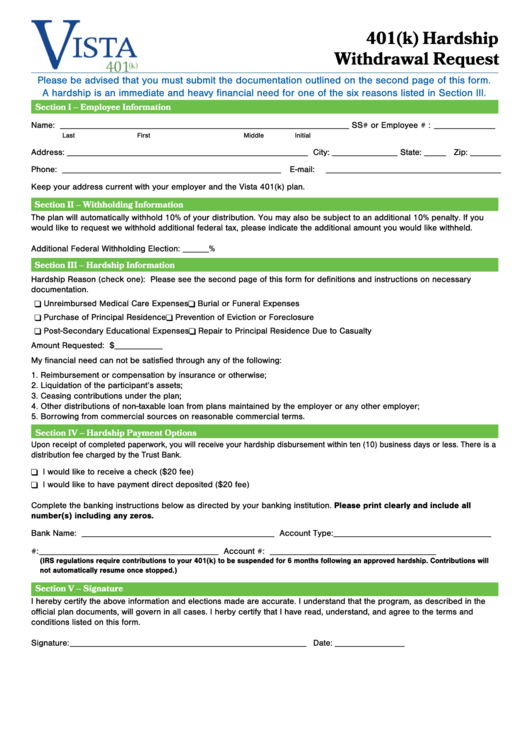

401K Hardship Withdrawal Form

401K Hardship Withdrawal Form - If you have an immediate and heavy financial need, the irs may allow a 401 (k) hardship withdrawal. How to take 401 (k) hardship withdrawals. What is a 401 (k) hardship withdrawal? Available for current employees only. Many 401(k) plans allow you to withdraw money before you actually retire to pay for certain events that cause you a financial hardship. Contact your tax professional for more information. A 401 (k) hardship withdrawal is a withdrawal from a 401 (k) for an immediate and heavy financial need. it is an authorized withdrawal, meaning. For example, some 401(k) plans may allow a hardship. If you're looking for resources.

Contact your tax professional for more information. If you have an immediate and heavy financial need, the irs may allow a 401 (k) hardship withdrawal. A 401 (k) hardship withdrawal is a withdrawal from a 401 (k) for an immediate and heavy financial need. it is an authorized withdrawal, meaning. Many 401(k) plans allow you to withdraw money before you actually retire to pay for certain events that cause you a financial hardship. How to take 401 (k) hardship withdrawals. If you're looking for resources. Available for current employees only. What is a 401 (k) hardship withdrawal? For example, some 401(k) plans may allow a hardship.

If you have an immediate and heavy financial need, the irs may allow a 401 (k) hardship withdrawal. A 401 (k) hardship withdrawal is a withdrawal from a 401 (k) for an immediate and heavy financial need. it is an authorized withdrawal, meaning. For example, some 401(k) plans may allow a hardship. If you're looking for resources. How to take 401 (k) hardship withdrawals. Many 401(k) plans allow you to withdraw money before you actually retire to pay for certain events that cause you a financial hardship. Contact your tax professional for more information. Available for current employees only. What is a 401 (k) hardship withdrawal?

401k withdrawal age

How to take 401 (k) hardship withdrawals. For example, some 401(k) plans may allow a hardship. Available for current employees only. A 401 (k) hardship withdrawal is a withdrawal from a 401 (k) for an immediate and heavy financial need. it is an authorized withdrawal, meaning. If you're looking for resources.

401(K) Hardship Withdrawal Form printable pdf download

Available for current employees only. Contact your tax professional for more information. How to take 401 (k) hardship withdrawals. If you have an immediate and heavy financial need, the irs may allow a 401 (k) hardship withdrawal. A 401 (k) hardship withdrawal is a withdrawal from a 401 (k) for an immediate and heavy financial need. it is an authorized.

Writing a Successful 401k Hardship Withdrawal Letter (Free Templates

If you have an immediate and heavy financial need, the irs may allow a 401 (k) hardship withdrawal. Contact your tax professional for more information. Available for current employees only. Many 401(k) plans allow you to withdraw money before you actually retire to pay for certain events that cause you a financial hardship. For example, some 401(k) plans may allow.

