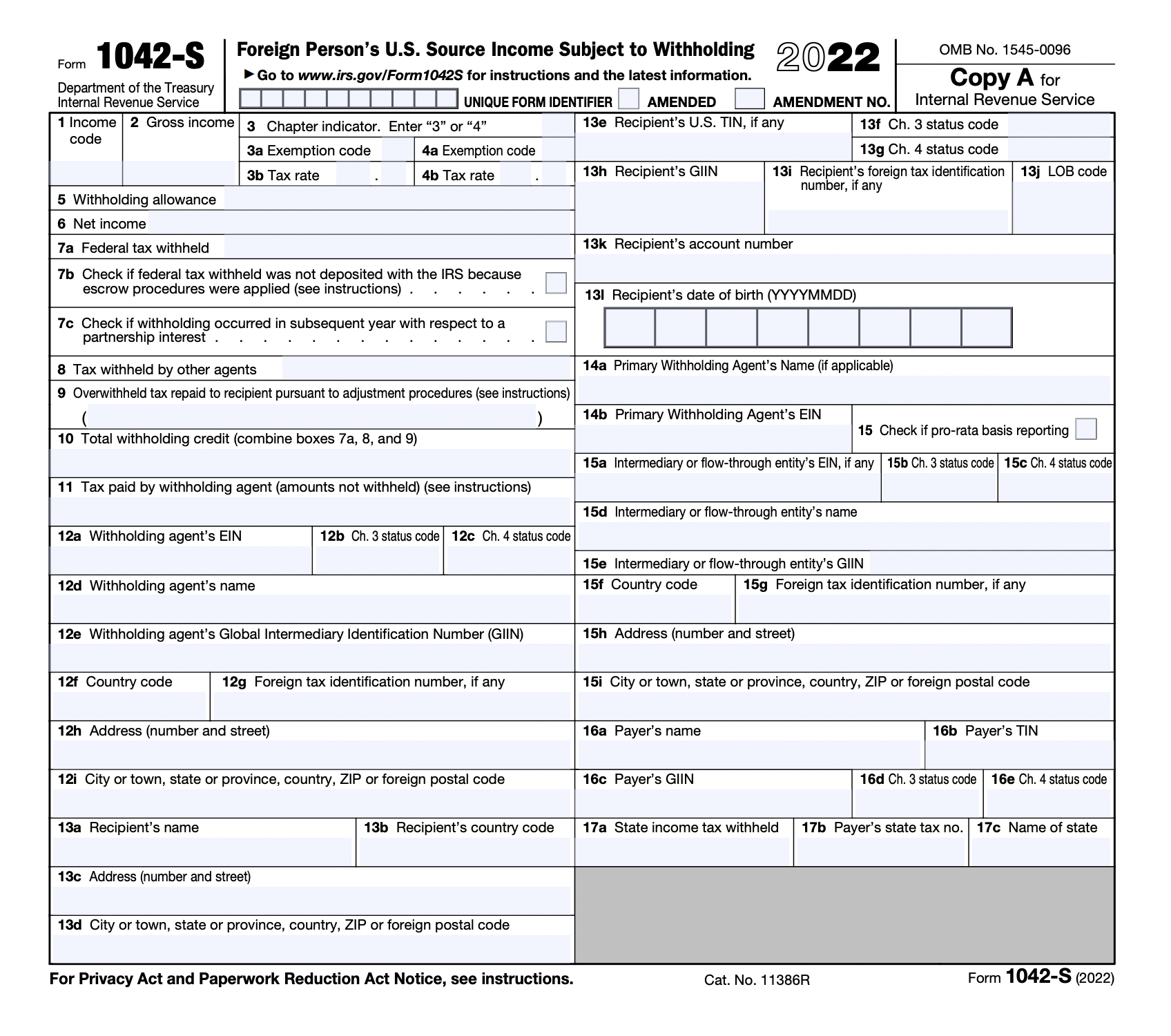

Form 1042S USEReady

I am a resident alien on f1 visa. Should i report it as an. Is the interest income taxable? However, i still received 1042s with income code 29, exemption code 02, and tax rate 0%. I am an international student, but have stayed in u.s for more than 5 years, and i am now considered a resident alien for tax.

