Commercial Letters Of Credit

Commercial Letters Of Credit - One party is required to guarantee something to another party;. A letter of credit (lc) can be thought of as a guarantee that is backstopped by the financial institution that issues it. What is a letter of credit? A commercial letter of credit, also known as a documentary credit, is an aspect of business banking. A commercial letter of credit is a legal document from a bank or a financial institution. Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit. Here’s how letters of credit work. It represents a promise to pay the holder if he fulfills his obligation. Other types of letters of credit are irrevocable. A letter of credit is a letter from a bank guaranteeing that a buyer’s payment will be received on time and for the correct amount.

It represents a promise to pay the holder if he fulfills his obligation. A commercial letter of credit is a legal document from a bank or a financial institution. A letter of credit is a letter from a bank guaranteeing that a buyer’s payment will be received on time and for the correct amount. It’s a document issued by a bank to guarantee payment for goods or services for a. What is a letter of credit? One party is required to guarantee something to another party;. Other types of letters of credit are irrevocable. Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit. Here’s how letters of credit work. A commercial letter of credit, also known as a documentary credit, is an aspect of business banking.

What is a letter of credit? A letter of credit (lc) can be thought of as a guarantee that is backstopped by the financial institution that issues it. Here’s how letters of credit work. Other types of letters of credit are irrevocable. One party is required to guarantee something to another party;. A letter of credit is a letter from a bank guaranteeing that a buyer’s payment will be received on time and for the correct amount. A commercial letter of credit is a legal document from a bank or a financial institution. It’s a document issued by a bank to guarantee payment for goods or services for a. It represents a promise to pay the holder if he fulfills his obligation. A commercial letter of credit, also known as a documentary credit, is an aspect of business banking.

Commercial Letters of Credit SouthState Commercial Lending

It represents a promise to pay the holder if he fulfills his obligation. It’s a document issued by a bank to guarantee payment for goods or services for a. A commercial letter of credit, also known as a documentary credit, is an aspect of business banking. Other types of letters of credit are irrevocable. Here’s how letters of credit work.

What Is Commercial Credit? And How it Can Work for You

A letter of credit is a letter from a bank guaranteeing that a buyer’s payment will be received on time and for the correct amount. Here’s how letters of credit work. One party is required to guarantee something to another party;. A commercial letter of credit is a legal document from a bank or a financial institution. Other types of.

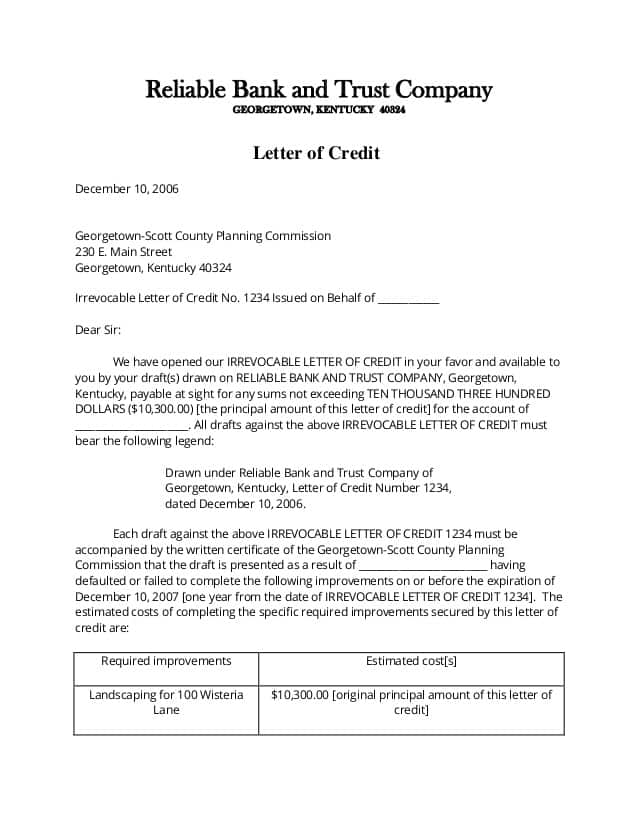

10+ Sample Letter Of Credit Writing Letters Formats & Examples

A commercial letter of credit, also known as a documentary credit, is an aspect of business banking. It represents a promise to pay the holder if he fulfills his obligation. Other types of letters of credit are irrevocable. A letter of credit is a letter from a bank guaranteeing that a buyer’s payment will be received on time and for.

Letter of Credit Basics L/C Transaction Export

A letter of credit is a letter from a bank guaranteeing that a buyer’s payment will be received on time and for the correct amount. Here’s how letters of credit work. Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit. A commercial letter of credit is a legal document from.