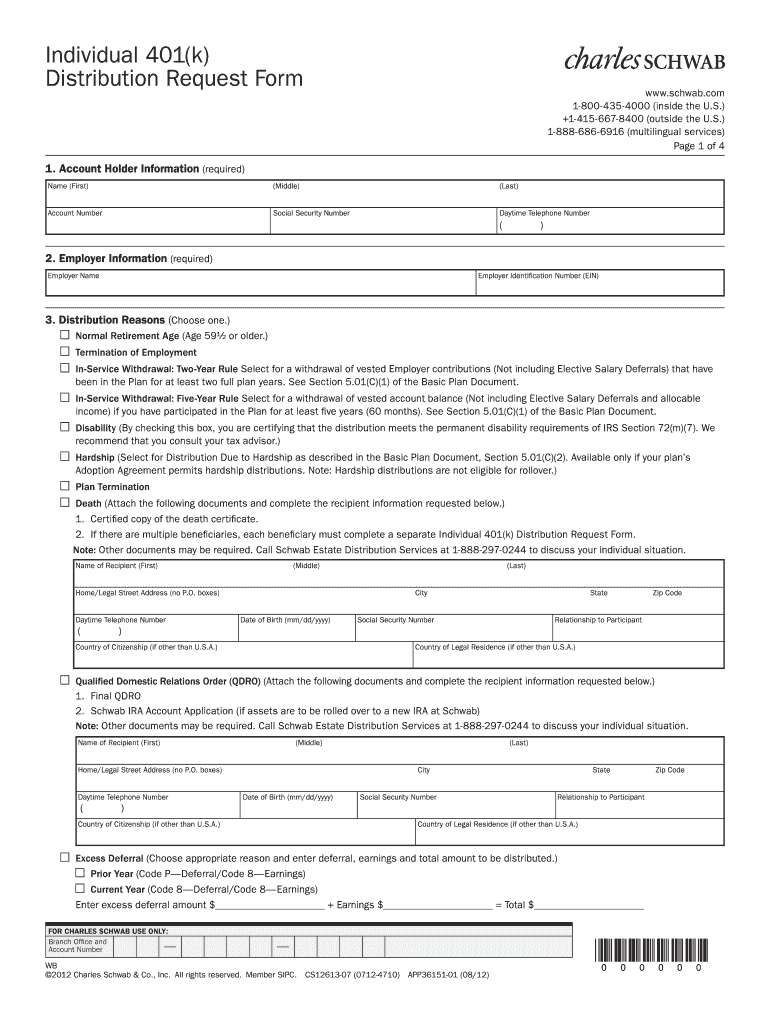

Charles Schwab Hardship Withdrawal 20122024 Form Fill Out and Sign

Contact your tax professional for more information. How to take 401 (k) hardship withdrawals. If you're looking for resources. If you have an immediate and heavy financial need, the irs may allow a 401 (k) hardship withdrawal. Many 401(k) plans allow you to withdraw money before you actually retire to pay for certain events that cause you a financial hardship.