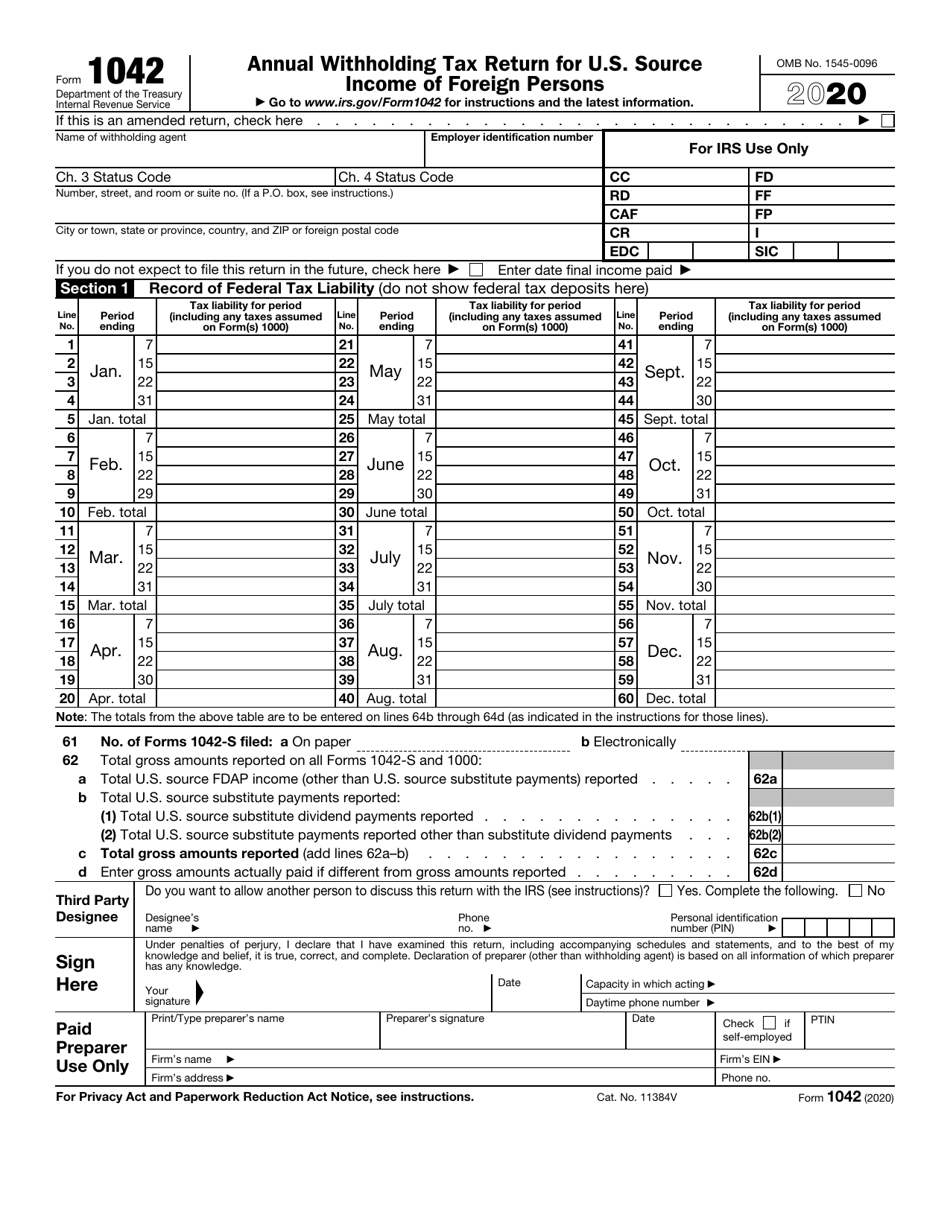

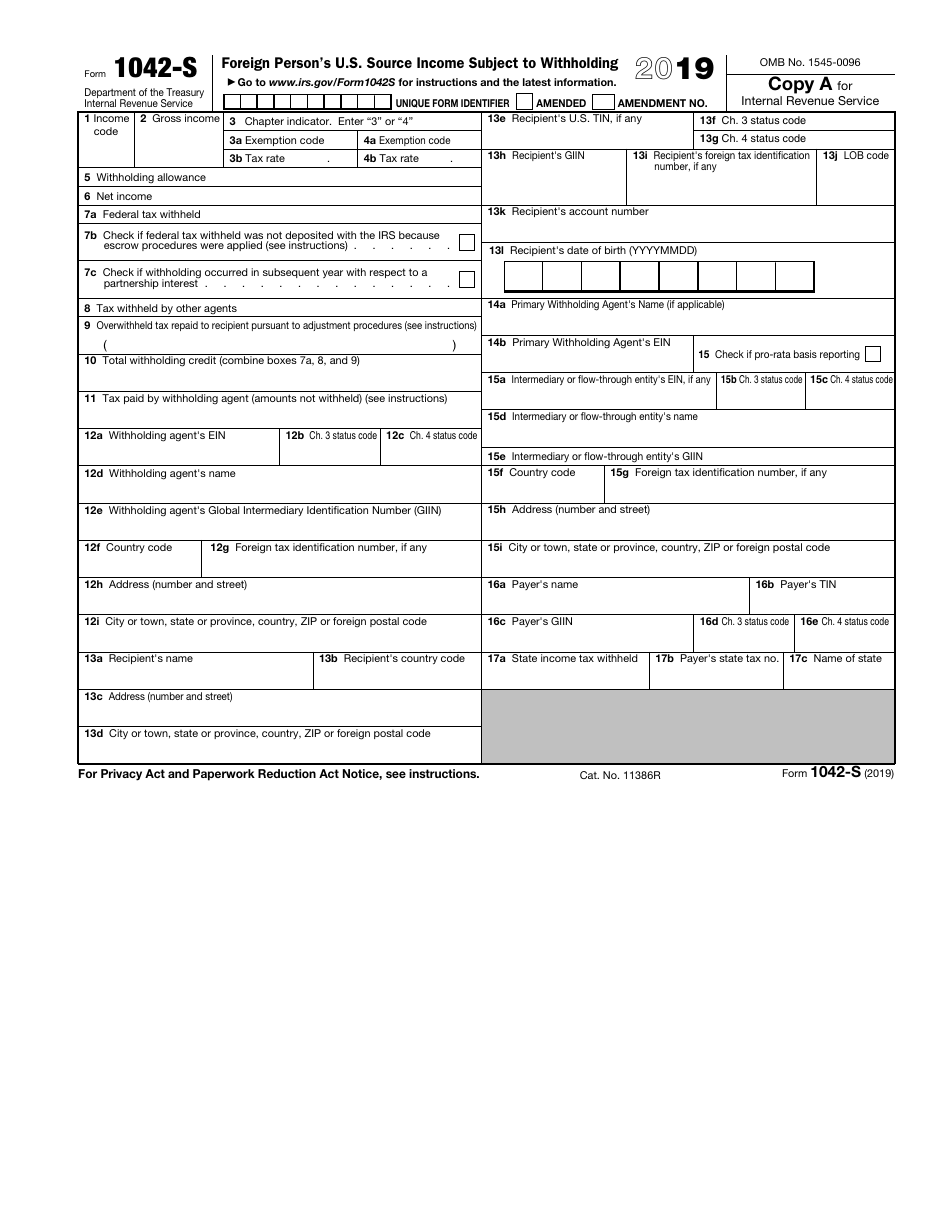

Irs 1042 s instructions 2019

Should i report it as an. I am a resident alien on f1 visa. Hello, i am a us citizen and i married my wife last year, who is working as a postdoc. However, i still received 1042s with income code 29, exemption code 02, and tax rate 0%. I'm resident alien for tax purposes.

Instructions for IRS Form 1042S How to Report Your Annual

I am an international student, but have stayed in u.s for more than 5 years, and i am now considered a resident alien for tax purposes. Is the interest income taxable? Hello, i am a us citizen and i married my wife last year, who is working as a postdoc. I'm resident alien for tax purposes. Should i report it.

What is Form 1042S? Tax reporting for foreign contractors Trolley

However, i still received 1042s with income code 29, exemption code 02, and tax rate 0%. I am an international student, but have stayed in u.s for more than 5 years, and i am now considered a resident alien for tax purposes. I'm resident alien for tax purposes. Hello, i am a us citizen and i married my wife last.