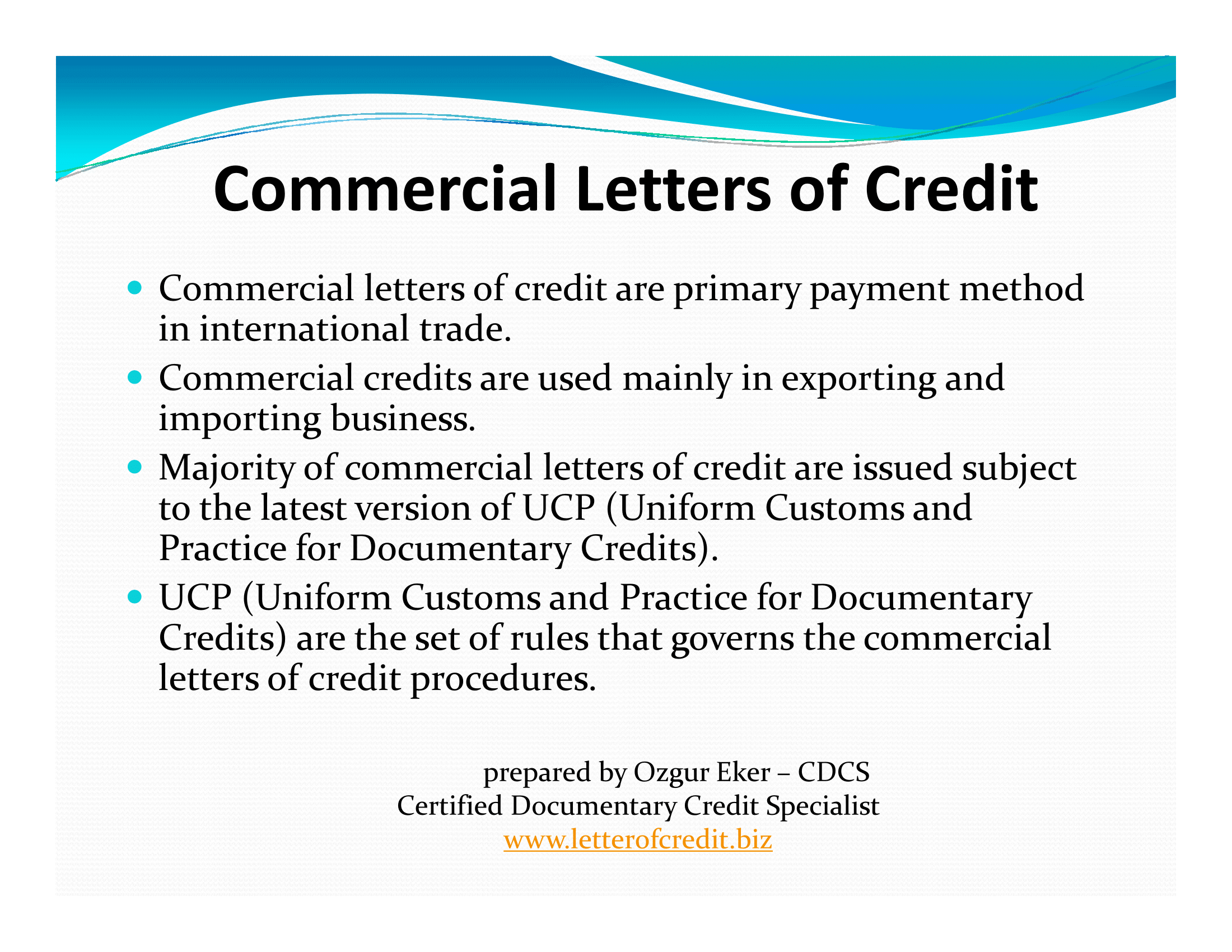

123. Commercial Letters Of Credit

What is a letter of credit? A letter of credit (lc) can be thought of as a guarantee that is backstopped by the financial institution that issues it. A commercial letter of credit is a legal document from a bank or a financial institution. Here’s how letters of credit work. Types of letters of credit include commercial letters of credit,.

Letter of Credit Basics Definition and Types

It represents a promise to pay the holder if he fulfills his obligation. A commercial letter of credit, also known as a documentary credit, is an aspect of business banking. Here’s how letters of credit work. A commercial letter of credit is a legal document from a bank or a financial institution. A letter of credit (lc) can be thought.

commercial credit application Doc Template pdfFiller

A letter of credit (lc) can be thought of as a guarantee that is backstopped by the financial institution that issues it. It represents a promise to pay the holder if he fulfills his obligation. It’s a document issued by a bank to guarantee payment for goods or services for a. A commercial letter of credit is a legal document.

What is Letter of Credit? Explained

A letter of credit (lc) can be thought of as a guarantee that is backstopped by the financial institution that issues it. Here’s how letters of credit work. It represents a promise to pay the holder if he fulfills his obligation. It’s a document issued by a bank to guarantee payment for goods or services for a. What is a.

Understanding Letters of Credit A Commercial Leasing Guide Occupier

It’s a document issued by a bank to guarantee payment for goods or services for a. A commercial letter of credit is a legal document from a bank or a financial institution. A letter of credit (lc) can be thought of as a guarantee that is backstopped by the financial institution that issues it. A commercial letter of credit, also.

Presentation Types of Letters of Credit LC L/C

A letter of credit is a letter from a bank guaranteeing that a buyer’s payment will be received on time and for the correct amount. Other types of letters of credit are irrevocable. Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit. A letter of credit (lc) can be thought.

What Is A Letter Of Credit?

It represents a promise to pay the holder if he fulfills his obligation. A commercial letter of credit, also known as a documentary credit, is an aspect of business banking. Here’s how letters of credit work. One party is required to guarantee something to another party;.

Types Of Letters Of Credit Include Commercial Letters Of Credit, Standby Letters Of Credit, And Revocable Letters Of Credit.

A letter of credit (lc) can be thought of as a guarantee that is backstopped by the financial institution that issues it. Other types of letters of credit are irrevocable. A letter of credit is a letter from a bank guaranteeing that a buyer’s payment will be received on time and for the correct amount. A commercial letter of credit is a legal document from a bank or a financial institution.