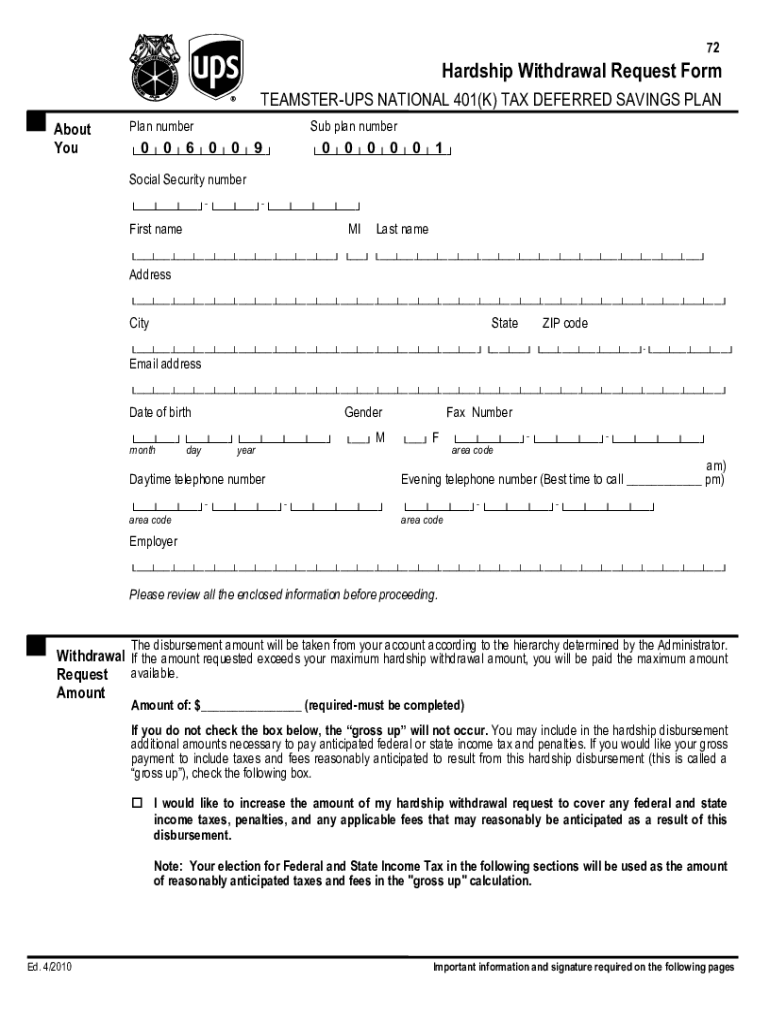

Prudential Teamsters 401k Fill Online, Printable, Fillable, Blank

Contact your tax professional for more information. What is a 401 (k) hardship withdrawal? Available for current employees only. If you have an immediate and heavy financial need, the irs may allow a 401 (k) hardship withdrawal. If you're looking for resources.

401k Hardship Withdrawals [What You Need To Know] YouTube

A 401 (k) hardship withdrawal is a withdrawal from a 401 (k) for an immediate and heavy financial need. it is an authorized withdrawal, meaning. What is a 401 (k) hardship withdrawal? Contact your tax professional for more information. If you're looking for resources. If you have an immediate and heavy financial need, the irs may allow a 401 (k).

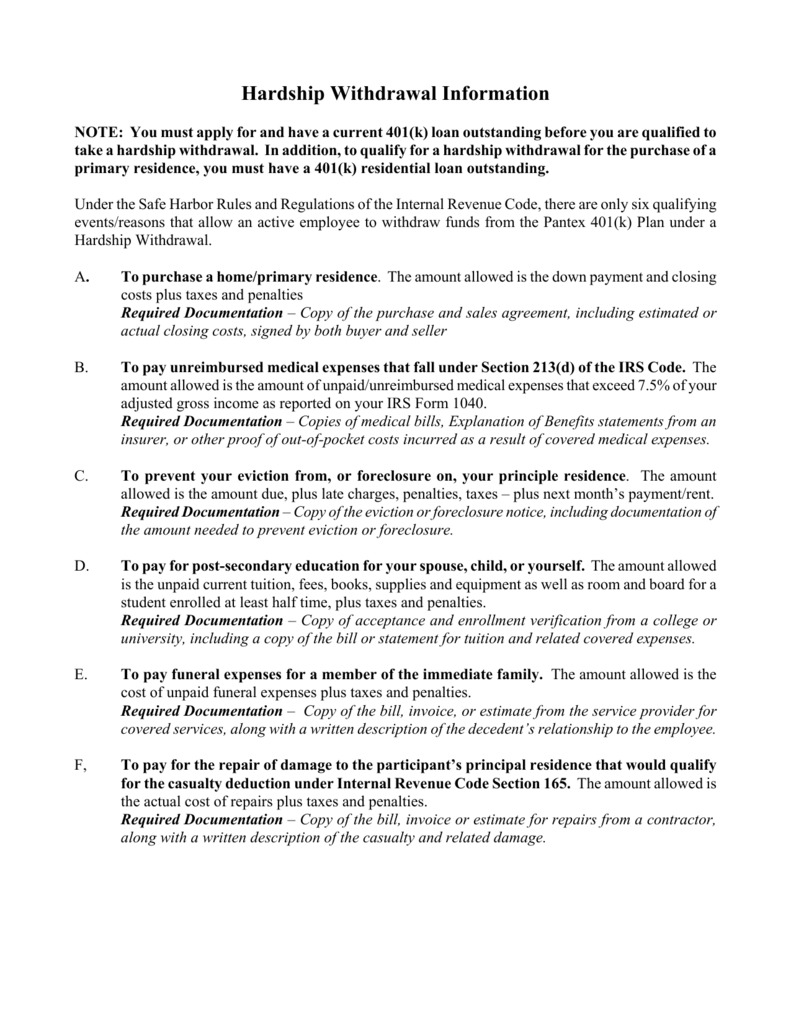

Hardship Withdrawal Information

What is a 401 (k) hardship withdrawal? How to take 401 (k) hardship withdrawals. Available for current employees only. Contact your tax professional for more information. A 401 (k) hardship withdrawal is a withdrawal from a 401 (k) for an immediate and heavy financial need. it is an authorized withdrawal, meaning.

PDF how to fill out a 401k withdrawal form PDF Télécharger Download

If you're looking for resources. For example, some 401(k) plans may allow a hardship. If you have an immediate and heavy financial need, the irs may allow a 401 (k) hardship withdrawal. A 401 (k) hardship withdrawal is a withdrawal from a 401 (k) for an immediate and heavy financial need. it is an authorized withdrawal, meaning. Contact your tax.

