Form 8843 Æ•™Å¸

Form 8843 Æ•™Å¸ - Form 8833 is a form. Tax calculations due to exempt status or a medical condition. Mail your tax return by the due date (including extensions) to the address shown in. Information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent. Form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for. What is a form 8843 and who must file one? Instructions to file form 8843 if you are a nonresident tax filer and have no u.s. Source income in the taxable year (and thereby an. Form 8843 is statement for exempt individuals and individuals with a medical condition. Form 8843 is a statement for exempt individuals who use to show they are not counting their days within the us.

Mail your tax return by the due date (including extensions) to the address shown in. Form 8843 is statement for exempt individuals and individuals with a medical condition. Form 8843 is not a u.s. Source income in the taxable year (and thereby an. Information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent. Instructions to file form 8843 if you are a nonresident tax filer and have no u.s. Tax calculations due to exempt status or a medical condition. It is an informational statement required by the irs for. Form 8843 is a statement for exempt individuals who use to show they are not counting their days within the us. Form 8833 is a form.

Tax calculations due to exempt status or a medical condition. What is a form 8843 and who must file one? Form 8833 is a form. Source income in the taxable year (and thereby an. Form 8843 is not a u.s. It is an informational statement required by the irs for. Form 8843 is a statement for exempt individuals who use to show they are not counting their days within the us. Information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent. Instructions to file form 8843 if you are a nonresident tax filer and have no u.s. Form 8843 is statement for exempt individuals and individuals with a medical condition.

Form 8843 2019 PDF

Form 8833 is a form. Source income in the taxable year (and thereby an. Form 8843 is statement for exempt individuals and individuals with a medical condition. Information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent. Form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a.

Do I need to file Form 8843

Tax calculations due to exempt status or a medical condition. It is an informational statement required by the irs for. Form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for. Instructions to file form 8843 if you are a nonresident tax filer and have no u.s. Source income in the.

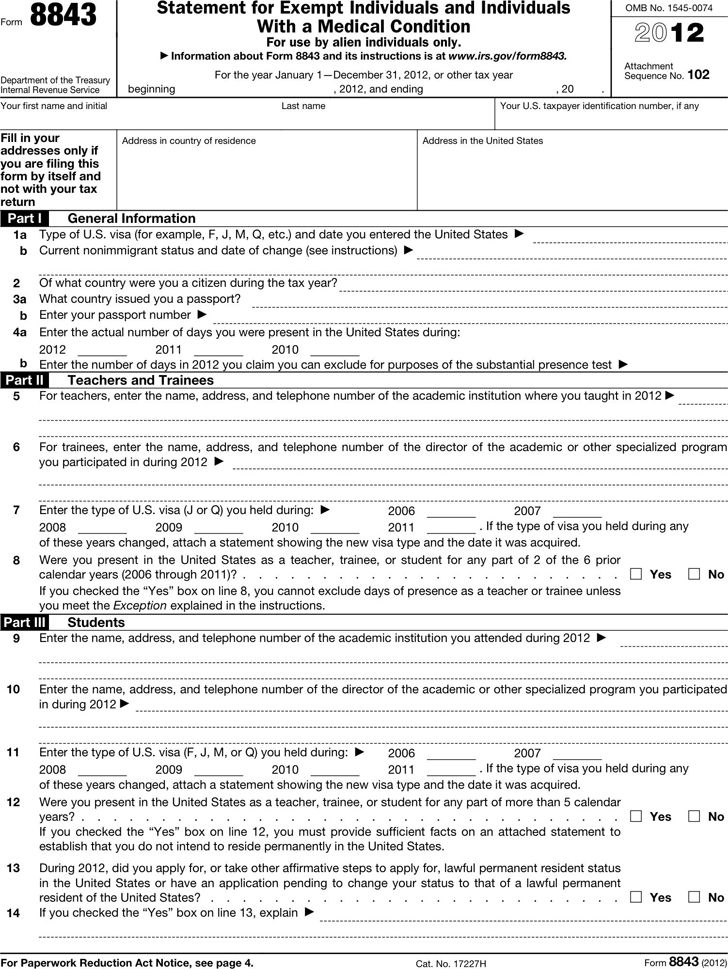

Free 2012 8843 Form PDF 99KB 4 Page(s)

Mail your tax return by the due date (including extensions) to the address shown in. Form 8843 is not a u.s. Form 8843 is a statement for exempt individuals who use to show they are not counting their days within the us. Source income in the taxable year (and thereby an. It is an informational statement required by the irs.