Fillable Form 1042 S Printable Forms Free Online

I am a resident alien on f1 visa. I'm resident alien for tax purposes. I am an international student, but have stayed in u.s for more than 5 years, and i am now considered a resident alien for tax purposes. Hello, i am a us citizen and i married my wife last year, who is working as a postdoc. Should.

The Newly Issued Form 1042S Foreign Person's U.S. Source

I am a resident alien on f1 visa. Is the interest income taxable? I'm resident alien for tax purposes. However, i still received 1042s with income code 29, exemption code 02, and tax rate 0%. I am an international student, but have stayed in u.s for more than 5 years, and i am now considered a resident alien for tax.

Form 1042 S Fill Out and Sign Printable PDF Template airSlate SignNow

Is the interest income taxable? I am an international student, but have stayed in u.s for more than 5 years, and i am now considered a resident alien for tax purposes. I am a resident alien on f1 visa. Should i report it as an. However, i still received 1042s with income code 29, exemption code 02, and tax rate.

1042 S Form slideshare

I am an international student, but have stayed in u.s for more than 5 years, and i am now considered a resident alien for tax purposes. I'm resident alien for tax purposes. Is the interest income taxable? I am a resident alien on f1 visa. Should i report it as an.

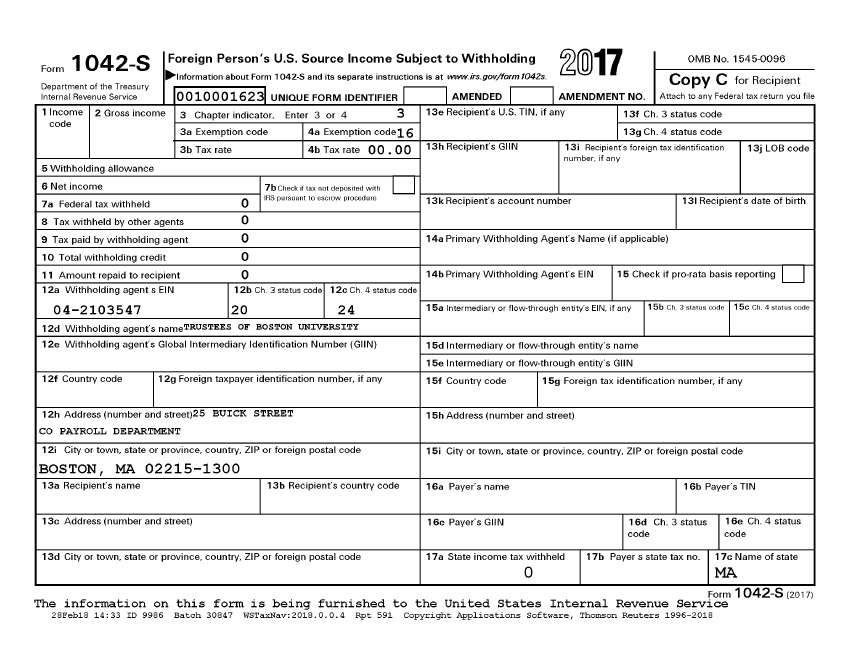

Understanding your 1042S » Payroll Boston University

Should i report it as an. However, i still received 1042s with income code 29, exemption code 02, and tax rate 0%. I'm resident alien for tax purposes. Hello, i am a us citizen and i married my wife last year, who is working as a postdoc. I am a resident alien on f1 visa.

IRS Form 1042S 2019 Fill Out, Sign Online and Download Fillable

However, i still received 1042s with income code 29, exemption code 02, and tax rate 0%. I'm resident alien for tax purposes. Should i report it as an. I am a resident alien on f1 visa. I am an international student, but have stayed in u.s for more than 5 years, and i am now considered a resident alien for.

Should I Report It As An.

Is the interest income taxable? However, i still received 1042s with income code 29, exemption code 02, and tax rate 0%. I am a resident alien on f1 visa. Hello, i am a us citizen and i married my wife last year, who is working as a postdoc.

I'm Resident Alien For Tax Purposes.

I am an international student, but have stayed in u.s for more than 5 years, and i am now considered a resident alien for tax purposes.