16 401k Form Templates free to download in PDF

What is a 401 (k) hardship withdrawal? A 401 (k) hardship withdrawal is a withdrawal from a 401 (k) for an immediate and heavy financial need. it is an authorized withdrawal, meaning. Available for current employees only. If you're looking for resources. Contact your tax professional for more information.

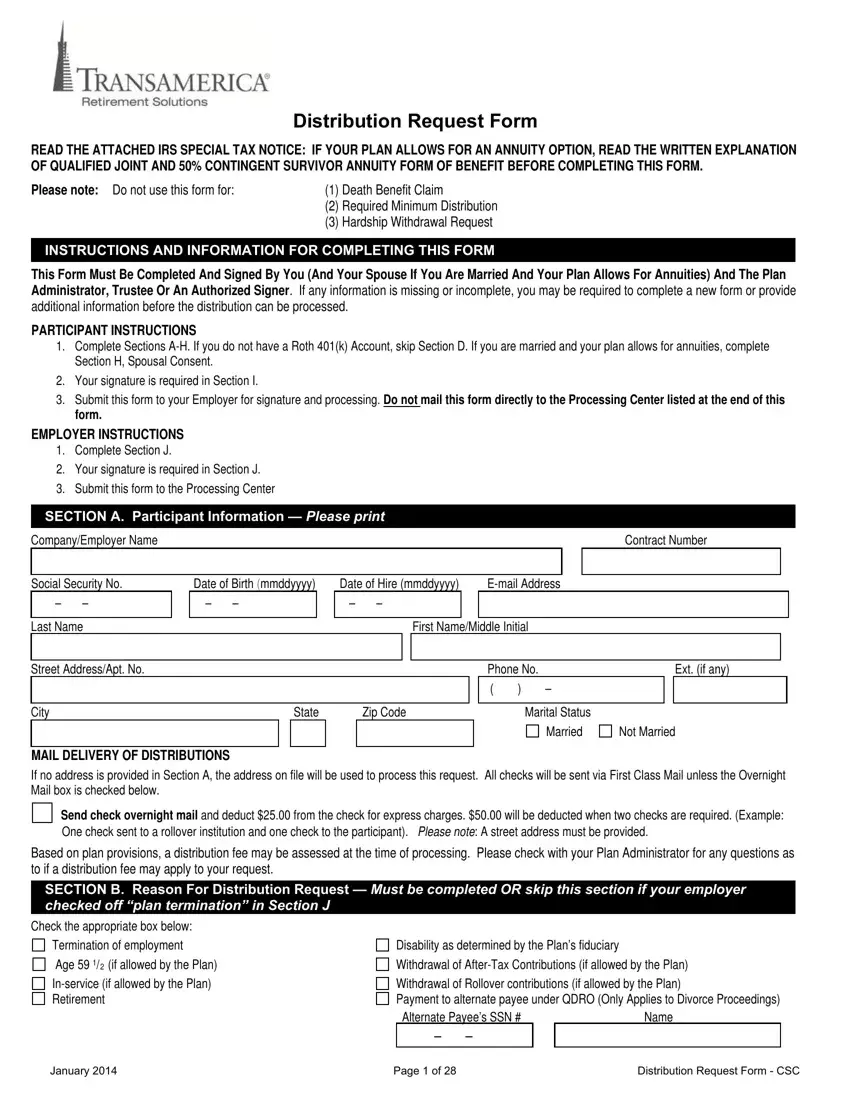

Transamerica 401K Withdrawal ≡ Fill Out Printable PDF Forms Online

If you have an immediate and heavy financial need, the irs may allow a 401 (k) hardship withdrawal. If you're looking for resources. Available for current employees only. What is a 401 (k) hardship withdrawal? How to take 401 (k) hardship withdrawals.

If You're Looking For Resources.

What is a 401 (k) hardship withdrawal? A 401 (k) hardship withdrawal is a withdrawal from a 401 (k) for an immediate and heavy financial need. it is an authorized withdrawal, meaning. How to take 401 (k) hardship withdrawals. For example, some 401(k) plans may allow a hardship.

Contact Your Tax Professional For More Information.

Available for current employees only. Many 401(k) plans allow you to withdraw money before you actually retire to pay for certain events that cause you a financial hardship. If you have an immediate and heavy financial need, the irs may allow a 401 (k) hardship withdrawal.

![401k Hardship Withdrawals [What You Need To Know] YouTube](https://i.ytimg.com/vi/AJ0gxuqu6Lw/maxresdefault.jpg)