Still Haven't Filed Your Taxes? 5 Tax Tips for LastMinute Filers

Form 8843 is statement for exempt individuals and individuals with a medical condition. It is an informational statement required by the irs for. Form 8843 is not a u.s. What is a form 8843 and who must file one? Form 8843 is a statement for exempt individuals who use to show they are not counting their days within the us.

Form 8843 정의와 제출 방법은? [2024] Sprintax

What is a form 8843 and who must file one? Source income in the taxable year (and thereby an. Form 8843 is not a u.s. Form 8843 is a statement for exempt individuals who use to show they are not counting their days within the us. Tax calculations due to exempt status or a medical condition.

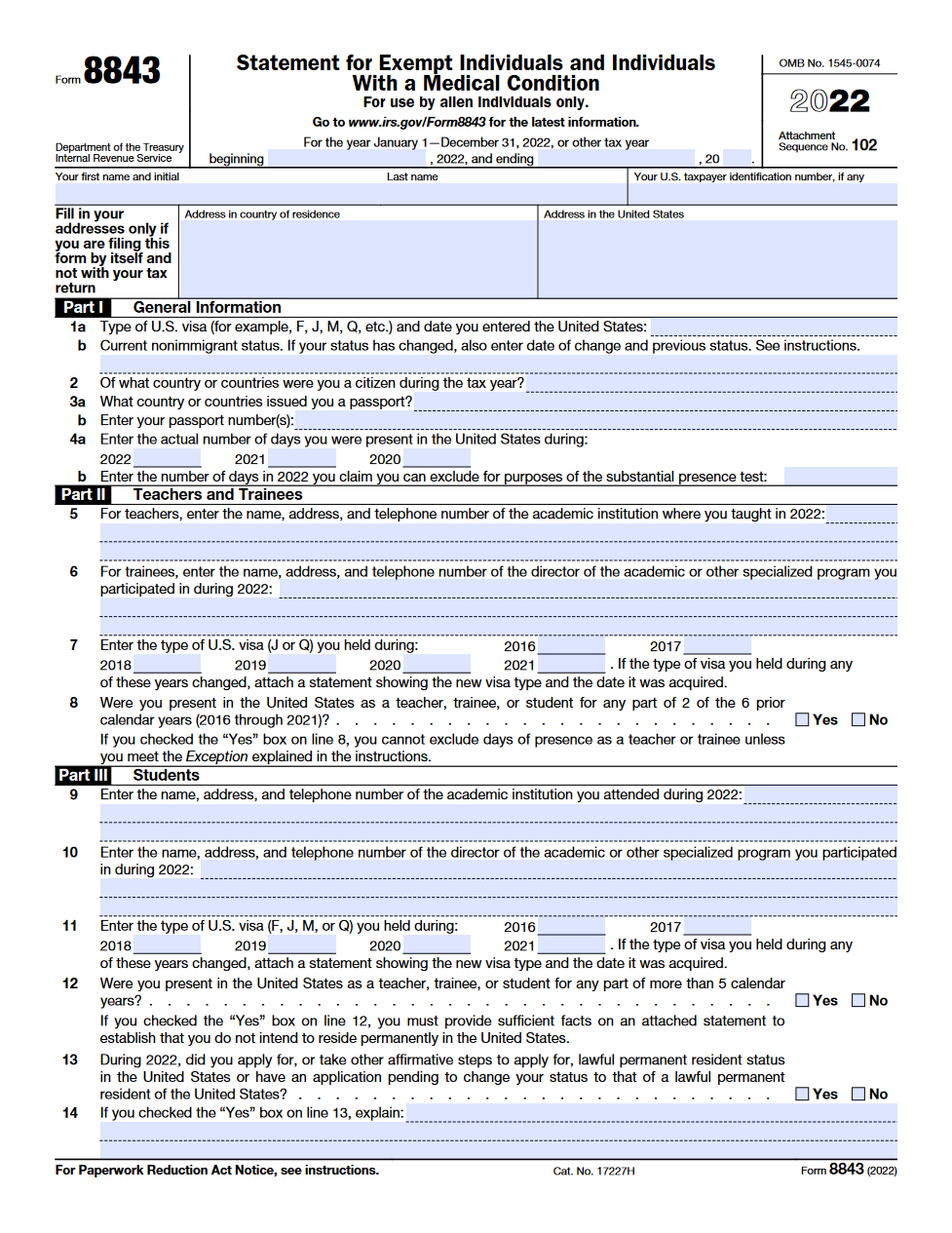

IRS Form 8843 Editable and Printable Statement to Fill out

Source income in the taxable year (and thereby an. What is a form 8843 and who must file one? Form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for. Instructions to file form 8843 if you are a nonresident tax filer and have no u.s. Information about form 8843, statement.

IRS Form 8843. Statement for Exempt Individuals and Individuals with a

Source income in the taxable year (and thereby an. Information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent. Form 8843 is not a u.s. Form 8843 is a statement for exempt individuals who use to show they are not counting their days within the us. Form 8843 department of the treasury internal revenue.

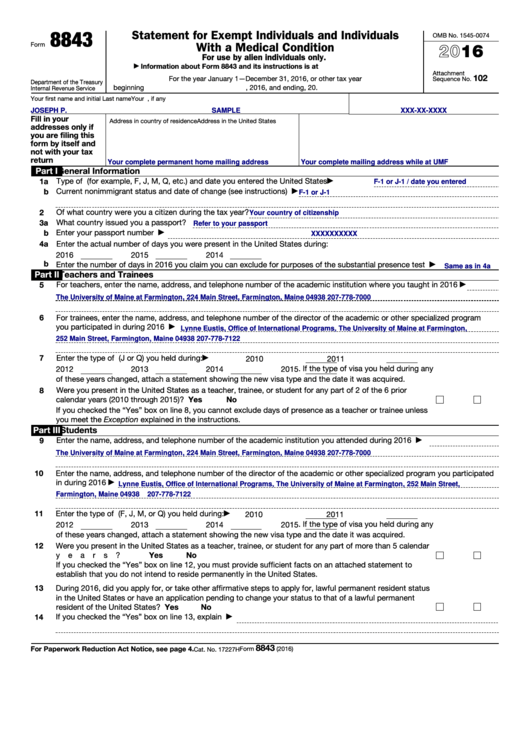

Form_8843_for_Scholars Government Of The United States United

What is a form 8843 and who must file one? Instructions to file form 8843 if you are a nonresident tax filer and have no u.s. Tax calculations due to exempt status or a medical condition. Information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent. Form 8843 is not a u.s.

Form 8843 Fillable Printable Forms Free Online

Form 8843 is statement for exempt individuals and individuals with a medical condition. What is a form 8843 and who must file one? It is an informational statement required by the irs for. Information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent. Source income in the taxable year (and thereby an.

Form 8843留学生报税必填表格 Tax Panda

Form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for. Form 8833 is a form. Form 8843 is a statement for exempt individuals who use to show they are not counting their days within the us. What is a form 8843 and who must file one? Tax calculations due to.

Form 8833 Is A Form.

Tax calculations due to exempt status or a medical condition. Instructions to file form 8843 if you are a nonresident tax filer and have no u.s. Form 8843 is a statement for exempt individuals who use to show they are not counting their days within the us. Form 8843 is statement for exempt individuals and individuals with a medical condition.

Mail Your Tax Return By The Due Date (Including Extensions) To The Address Shown In.

Information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent. Source income in the taxable year (and thereby an. Form 8843 is not a u.s. What is a form 8843 and who must file one?

Form 8843 Department Of The Treasury Internal Revenue Service Statement For Exempt Individuals And Individuals With A Medical Condition For.

It is an informational statement required by the irs for.

![Form 8843 정의와 제출 방법은? [2024] Sprintax](https://blog.sprintax.com/wp-content/uploads/2021/01/KO-form-8843-1536x864.jpg)